- United States

- /

- Consumer Finance

- /

- NasdaqGS:FCFS

Is FirstCash Holdings (FCFS) Overvalued After Recent Share Price Gains? A Closer Look at Its Valuation

Reviewed by Kshitija Bhandaru

FirstCash Holdings (FCFS) has been making gradual gains over the past month, drawing interest from investors curious about the company's direction. With a steady climb in recent weeks, many are taking a closer look at its fundamentals.

See our latest analysis for FirstCash Holdings.

FirstCash Holdings' share price is up nearly 55% year-to-date and has gained an impressive 8.8% in the last month, signaling that momentum has been steadily building. Its strong 1-year total shareholder return of 41% and a three-year total return above 100% reinforce the idea that recent optimism is supported by meaningful longer-term growth.

If you’re in the mood to discover more potential winners with a similar pattern of building momentum, now is the perfect time to check out fast growing stocks with high insider ownership.

With impressive returns and steady revenue growth, investors face a key question: is FirstCash Holdings still undervalued, or has the recent surge already accounted for all its future prospects, leaving little room for further upside?

Price-to-Earnings of 24.1: Is it justified?

FirstCash Holdings is trading at a price-to-earnings (P/E) ratio of 24.1, based on its current share price of $158.52. This stands out as quite expensive in comparison to its US Consumer Finance industry peers and signals the market is pricing in substantial profit growth or additional strengths.

The P/E ratio measures what investors are willing to pay today for every dollar of earnings generated by the company. High P/E ratios often reflect optimism for future earnings expansion, but they can also mean the market is overvaluing the company's prospects relative to the underlying numbers. With FirstCash's solid historical profits and growing earnings, this higher multiple shows investors may be betting on continued success. However, it depends on the company's ability to maintain or exceed its recent trajectory.

In comparison, the industry average P/E sits at just 10.3, making FirstCash's multiple more than double that of its sector. Additionally, the estimated fair price-to-earnings ratio for FirstCash is 16.3, suggesting the market is currently stretching well above a reasonable level based on statistical benchmarks. This leaves little margin for error should growth expectations fall short.

Explore the SWS fair ratio for FirstCash Holdings

Result: Price-to-Earnings of 24.1 (OVERVALUED)

However, slower revenue growth or a pullback in consumer finance demand could quickly test the optimism behind FirstCash Holdings' premium valuation.

Find out about the key risks to this FirstCash Holdings narrative.

Another View: SWS DCF Model Offers a Different Take

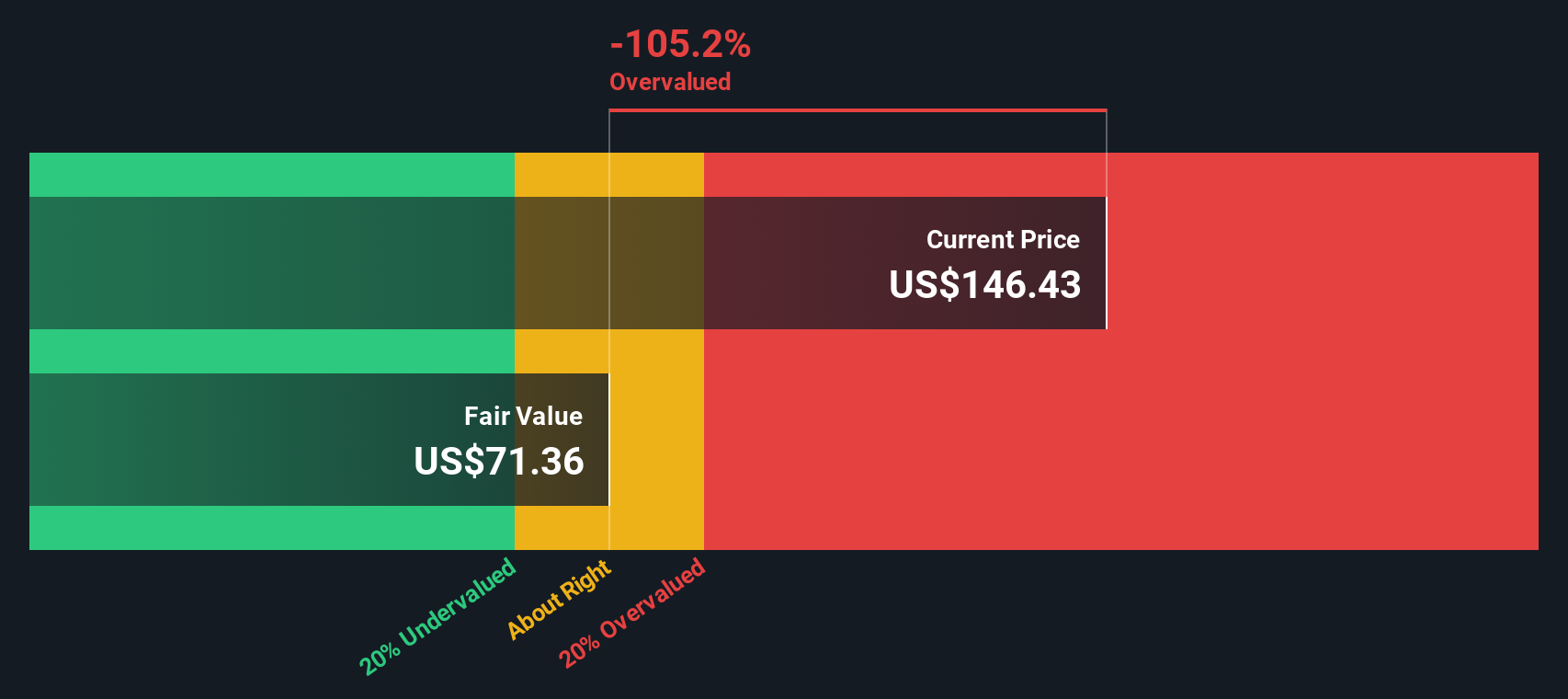

While FirstCash Holdings looks pricey using traditional profit-based multiples, the SWS DCF model provides a sharper contrast. According to our DCF approach, the current share price sits well above the estimated fair value of $72.79, which points to significant overvaluation if the model's assumptions hold true. Could this mean the market's optimism has gone too far, or does it merely reflect factors the model cannot capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FirstCash Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FirstCash Holdings Narrative

If you have a different perspective or want to dive deeper into the numbers, it's easy to shape your own view of FirstCash Holdings in just a few minutes. Do it your way.

A great starting point for your FirstCash Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for opportunity to find you. Take the lead and uncover new stocks making waves with the Simply Wall Street Screener’s powerful filters.

- Spot fast-growing companies by starting with these 3576 penny stocks with strong financials that boast strong financials and untapped potential for standout returns.

- Maximize your income by choosing these 20 dividend stocks with yields > 3% that offer substantial yields, letting your portfolio work harder for you in any market.

- Get ahead of tomorrow’s breakthroughs by targeting these 26 quantum computing stocks shaping the future of computing and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FCFS

FirstCash Holdings

Operates retail pawn stores in the United States, Mexico, and rest of Latin America.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives