- United States

- /

- Consumer Finance

- /

- NasdaqGS:FCFS

Does FirstCash’s 48% Stock Surge in 2025 Reflect Its True Value?

Reviewed by Bailey Pemberton

If you are watching FirstCash Holdings and weighing your next move, you are certainly not alone. The stock has had a remarkable run, closing recently at $151.79 after racking up an impressive 48.0% gain year-to-date and surging 178.2% over the past five years. Even with a small dip of -1.0% in the last week, the overall trajectory has been steeply upward, catching the eye of investors who are attentive to both short-term swings and long-term value.

What is fueling the optimism? Market sentiment around FirstCash Holdings seems to be shaped by a stronger confidence in the alternative lending and pawn markets, which could suggest a shift in how investors are assessing risk and opportunity in the sector. That 35.0% increase in the past year alone is no fluke. It reflects a real change in how the company is perceived, possibly tied to underlying macro trends and new growth avenues. Not every week brings exciting news, but the big-picture momentum is hard to ignore.

So, where does valuation come in? Out of six key measures, FirstCash Holdings is only undervalued in one, giving it a modest value score of 1. This might make you wonder if the stock is priced for perfection or if there is room left to run based on deeper valuation insights. Up next, we will break down exactly how FirstCash stacks up on a range of valuation checks. Stick around, because we will wrap up with a more powerful way to think about valuation that goes beyond the usual metrics.

FirstCash Holdings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: FirstCash Holdings Excess Returns Analysis

The Excess Returns valuation model estimates a company's intrinsic value by evaluating how much value it creates beyond the required return for shareholders. In other words, it measures whether the firm is generating profits above its cost of equity, based on return on invested capital and projected growth.

For FirstCash Holdings, the key figures are as follows:

- Book Value: $48.24 per share

- Stable EPS: $5.30 per share

(Source: Median Return on Equity from the past 5 years.) - Cost of Equity: $3.75 per share

- Excess Return: $1.55 per share

- Average Return on Equity: 11.99%

- Stable Book Value: $44.21 per share

(Source: Median Book Value from the past 5 years.)

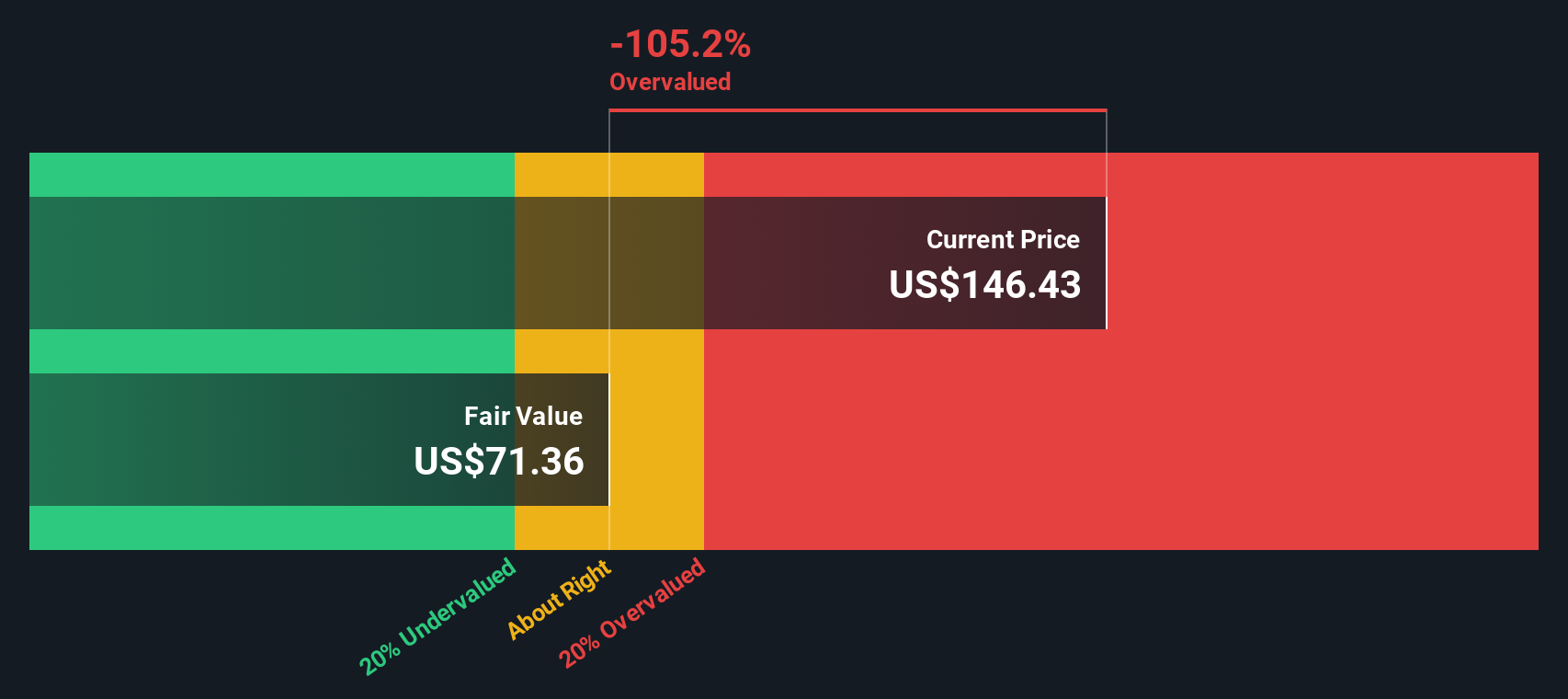

Based on the excess returns produced and the company's ability to generate value above its equity cost, the intrinsic value of FirstCash Holdings is calculated as $72.77 per share. When compared to the current market price of $151.79, this model suggests the stock is trading at a 108.6% premium, indicating it is significantly overvalued by this measure.

Result: OVERVALUED

Our Excess Returns analysis suggests FirstCash Holdings may be overvalued by 108.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: FirstCash Holdings Price vs Earnings

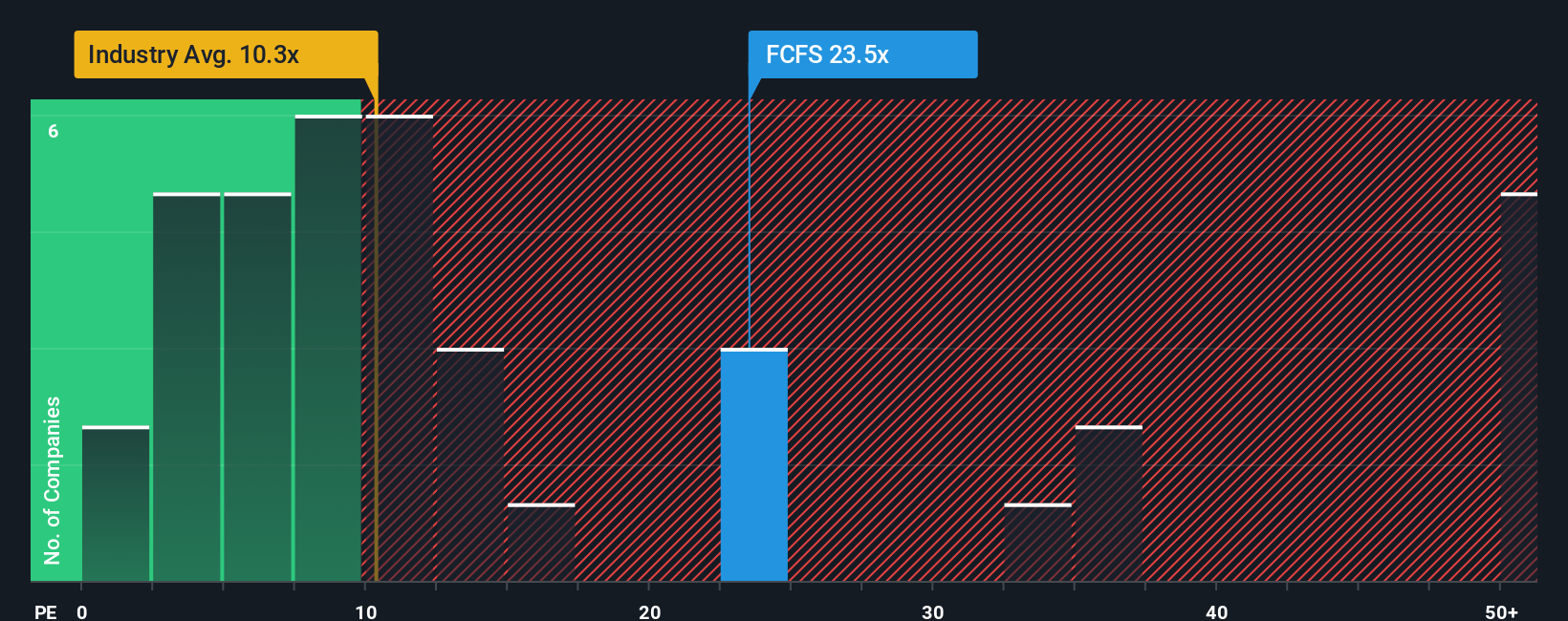

For profitable businesses like FirstCash Holdings, the Price-to-Earnings (PE) ratio is a popular valuation tool because it relates a company’s market price directly to its earnings, providing a clear picture of how much investors are paying for each dollar of profit. The PE ratio is especially helpful when a company is generating steady profits, as it can signal how the market views its growth prospects and risks in comparison to other businesses.

Growth expectations and perceived risk play a major role in setting what is considered a “fair” or “normal” PE ratio. Companies with better growth outlooks or more stable businesses tend to command higher PE ratios, while those seen as riskier or with slower growth are often valued lower. At present, FirstCash Holdings trades at a PE ratio of 23.08x, which is more than double the Consumer Finance industry average of 10.06x and also well above the peer average of 47.96x. This premium suggests investors have strong expectations for FirstCash relative to the broader sector.

Simply Wall St calculates a unique “Fair Ratio” of 16.15x for FirstCash Holdings. This proprietary metric offers a more customized benchmark than the blunt industry and peer averages, as it takes into account the company’s earnings growth, profit margins, risk profile, market cap and the specific nuances of its industry. The Fair Ratio is designed to reflect a more tailored valuation context, making it a more insightful yardstick for investors.

Comparing FirstCash Holdings' actual PE ratio of 23.08x to its Fair Ratio of 16.15x shows that the stock is priced at a sizable premium to what would be considered fair, given its financial characteristics and outlook. This suggests the market may be a bit ahead of itself on this name.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your FirstCash Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative goes beyond the numbers, allowing you to connect your perspective on a company to a personalized financial forecast and, importantly, a fair value estimate. Narratives are stories you create about a company's future performance, specifying what you think will happen to its revenue, earnings, and margins. This approach makes investing feel less like guesswork and more like building your own roadmap, all in a format that is simple and easy to use right on Simply Wall St’s Community page, trusted by millions of investors.

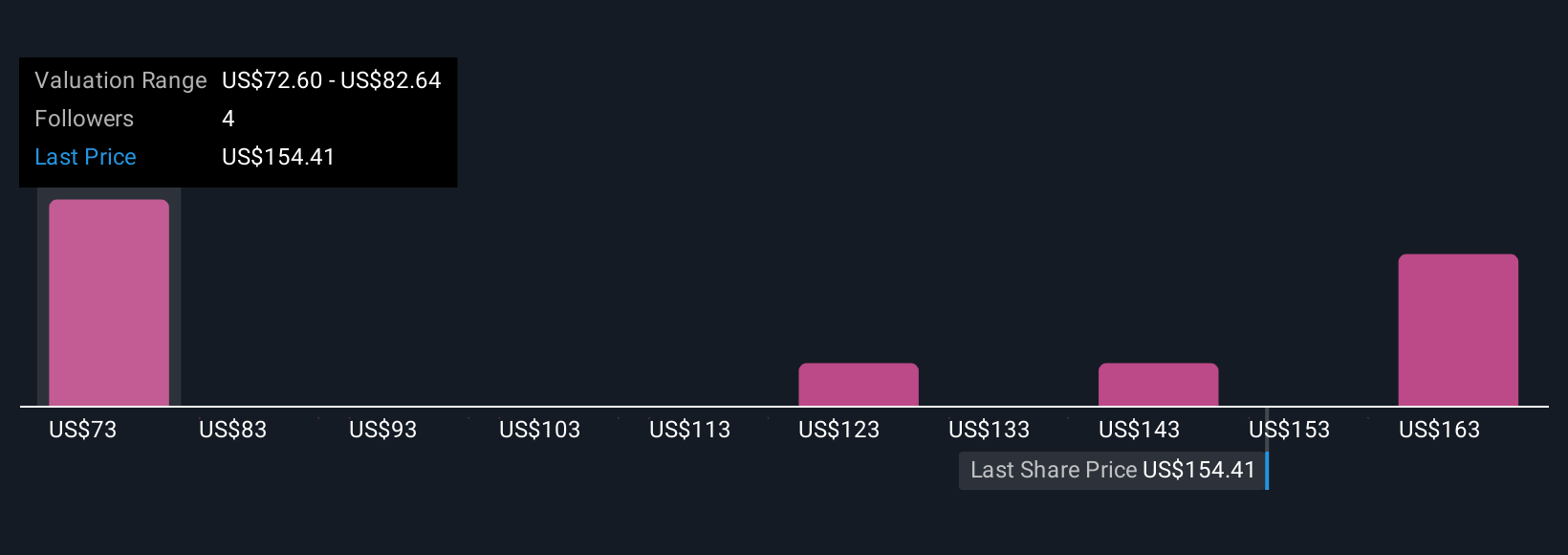

With Narratives, you can instantly see when your view says it is time to buy, sell, or hold by comparing your Fair Value to the current Price. Whenever new news or updates arrive, your Narrative updates as well. For example, one investor might see FirstCash Holdings’ fair value as conservative at $65 per share, while another takes a far more optimistic view with a fair value of $170 per share. Narratives give every investor a seat at the table and a smarter way to act on their convictions as the story unfolds.

Do you think there's more to the story for FirstCash Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FCFS

FirstCash Holdings

Operates retail pawn stores in the United States, Mexico, and rest of Latin America.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives