- United States

- /

- Consumer Finance

- /

- NasdaqGS:EZPW

Is EZCORP (EZPW) Still Undervalued After Its Recent Share Price Rally?

Reviewed by Simply Wall St

EZCORP (EZPW) has quietly delivered strong gains this year, and the move is catching investor attention. With the pawn and pre-owned retail business humming along, the recent rally raises fair questions about what is already priced in.

See our latest analysis for EZCORP.

The recent climb to a share price of $20.14, backed by a 30 day share price return of 11.89 percent and a 5 year total shareholder return of 294.90 percent, suggests momentum is still building as investors reassess EZCORP’s growth and risk profile.

If EZCORP’s run has you rethinking where to find the next mover, it might be worth exploring fast growing stocks with high insider ownership as a curated set of potential ideas.

With double digit growth in earnings and a share price that still sits below analyst targets, is EZCORP quietly setting up for another move higher, or is the current valuation already factoring in its next phase of expansion?

Most Popular Narrative: 14.7% Undervalued

With the narrative fair value set above EZCORP’s last close of $20.14, the story leans toward upside potential driven by execution and growth.

Enhanced operational efficiency through best practice adoption, advanced pricing and inventory systems, and disciplined cost management is generating recurring operating leverage, as evidenced by multi-quarter EBITDA margin expansion, improving net margins and driving outsized earnings growth relative to revenue.

Curious how steady, mid single digit revenue growth can still justify a richer future earnings multiple than today, even after share count rises and margins climb?

Result: Fair Value of $23.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising regulatory scrutiny and slower than expected digital adoption could compress margins and stall the operational momentum that underpins the current upside narrative.

Find out about the key risks to this EZCORP narrative.

Another Angle on Valuation

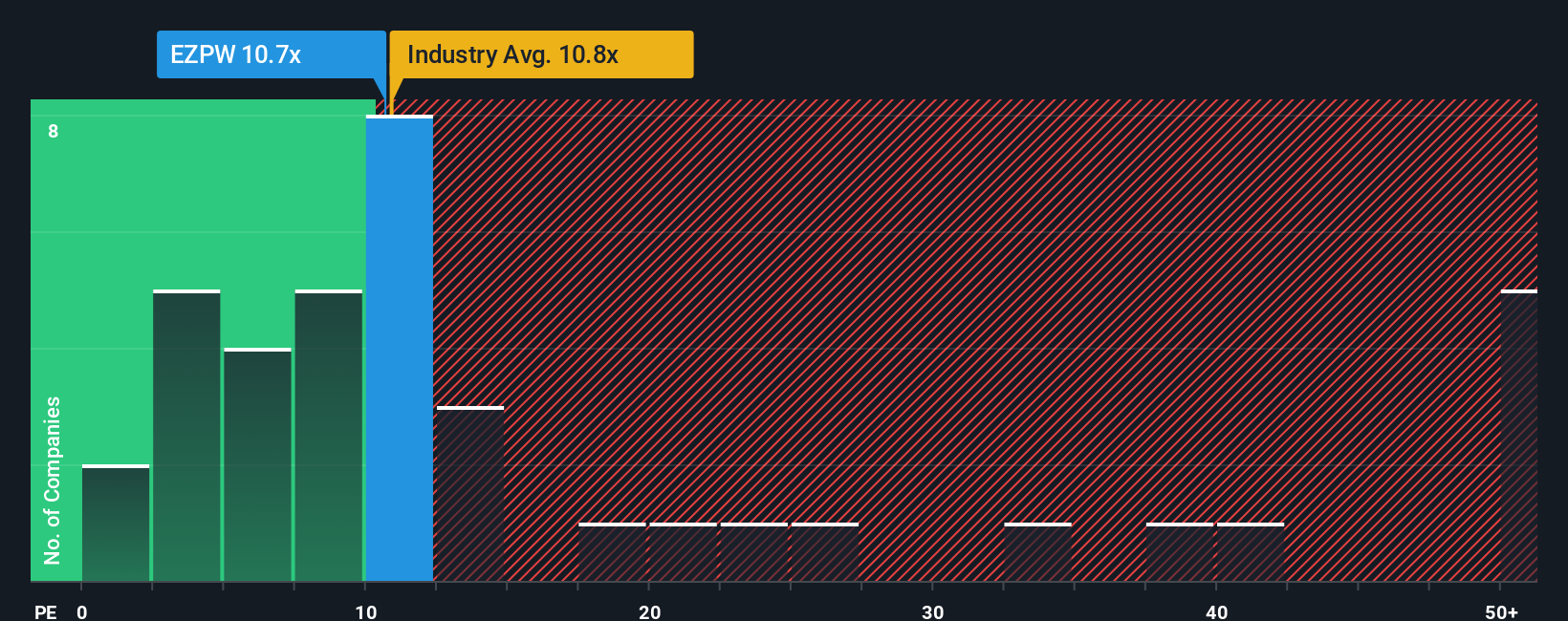

On a simple earnings basis, EZCORP looks less clear cut. Its 11.2x price to earnings ratio sits above both peer averages and the broader consumer finance industry, hinting that investors already pay a premium for its execution and growth story. If growth cools, how much of that premium could unwind?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EZCORP Narrative

If this perspective does not fully align with your view, or you would rather dive into the numbers yourself, you can build a custom narrative in under three minutes, starting with Do it your way.

A great starting point for your EZCORP research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next smart move?

Before you move on, consider using the Simply Wall St screener to identify fresh opportunities that many investors still overlook.

- Explore smaller names with early momentum by scanning these 3577 penny stocks with strong financials that pair higher risk with improving fundamentals.

- Focus on technological change by targeting these 26 AI penny stocks that are linked to shifts in automation and data intelligence.

- Review these 15 dividend stocks with yields > 3% that aim to provide income through regular payouts alongside the potential for long term capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EZCORP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EZPW

EZCORP

Provides pawn services in the United States, Mexixo, and Latin America.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026