- United States

- /

- Consumer Finance

- /

- NasdaqGS:EZPW

A Look at EZCORP (EZPW) Valuation Following Recent Share Price Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for EZCORP.

Momentum is clearly building for EZCORP, with the share price up more than 12% over the past month and 56% year-to-date. The bigger story, however, is the impressive 69% total shareholder return over the past year. This points to strengthening confidence in its long-term outlook, despite a recent pause this week.

If the recent surge in EZCORP inspires you to broaden your market view, now could be the perfect time to discover fast growing stocks with high insider ownership.

With such impressive returns on the table, the big question now is whether EZCORP remains undervalued and primed for more gains, or if the market has already priced in much of its future growth and potential opportunity.

Most Popular Narrative: 10.2% Undervalued

EZCORP’s most widely-followed fair value estimate sits noticeably above the last traded price, suggesting the shares may still have untapped upside. Investors have seen strong momentum already. What underpins this view of further potential?

Growing investments in digital engagement, such as EZ+ Rewards, online payment and layaway options, view-online-purchase-in-store, and Instant Quote, are expanding channels for customer acquisition and enabling more efficient customer servicing. This is likely strengthening repeat business and boosting overall revenue growth and margin leverage.

The secret sauce of this bullish narrative? It all hinges on bold projections for expanding earnings, higher profit margins, and a forward-looking profit multiple that is more aggressive than industry averages. Curious which key assumptions analysts are wagering on to back this “hidden value” call? The real numbers might just surprise you, but you’ll have to dig deeper to see.

Result: Fair Value of $21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting gold prices or slow adoption of new digital tools could quickly challenge this positive outlook and affect EZCORP’s longer-term performance.

Find out about the key risks to this EZCORP narrative.

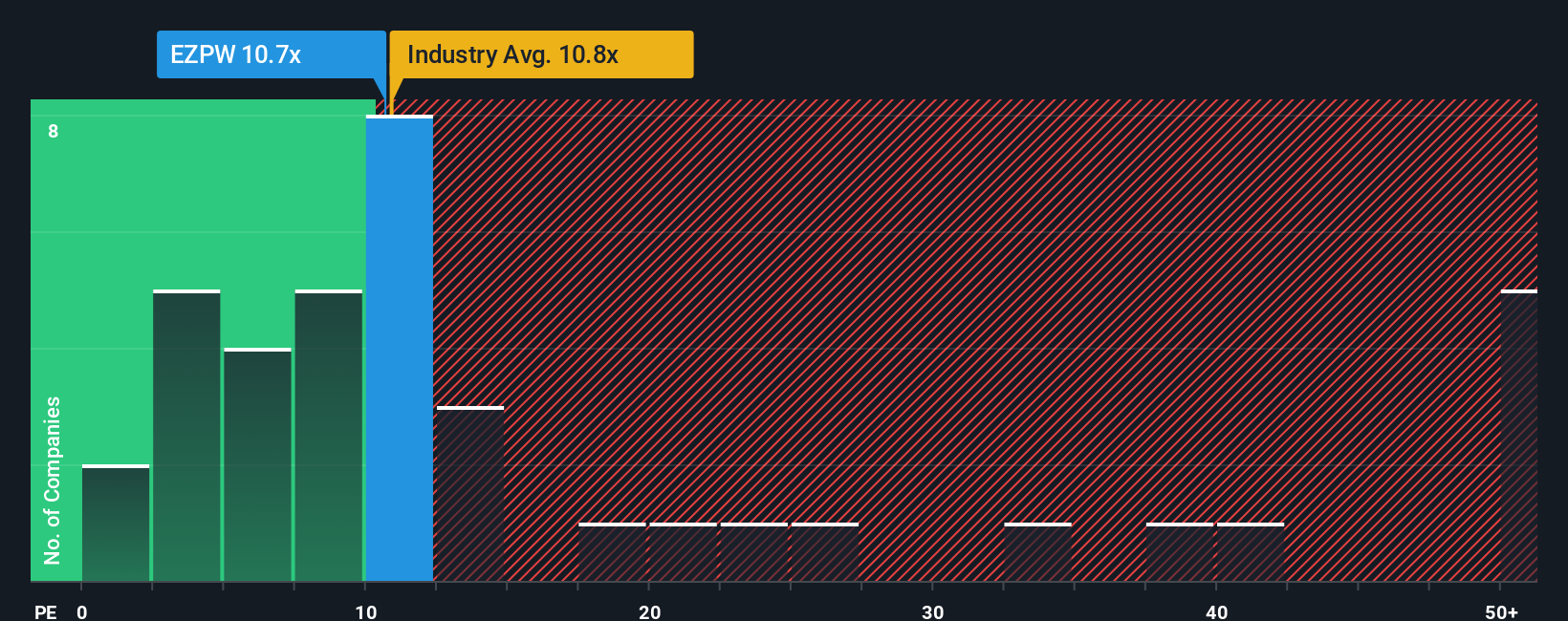

Another View: Price-to-Earnings Puts the Spotlight on Value

Looking at a different yardstick, EZCORP trades at 11.7x earnings, which is higher than its peer average of 8.1x and above the US Consumer Finance sector average of 10.3x. However, this is still below its fair ratio of 13.4x. This gap means the market sees more risk or is less optimistic about EZCORP than about its peers, while the fair ratio hints at possible upside if sentiment shifts. With multiples sending a mixed message, could valuation risks be hiding in plain sight, or is there an overlooked opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EZCORP Narrative

If you see the story differently or want to dive into the numbers yourself, it’s simple to craft your own take on EZCORP’s outlook in just a few minutes: Do it your way.

A great starting point for your EZCORP research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Opportunities?

Don’t limit yourself to a single story. Accelerate your investing journey with handpicked opportunities that could set your portfolio apart from the crowd.

- Maximize your income potential by targeting resilient companies with these 19 dividend stocks with yields > 3% that offer yields above 3% and show strong payout consistency.

- Get ahead of the curve by acting on market trends. Tap into the explosive potential of these 78 cryptocurrency and blockchain stocks and capitalize on innovations in digital assets and blockchain.

- Catch tomorrow’s leaders early by backing these 25 AI penny stocks driving breakthroughs in artificial intelligence, automation, and advanced analytics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EZCORP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EZPW

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives