- United States

- /

- Diversified Financial

- /

- NasdaqGS:EEFT

Is Euronet Worldwide’s (EEFT) CoreCard Acquisition Transforming Its Digital Payment Processing Ambitions?

Reviewed by Sasha Jovanovic

- In the past week, Euronet Worldwide announced its acquisition of CoreCard, a proven credit card processing platform, as part of its move to expand digital payment processing and credit issuing across Europe and Asia.

- This development signals a commitment to accelerating growth in scalable, software-driven payments and highlights Euronet's focus on building capabilities in rapidly evolving high-demand regions.

- We will explore how the CoreCard acquisition could shape Euronet Worldwide’s investment narrative through enhanced digital payment processing capabilities.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Euronet Worldwide Investment Narrative Recap

To be a Euronet Worldwide shareholder today, you have to believe in the company's ability to transition its business toward scalable, software-driven digital payments and credit products, especially in Europe and Asia. The recent acquisition of CoreCard is a clear step in this direction and could strengthen this long-term narrative, but it is unlikely to materially shift the biggest near-term risk: the potential decline in high-margin legacy cash-based businesses as digital payments rise. The catalyst to watch remains execution and integration of CoreCard’s technology to offset this risk. One announcement especially connected to these catalysts is Euronet’s May 2025 partnership with Visa for Visa Direct, expanding access to over 4 billion debit cards globally. Combined with the CoreCard acquisition, this move gives Euronet greater scale and reach in digital payments and positions the company to broaden its revenue streams away from cash and toward higher-margin digital solutions. But while the growth story is compelling, investors should also be aware of risks around regulatory shifts and new remittance taxes that may affect...

Read the full narrative on Euronet Worldwide (it's free!)

Euronet Worldwide's narrative projects $5.2 billion revenue and $476.3 million earnings by 2028. This requires 8.2% yearly revenue growth and a $143.6 million earnings increase from $332.7 million today.

Uncover how Euronet Worldwide's forecasts yield a $127.71 fair value, a 46% upside to its current price.

Exploring Other Perspectives

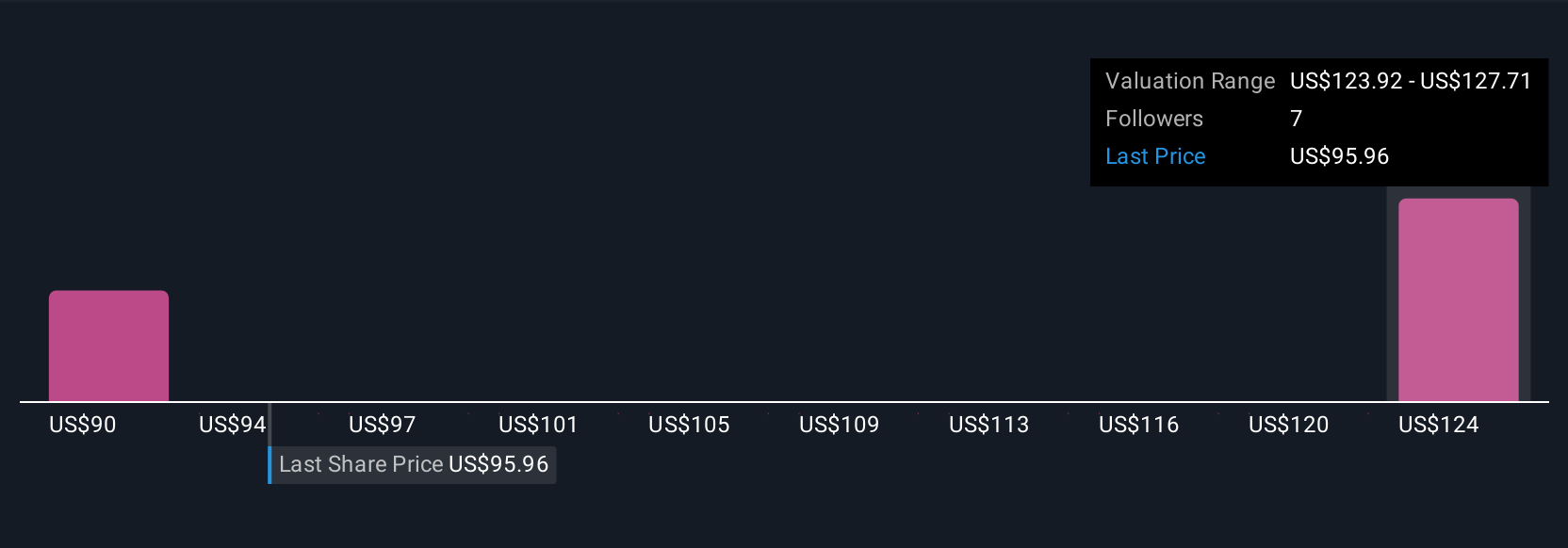

Three fair value estimates from the Simply Wall St Community range from US$87.84 to US$127.71, highlighting varied assessments among private investors. While investors hold sharply different views, persistent shifts in cash-to-digital transactions remain a key challenge for the company’s long-term profit mix.

Explore 3 other fair value estimates on Euronet Worldwide - why the stock might be worth as much as 46% more than the current price!

Build Your Own Euronet Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Euronet Worldwide research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Euronet Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Euronet Worldwide's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Euronet Worldwide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EEFT

Euronet Worldwide

Provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives