- United States

- /

- Consumer Finance

- /

- NasdaqGS:ECPG

The Bull Case For Encore Capital Group (ECPG) Could Change Following Buyback Boost and Record Earnings—Learn Why

Reviewed by Sasha Jovanovic

- Encore Capital Group announced in the past week that it delivered third-quarter 2025 earnings with revenue of US$460.35 million and net income of US$74.66 million, both up sharply from the prior year, while also increasing its share repurchase authorization to a total of US$600 million.

- A key insight from management highlighted that recent record collections and improvements in digital operations have played a central role in these financial results.

- We'll explore how Encore's buyback expansion and record collections performance shape its investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Encore Capital Group Investment Narrative Recap

Owning shares of Encore Capital Group means believing that a sustained surge in U.S. consumer delinquencies and enhanced digital operations will help drive higher collections, even as the supply of non-performing loans remains crucial for future growth. The latest quarterly results, with significantly higher revenue and net income, reinforce the importance of these trends; however, the biggest near-term catalyst, continued record collections, remains tightly linked to U.S. consumer credit behavior, while a shift in these conditions or regulatory tightening stands out as the key risk. The recent news improves sentiment but does not fundamentally alter this risk-catalyst balance in the short term.

Among recent announcements, Encore’s decision to expand its share repurchase authorization to US$600 million is especially pertinent. This larger buyback not only reflects management’s confidence but also gives Encore greater flexibility in its capital allocation as it seeks to balance growing collections with the need to address rising funding costs and market challenges.

In contrast, hidden behind robust results, the risk of regulatory changes disrupting collections remains something investors should be attentive to as...

Read the full narrative on Encore Capital Group (it's free!)

Encore Capital Group's narrative projects $2.1 billion in revenue and $838.0 million in earnings by 2028. This requires 11.8% yearly revenue growth and a $927.1 million increase in earnings from -$89.1 million today.

Uncover how Encore Capital Group's forecasts yield a $60.25 fair value, a 21% upside to its current price.

Exploring Other Perspectives

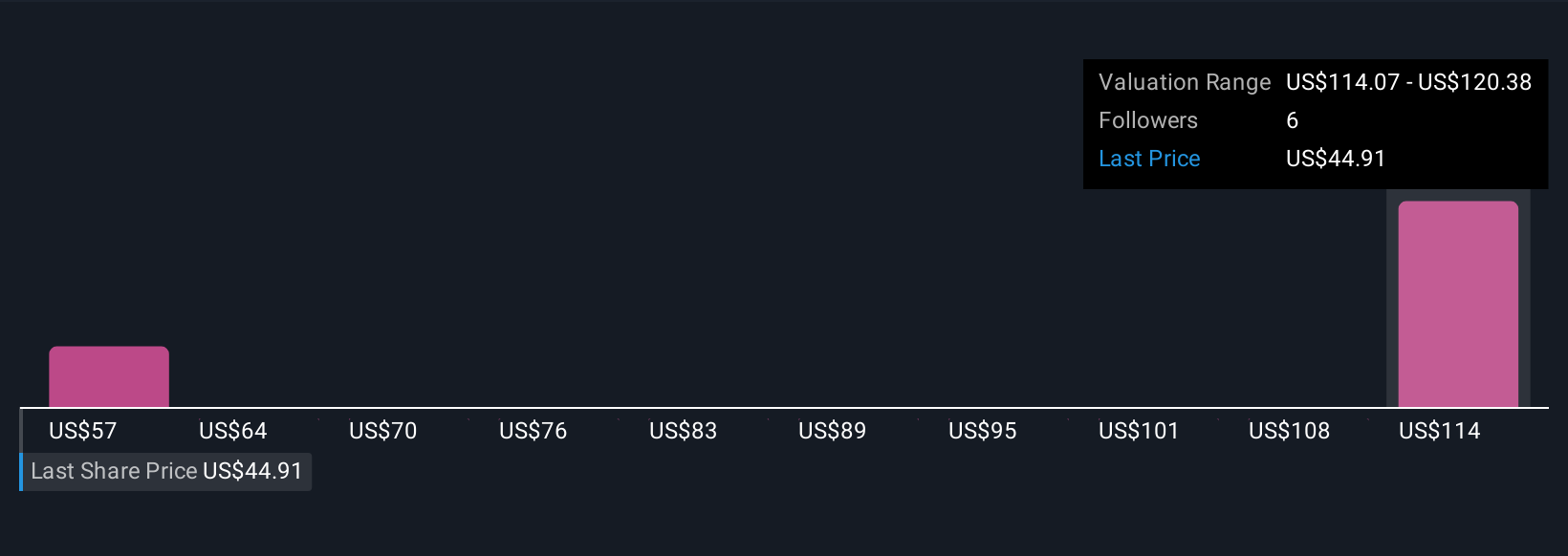

Simply Wall St Community members set Encore’s fair value between US$60.25 and US$120.38, based on two different perspectives. With such a spread, and considering that revenue growth is still closely tied to U.S. portfolio supply, you can explore just how differently market participants view Encore’s performance drivers.

Explore 2 other fair value estimates on Encore Capital Group - why the stock might be worth over 2x more than the current price!

Build Your Own Encore Capital Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Encore Capital Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Encore Capital Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Encore Capital Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Encore Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ECPG

Encore Capital Group

A specialty finance company, provides debt recovery solutions and other related services for consumers across financial assets worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives