- United States

- /

- Diversified Financial

- /

- NasdaqGS:DLO

Evaluating DLocal (NasdaqGS:DLO)’s Valuation After Truist’s Upgrade on Q3 Beat and New CEO Strategy

Reviewed by Simply Wall St

Truist Securities just upgraded DLocal (NasdaqGS:DLO) to Buy after a stronger than expected third quarter, pointing to new CEO Pedro Arnt’s early turnaround moves and more comfortable take rate trends.

See our latest analysis for DLocal.

The upgrade comes after a choppy stretch for the stock, with a 30 day share price return of negative 3.65 percent, a much healthier year to date share price return of 19.78 percent, and a 25.36 percent one year total shareholder return. This suggests momentum is rebuilding as investors reassess growth and execution risk.

If DLocal’s story has you rethinking growth plays in your portfolio, this could be a good moment to explore fast growing stocks with high insider ownership.

Yet with DLocal trading below analyst targets but already posting robust double digit revenue and earnings growth, is the recent upgrade flagging a genuine buying opportunity, or simply confirming that markets are pricing in the rebound?

Most Popular Narrative: 92.8% Undervalued

According to WynnLevi, the narrative fair value sits far above DLocal’s last close of 13.99 dollars, framing a bold upside scenario that leans heavily on execution and product breadth.

DLocal emphasizes continuous investment in developing new products and services. The company’s pipeline is closely tied to:

• Expanding into new geographic markets.

• Integrating new payment methods.

• Developing advanced tools for merchants, especially for managing collections and disbursements.

• Innovating solutions for complex transactions, such as cross border payments and compliance with local regulations. DLocal highlights that these efforts are not just incremental but necessary to remain competitive amid rapid technological change, the entrance of new competitors, and evolving client demands. The pipeline projects are also described as high risk, involving potential cost overruns, delays, performance problems, or lack of merchant adoption. The company notes that a delay or failure to deliver these new services on time could render its offerings less attractive or even obsolete. Moreover, DLocal sometimes relies on third parties for new technology, which can further influence the pace and nature of innovation

Curious how one narrative turns aggressive revenue expansion, rising margins, and a punchy future earnings multiple into such a high fair value target? The full story spells out the exact growth runway, profitability path, and valuation lens behind that number, but keeps one crucial assumption hidden in plain sight.

Result: Fair Value of $195.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained execution missteps or delayed product rollouts, especially in new markets, could quickly erode merchant trust and force investors to reconsider that optimistic valuation.

Find out about the key risks to this DLocal narrative.

Another View: Earnings Multiple Sends a Different Signal

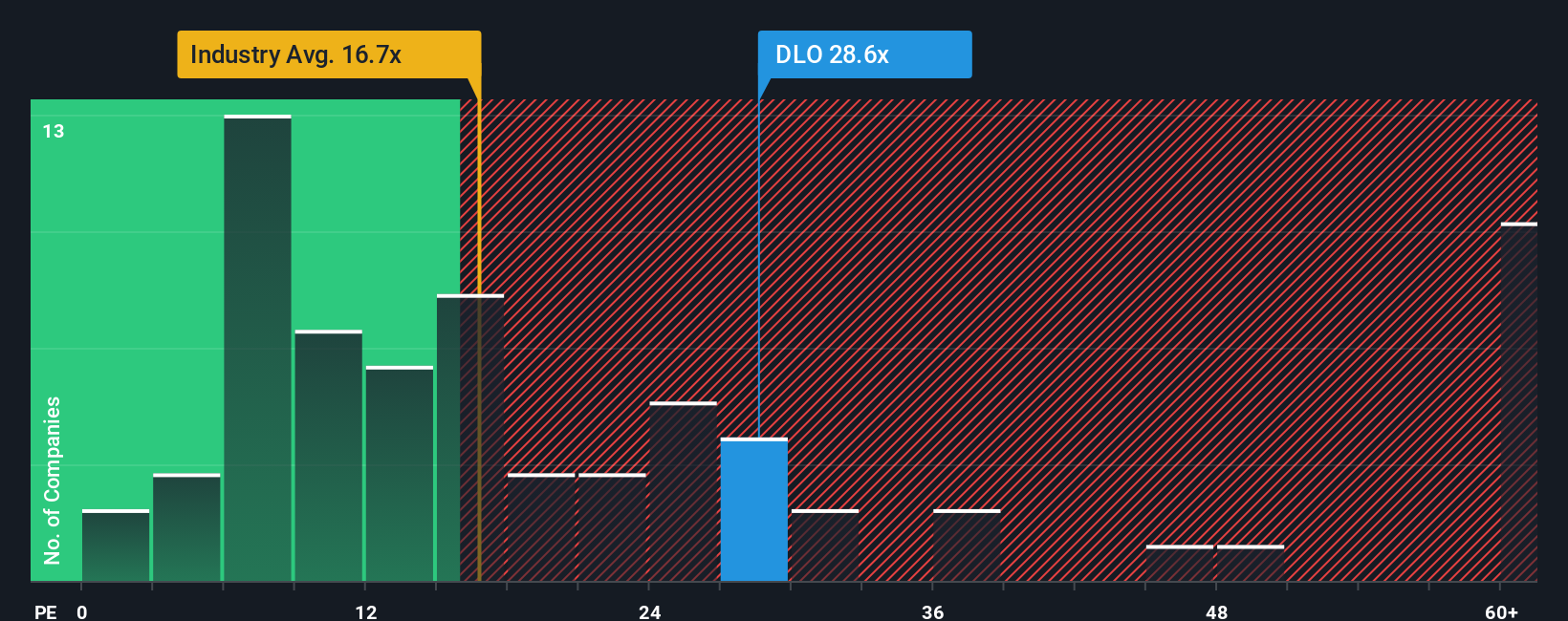

Step away from narratives and growth curves and DLocal starts to look pricey. Its price to earnings ratio sits at 24.1 times, above both the US diversified financials average of 13.6 times and its 23 times fair ratio, even if it screens cheaper than peers on 66 times. Is the market already baking in a lot of good news?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DLocal Narrative

If you want to dig into the numbers yourself or challenge these assumptions, you can build a custom view of DLocal in minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding DLocal.

Looking for more investment ideas?

Before you move on, consider using the Simply Wall St Screener to spot fresh stocks that truly fit your strategy.

- Position yourself for potential price moves by focusing on quality using these 3607 penny stocks with strong financials that balance smaller size with solid underlying fundamentals.

- Explore the next wave of automation and data transformation by targeting these 25 AI penny stocks involved in how software, services, and infrastructure evolve.

- Strengthen your income stream and reduce guesswork by zeroing in on these 12 dividend stocks with yields > 3% that may support a steadier level of cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLO

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026