- United States

- /

- Capital Markets

- /

- NasdaqGS:DHIL

Here's Why I Think Diamond Hill Investment Group (NASDAQ:DHIL) Is An Interesting Stock

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Diamond Hill Investment Group (NASDAQ:DHIL). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Diamond Hill Investment Group

Diamond Hill Investment Group's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, Diamond Hill Investment Group has grown EPS by 13% per year. That's a good rate of growth, if it can be sustained.

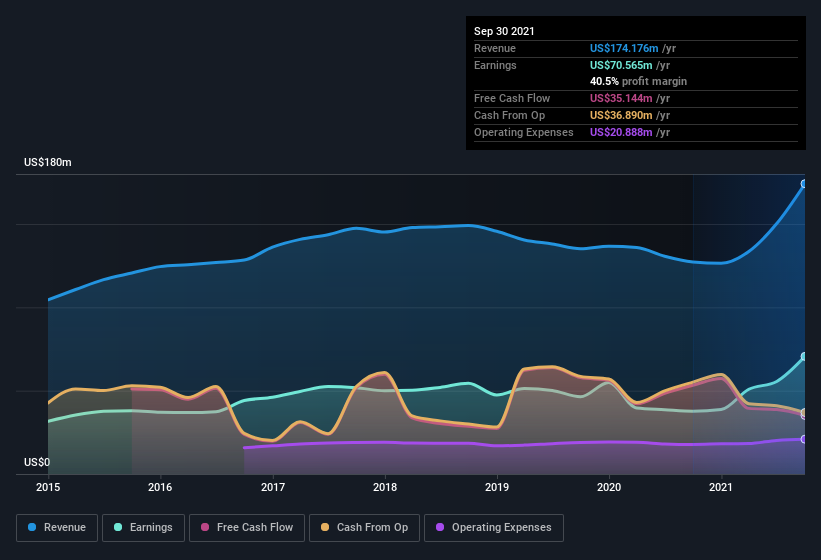

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Diamond Hill Investment Group's EBIT margins were flat over the last year, revenue grew by a solid 37% to US$174m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Diamond Hill Investment Group's balance sheet strength, before getting too excited.

Are Diamond Hill Investment Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

While Diamond Hill Investment Group insiders did net -US$266k selling stock over the last year, they invested US$513k, a much higher figure. You could argue that level of buying implies genuine confidence in the business. Zooming in, we can see that the biggest insider purchase was by Chairman of the Board & Lead Independent Director James Laird for US$290k worth of shares, at about US$145 per share.

On top of the insider buying, it's good to see that Diamond Hill Investment Group insiders have a valuable investment in the business. Indeed, they hold US$23m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 3.5% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Heather Brilliant, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Diamond Hill Investment Group with market caps between US$400m and US$1.6b is about US$2.3m.

Diamond Hill Investment Group offered total compensation worth US$2.0m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Diamond Hill Investment Group Worth Keeping An Eye On?

As I already mentioned, Diamond Hill Investment Group is a growing business, which is what I like to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Diamond Hill Investment Group (1 is significant) you should be aware of.

The good news is that Diamond Hill Investment Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:DHIL

Diamond Hill Investment Group

Through its subsidiary, Diamond Hill Capital Management, Inc., provides investment advisory and fund administration services in the United States.

Flawless balance sheet and good value.