- United States

- /

- Capital Markets

- /

- NasdaqCM:CWD

Lacklustre Performance Is Driving CaliberCos Inc.'s (NASDAQ:CWD) Low P/S

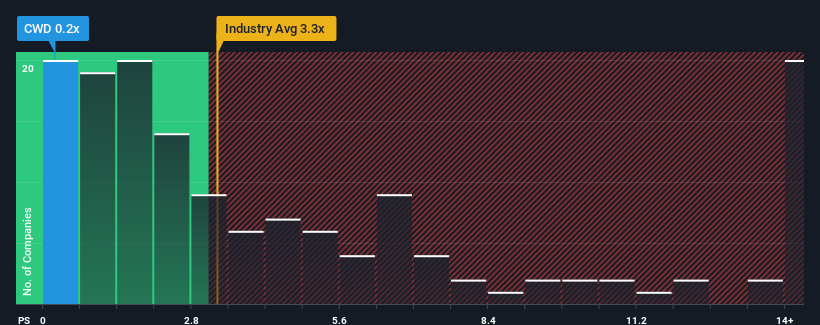

You may think that with a price-to-sales (or "P/S") ratio of 0.2x CaliberCos Inc. (NASDAQ:CWD) is definitely a stock worth checking out, seeing as almost half of all the Capital Markets companies in the United States have P/S ratios greater than 3.3x and even P/S above 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for CaliberCos

What Does CaliberCos' P/S Mean For Shareholders?

Recent times haven't been great for CaliberCos as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on CaliberCos will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For CaliberCos?

The only time you'd be truly comfortable seeing a P/S as depressed as CaliberCos' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a decent 7.3% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 80% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 26% each year during the coming three years according to the only analyst following the company. That's not great when the rest of the industry is expected to grow by 9.5% each year.

With this in consideration, we find it intriguing that CaliberCos' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does CaliberCos' P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of CaliberCos' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, CaliberCos' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for CaliberCos that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CWD

CaliberCos

A real estate investment, and an asset management firm specializes in middle-market assets.

Undervalued with adequate balance sheet.