- United States

- /

- Capital Markets

- /

- NasdaqGS:COIN

Here are Coinbase's (NASDAQ:COIN) Fundamental Estimates and some Price Factors

When thinking of Coinbase Global, Inc. (NASDAQ:COIN), we want to evaluate to which extent the stock is dependent on the crypto market, as well as to see how the future looks for the company. Because the recent slide made the stock come close to the lower resistance levels, we will go through both the fundamentals and crypto dependence to see what we can expect in the future.

Check out our latest analysis for Coinbase Global

Starting with the fundamentals, Coinbase has a rough intrinsic value estimate of US$295 per share, which means that if the stock drops further down, it could be an undervalued opportunity. Now let's examine the possible price drivers.

Analyst Forecasts

Shareholders are probably feeling a little disappointed, since its shares started steadily falling from November 2021, US$243 in the week after its latest third-quarter results.

Considering the Q3 report, the results were mixed: although revenues of US$1.3b fell 17% short of analyst estimates, statutory earnings per share (EPS) of US$1.62 beat expectations by 13%.

Unlike most young companies, Coinbase is a profitable company and primarily makes its income by transaction fees when users buy or sell crypto, as well as subscription services for institutional clients. That is why the future income is dependent on the number of user accounts (currently about 73+m verified users), and trading volume (US$327b traded last quarter). This way, analysts have a basis on which they can build their expectations for the future.

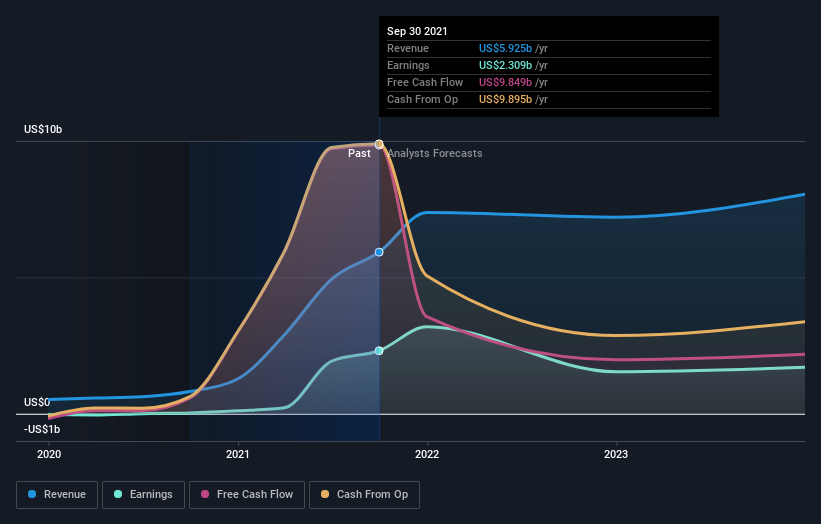

Following the result, the analysts have updated their earnings model, and we can see what they expect in the next year or so:

Coinbase Global's 22 analysts are now forecasting revenues of US$7.20b in 2022. This would be a huge 22% improvement in sales compared to the last 12 months.

The analysts have been lifting their price targets on the back of the earnings upgrade, with the consensus price target rising 8.1% to US$380. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on Coinbase Global, with the most bullish analyst valuing it at US$500 and the most bearish at US$225 per share.

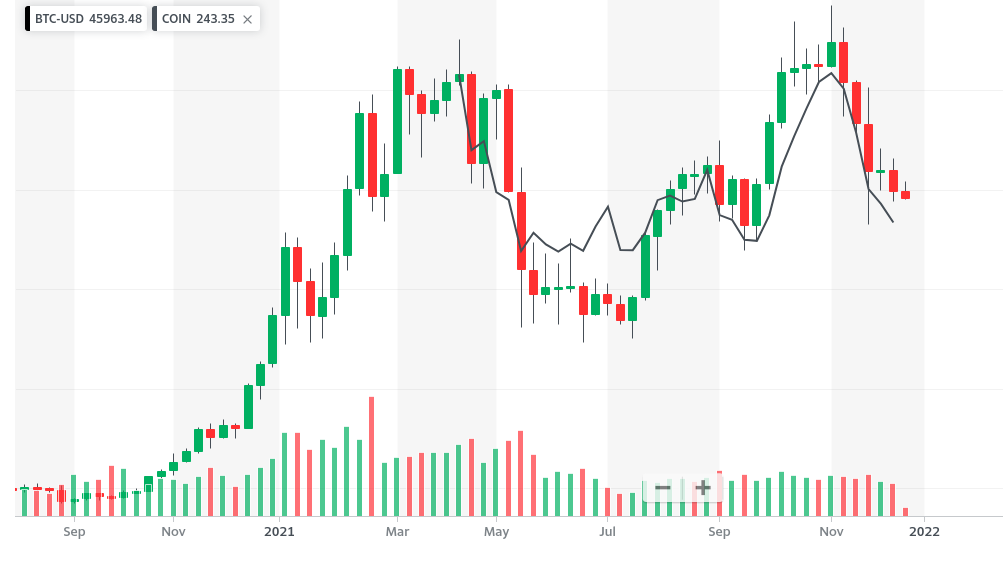

It seems that the stock is closely related to the BTC-USD price, and closely follows the volatility in crypto. In the chart below, we can see this relationship more clearly:

It seems that a bet on Coinbase is a bet on crypto, and fundamentals will follow shortly after. People that are more in sync with the Crypto markets, have a better chance to profit from future developments.

At present, there are a few factors one should be aware of in the Crypto space:

- Governments are taking stances on Crypto (positive or negative), and there is significant legislative risk and opportunity.

- Retail trading is dependent on the performance of cryptos - if the price drops too much, retail traders start exiting the market.

- Crypto ownership is consolidating to some extent, and fewer wallets own the majority of assets, which can increase volatility.

- More companies are entering the landscape and competition may pressure the profit margins of Coinbase.

For investors, a company that deals in crypto (such as Coinbase), may be an alternative and diversified way of entering the cryptocurrency market, instead of exposing oneself directly to one particular crypto.

The Bottom Line

It seems that the future of Coinbase is primarily dependent on the price of major cryptocurrencies and the active retail trading accounts, with fundamentals following these trends.

The cryptocurrency market is definitely one of the more volatile ones, and investors can expect high swings in the price of the stock, giving them a high dose of both risk and opportunity.

The stock looks currently undervalued, but for that to hold true, the sentiment and price of crypto must rebound.

However, before you get too enthused, we've discovered 2 warning signs for Coinbase Global (1 shouldn't be ignored!) that you should be aware of.

If you're looking to trade Coinbase Global, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:COIN

Coinbase Global

Operates platform for crypto assets in the United States and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives