- United States

- /

- Capital Markets

- /

- NasdaqGS:CG

Carlyle Group (CG) valuation check after weak earnings, revenue miss and peer-lagging quarterly performance

Reviewed by Simply Wall St

Carlyle Group (CG) just turned in a rough earnings report, with revenue down sharply year on year and both sales and EPS missing expectations, making it the weakest performer in its peer group.

See our latest analysis for Carlyle Group.

Even with the weak quarter, investors have mostly looked through the noise, with a 1 month share price return of 7.68% offsetting a softer 90 day move and backing up a hefty 3 year total shareholder return of 113.09%. This suggests longer term momentum remains broadly intact despite some near term nerves.

If results like Carlyle’s have you reassessing risk, it could be worth exploring fast growing stocks with high insider ownership as a way to spot other compelling ideas with aligned management incentives.

With revenues sliding, analyst expectations missed, and the stock still trading about 17% below consensus targets, the big question now is whether Carlyle is mispriced value or if the market is already factoring in future growth.

Most Popular Narrative: 14.2% Undervalued

With Carlyle Group closing at $55.79 versus a narrative fair value of $65, the story hinges on how fast earnings and margins can compound from here.

Surging institutional allocations to alternatives, reinforced by significant momentum in areas like private credit and asset-based finance (with AUM up 40% YoY), as well as a growing insurance channel (notably Fortitude Re and reinsurance flows), increasingly diversify Carlyle's revenue streams and enhance margins by providing higher recurring, stable fee income across cycles.

Curious how shrinking top line forecasts can still support rising earnings, fatter margins, and a premium multiple to today, without stretching assumptions too far?

Result: Fair Value of $65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition and any stumble in fundraising or performance could quickly pressure margins and challenge the case for a higher multiple.

Find out about the key risks to this Carlyle Group narrative.

Another Angle on Valuation

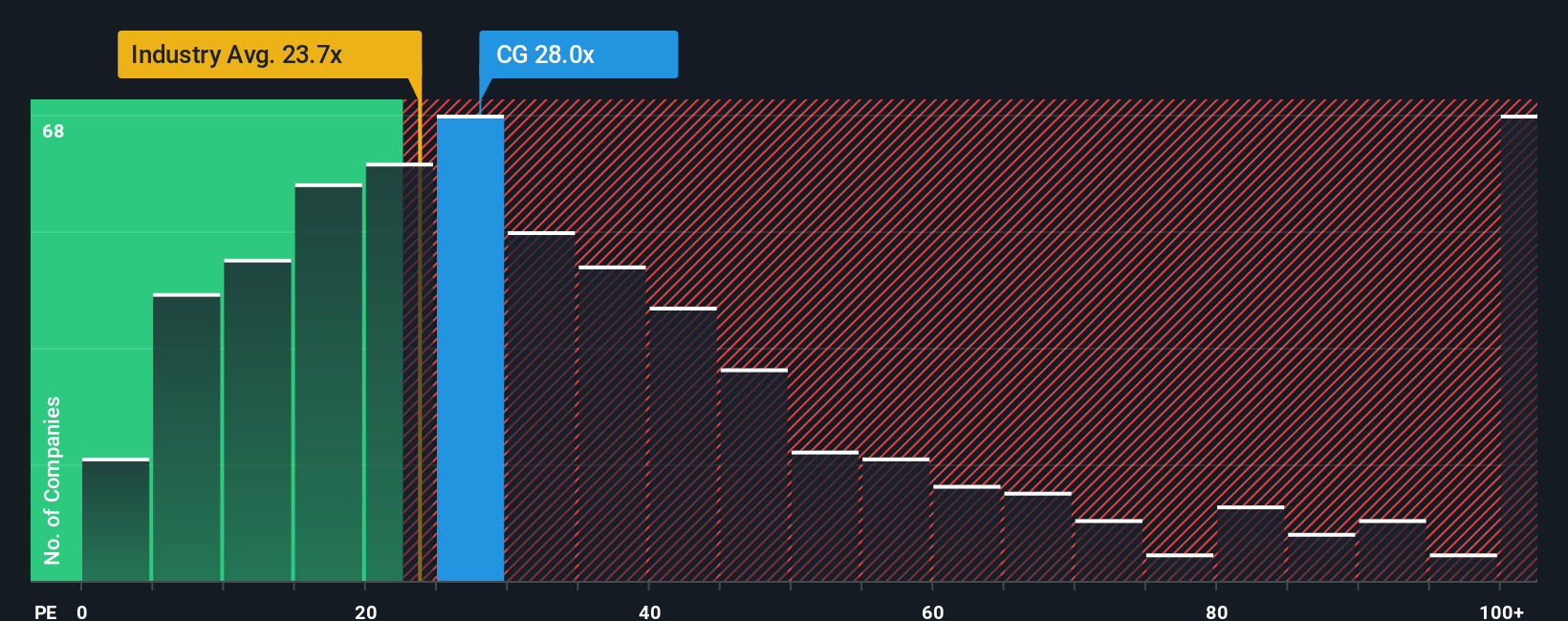

On earnings, Carlyle looks far less forgiving. The stock trades at about 30.4 times earnings, compared to 23.8 times for the wider US Capital Markets group and a fair ratio of 18.9 times. That rich gap points to downside risk if sentiment or growth expectations fade.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carlyle Group Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a full narrative in minutes, Do it your way.

A great starting point for your Carlyle Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop with one opportunity. Use the Simply Wall St Screener now to uncover fresh, data backed ideas before other investors move first.

- Capture potential mispricings by reviewing these 919 undervalued stocks based on cash flows that may be trading at meaningful discounts to their long term cash flow prospects.

- Ride powerful technology trends by targeting these 25 AI penny stocks positioned at the front line of artificial intelligence innovation.

- Strengthen your portfolio’s income engine with these 14 dividend stocks with yields > 3% that offer attractive yields supported by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CG

Carlyle Group

An investment firm specializing in direct and fund of fund investments.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026