- United States

- /

- Consumer Finance

- /

- NasdaqGS:CACC

Credit Acceptance (CACC): Assessing Valuation After $500 Million Non-Recourse Financing Boosts Balance Sheet Flexibility

Reviewed by Simply Wall St

Credit Acceptance (CACC) just completed a $500 million asset-backed non-recourse secured financing. This move helps the company pay down more expensive debt, improving its overall financial flexibility and cash position.

See our latest analysis for Credit Acceptance.

Shares of Credit Acceptance have seen some sharp moves lately, with a 2.69% one-day share price gain and a recent rebound from last week. However, the stock’s year-to-date share price return sits at -5.5%, and total shareholder return over the past year is -9.4%. Despite near-term volatility and last month’s slide, the company still boasts a 47.3% total shareholder return over five years. This suggests potential long-run value for patient investors as management navigates new financing and shifts the balance sheet.

If the latest financing piqued your interest, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With share prices still trailing their five-year highs and new financing on the table, is Credit Acceptance an undervalued play poised for a rebound, or is the market already factoring in its future growth potential?

Most Popular Narrative: 4% Undervalued

At $439.61, Credit Acceptance trades just below the most-followed narrative's fair value estimate of $458, suggesting a slight disconnect. The stage is set as analysts debate whether future growth and operational improvements are worth a modest premium.

The recent investments in technology modernization, including a revamped loan origination system and accelerated feature development, should improve customer and dealer experiences, drive operating efficiency, and support net margin improvement through cost reductions. Adoption of more advanced data analytics and ongoing scorecard updates are expected to enhance risk assessment and loan performance over coming vintages, reducing future default rates and stabilizing or expanding net margins and earnings.

Want to know the true force behind this rising valuation? One key ingredient is the sweeping tech upgrades at the heart of analysts’ bullish projections. Which critical profit levers and revenue forecasts really justify paying above the current market price? Explore the complete narrative to uncover the numbers and drivers the market is watching closely.

Result: Fair Value of $458 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent credit risks and tough competition could quickly undermine the company’s positive outlook. These factors may put pressure on margins and slow growth momentum.

Find out about the key risks to this Credit Acceptance narrative.

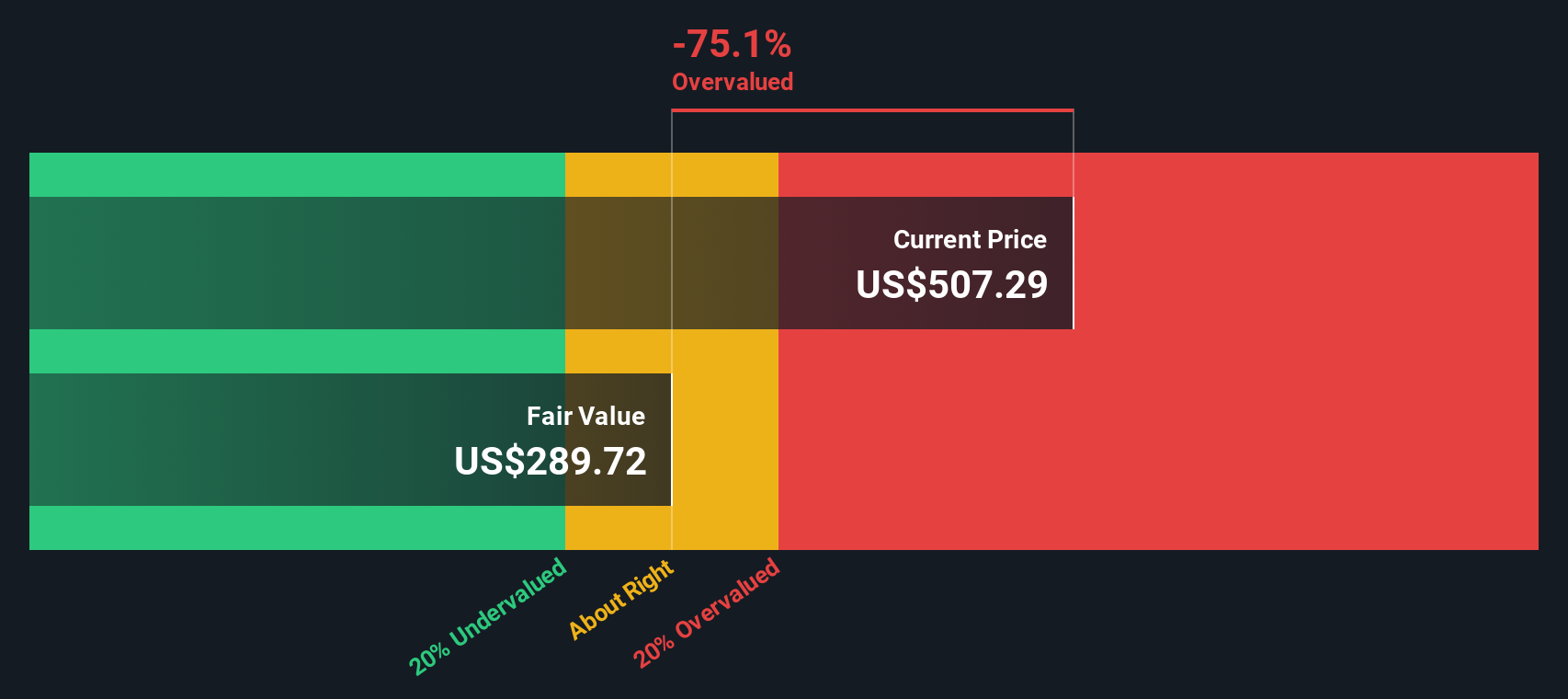

Another View: The SWS DCF Model Challenges the Narrative

While the analyst consensus points to Credit Acceptance being undervalued, our DCF model paints a very different picture. According to the SWS DCF model, the current share price sits notably above its estimated fair value. This hints at possible overvaluation and raises the question of whether market expectations are getting ahead of the fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Credit Acceptance for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Credit Acceptance Narrative

If you have your own interpretation of the numbers or want to put a different spin on the story, you can craft your own view in just a few minutes. Do it your way

A great starting point for your Credit Acceptance research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why stop with one pick when smarter, real-world ideas are waiting for you? Don’t let your next big winner pass by. Let the Simply Wall Street Screener power your search for stocks with standout advantages.

- Benefit from strong, reliable paychecks by checking out these 15 dividend stocks with yields > 3% with yields over 3%, perfect for consistent income seekers.

- Catch the wave in transformative tech by evaluating these 26 AI penny stocks leading innovation with breakthroughs in artificial intelligence.

- Capitalize on tomorrow’s market leaders by uncovering value opportunities among these 924 undervalued stocks based on cash flows based on compelling cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CACC

Credit Acceptance

Engages in the provision of financing programs, and related products and services in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives