- United States

- /

- Capital Markets

- /

- NasdaqGS:BGC

BGC Group (BGC): Valuation Insights After Macro Hive Acquisition and Digital Strategy Push

Reviewed by Kshitija Bhandaru

BGC Group (BGC) is drawing extra attention this week after announcing the acquisition of Macro Hive Limited, a global macro analytics firm known for its AI-driven technology. The deal expands BGC’s digital capabilities in agency broking.

See our latest analysis for BGC Group.

BGC Group’s acquisition of Macro Hive and recent insider activity have turned heads, especially after a string of high-profile ownership changes and an extension to its debt exchange offer. Even with these developments, the company’s 1-year total shareholder return is slightly negative at -4.8%. Long-term holders have seen a remarkable 157% return over three years and more than 250% over five. Recent share price momentum has faded. However, these bold moves hint at a pivot in strategy that could reignite investor confidence.

If you’re interested in what other companies with strong growth stories and high insider skin in the game are up to, now’s the perfect chance to broaden your perspective and discover fast growing stocks with high insider ownership

With the stock still trading nearly 40% below analyst targets, and growth bets piling up, investors have to ask if BGC Group is truly undervalued or if the recent optimism is already reflected in the price.

Most Popular Narrative: 36.8% Undervalued

With BGC Group closing at $9.17 and the most widely followed narrative estimating a fair value of $14.50, there is a substantial gap that suggests opportunity for investors paying attention. Importantly, this view is grounded in expectations of digital expansion and rapidly scaling earnings.

*Continued expansion and strong revenue growth from BGC's electronic trading platforms (notably Fenics and FMX), supported by substantial increases in electronic volumes and market share across asset classes, suggest that BGC is positioned to capitalize on the accelerating shift toward technology-driven trading. This is likely to boost top-line revenue and expand margins due to the higher scalability and profitability of electronic versus voice-driven trading.*

Want to know the roadmap behind this bold valuation? The driver is a digital trading surge, along with profitability projections rarely seen in this sector. Curious about the figures that shape this price target? Explore the full narrative to see what is fueling the narrative’s bullish outlook.

Result: Fair Value of $14.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if recent revenue momentum fades or if acquisition synergies fall short, BGC Group’s ambitious growth story could face setbacks despite its digital expansion.

Find out about the key risks to this BGC Group narrative.

Another View: Market Multiples Tell a Different Story

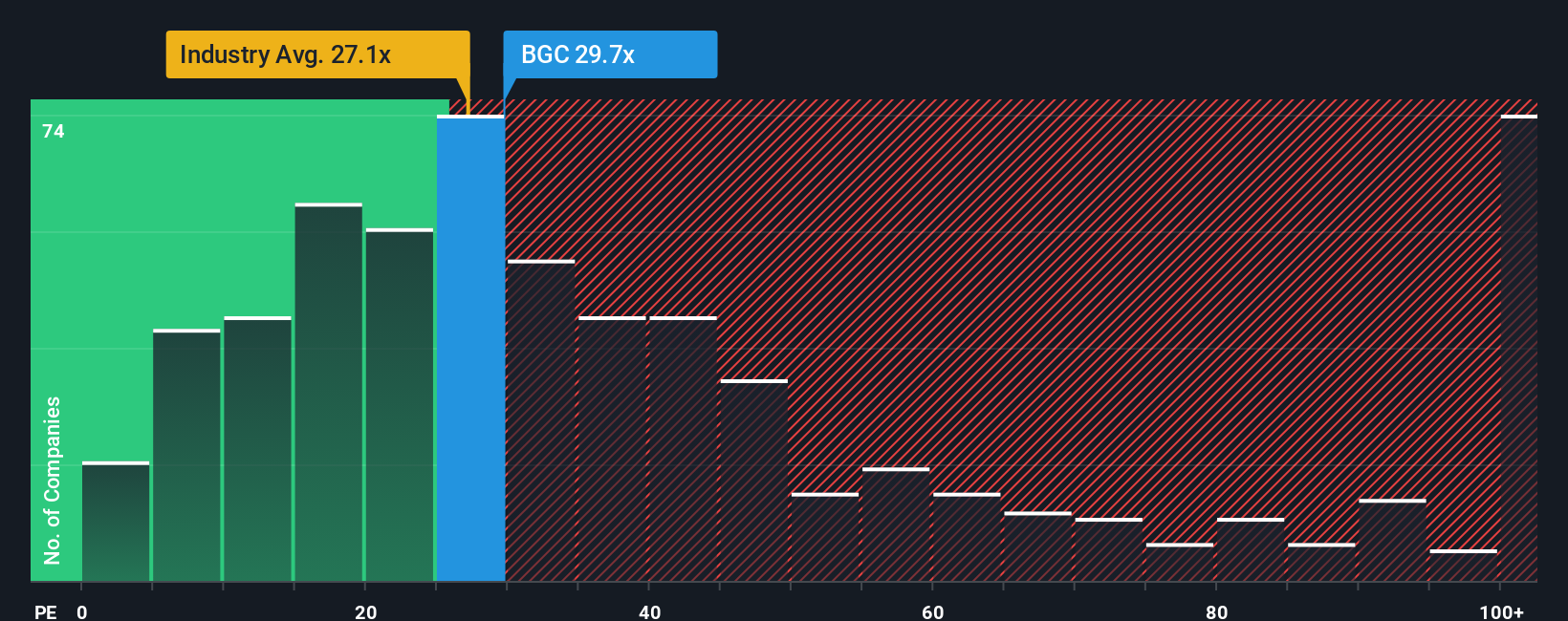

While analyst forecasts paint BGC Group as undervalued, the current price-to-earnings ratio is 29.6x, notably higher than both the US Capital Markets industry average of 27x and its peer average of 6.9x. This suggests that, by this metric, the stock is more expensive than its sector rivals. This could be a potential red flag for value-focused investors. Could the premium be justified, or is the market overlooking risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BGC Group Narrative

If you have a different perspective or want your own take, dive into the numbers yourself and shape your personal story in just minutes with Do it your way

A great starting point for your BGC Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investing means keeping your options open, so don’t miss out on eye-opening stocks across different themes. Take action now and broaden your investment universe with these handpicked opportunities:

- Boost your portfolio’s growth potential by tapping into these 25 AI penny stocks, which are shaping tomorrow through advancements in artificial intelligence and automation.

- Capture reliable long-term income when you target these 19 dividend stocks with yields > 3%, offering strong yields and solid fundamentals in today’s market.

- Position yourself early in emerging tech frontiers by investigating these 26 quantum computing stocks, leading the way in quantum computing breakthroughs and industry disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BGC Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BGC

BGC Group

Operates as a financial brokerage and technology company in the United States, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026