- United States

- /

- Diversified Financial

- /

- NasdaqGM:BETR

How Investors Are Reacting To Better (BETR) Launching an AI-Based HELOC for Self-Employed Borrowers

Reviewed by Sasha Jovanovic

- Better Home & Finance Holding Company recently announced the launch of its new AI-powered Bank Statement HELOC program, aimed at making home equity more accessible to self-employed borrowers and small business owners who traditionally can't meet standard income verification requirements.

- This initiative leverages automated analysis of bank statements for rapid underwriting, directly addressing the needs of over 36.2 million small business owners in the US with flexible, streamlined access to their home equity.

- We'll explore how this AI-driven HELOC expansion could shape Better's investment story, especially amid rising consumer demand for alternative lending solutions.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Better Home & Finance Holding's Investment Narrative?

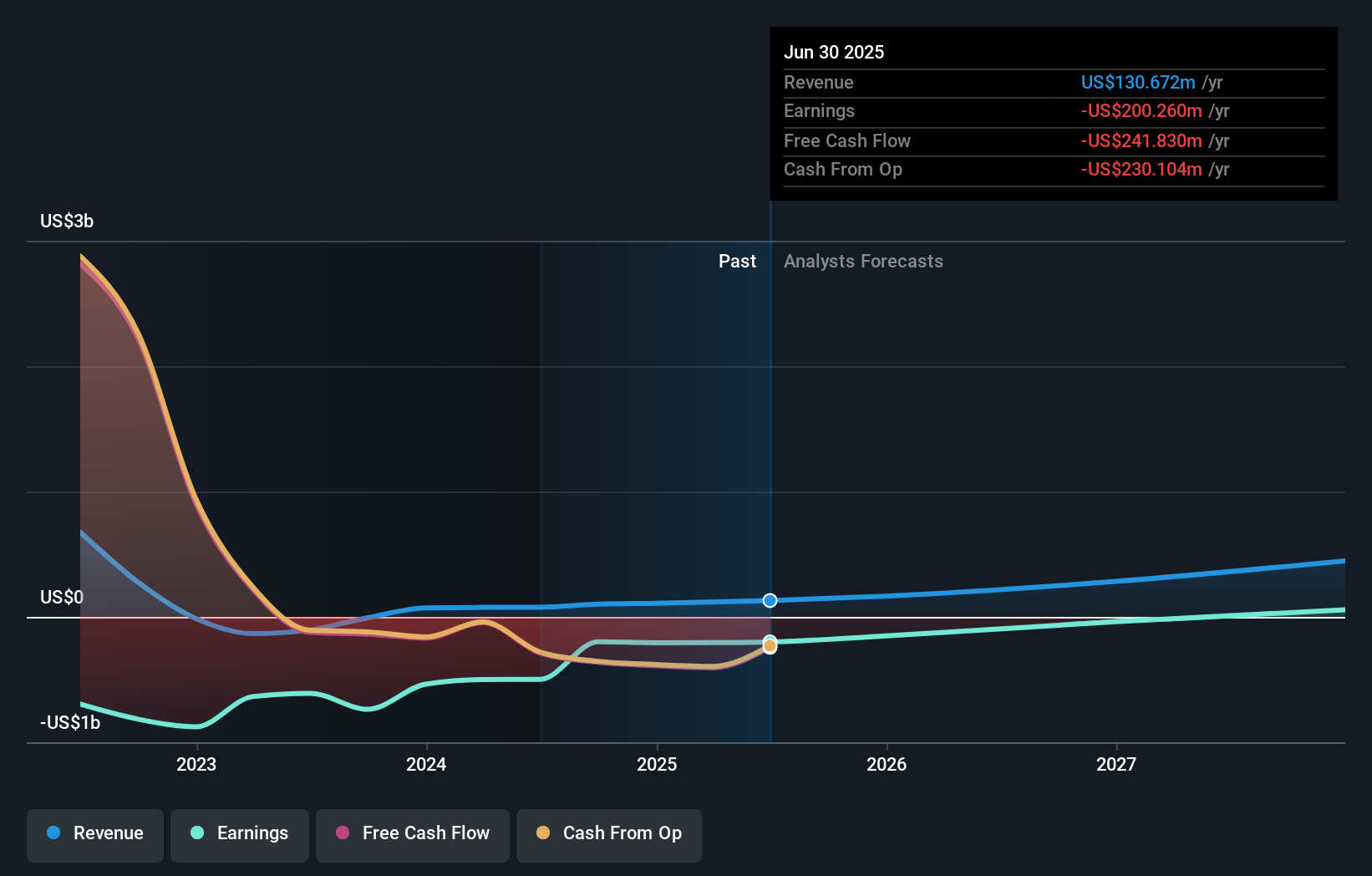

To be a shareholder of Better Home & Finance Holding, you’d want to be convinced by its promise as an AI-native disruptor in the home equity lending space, particularly now, following the launch of its AI-powered Bank Statement HELOC. This move speaks directly to the rising shift toward digital lending and better access for the millions of self-employed Americans overlooked by traditional banks. The recent rollout could provide a meaningful short-term catalyst by widening the eligible borrower pool, potentially supporting revenue growth which had previously faced mounting losses. At the same time, the $75 million follow-on equity offering raises questions about ongoing dilution and funding needs, reminding us that profitability is still a work in progress. The risk profile may also evolve as new lending products scale; increased loan originations can boost top-line results, but could also expose the company to credit risks and margin pressures if market adoption lags expectations. Given the recent surge in share price, it's possible the market is already pricing in much of the optimism, but the sustainable impact of this product launch still bears watching.

But investor enthusiasm can sometimes move faster than revenue or profits, something worth keeping in mind. Insights from our recent valuation report point to the potential overvaluation of Better Home & Finance Holding shares in the market.Exploring Other Perspectives

Explore 3 other fair value estimates on Better Home & Finance Holding - why the stock might be worth less than half the current price!

Build Your Own Better Home & Finance Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Better Home & Finance Holding research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Better Home & Finance Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Better Home & Finance Holding's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Better Home & Finance Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BETR

Better Home & Finance Holding

Operates as a homeownership company in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives