- United States

- /

- Mortgage REITs

- /

- NasdaqGS:AGNC

AGNC Investment (NasdaqGS:AGNC) Announces Q1 Preferred Dividends and US$0.12 Common Dividend

Reviewed by Simply Wall St

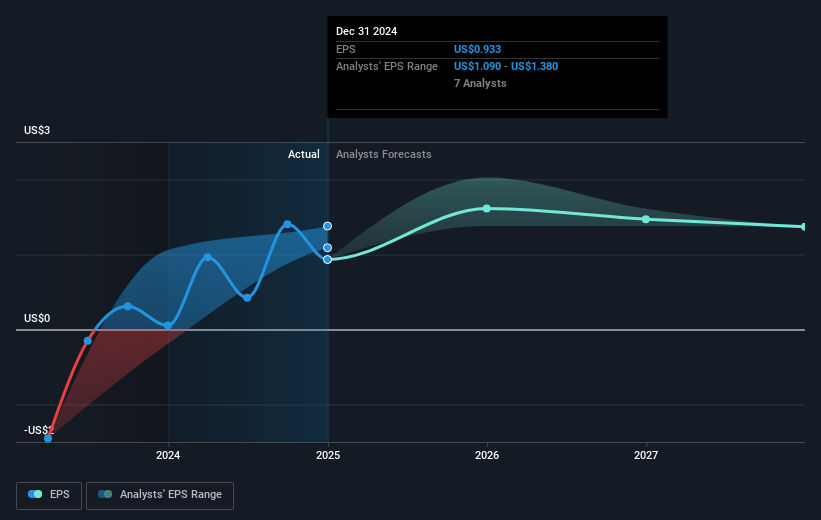

AGNC Investment (NasdaqGS:AGNC) experienced a share price increase of 4.8% over the last quarter, a period marked by significant dividend announcements and shifts in market trends. On March 13, 2025, the company declared cash dividends for its series of preferred stocks and common stock, positioning itself as an attractive choice for income-focused investors. Despite a challenging broader market environment, where the S&P 500 and Nasdaq have experienced multiple weeks of declines due to concerns over tariffs and economic growth, AGNC's firm dividend commitments provided a relative sense of stability. Additionally, AGNC's earnings report for the fourth quarter of 2024 revealed net income of $122 million, aligning closely with shareholder expectations. A tech sector rally, led by Nvidia and Palantir, along with a market rebound as stocks moved higher, may have further supported AGNC's share price despite the market volatility.

Click to explore a detailed breakdown of our findings in AGNC Investment's financial health report.

Find companies with promising cash flow potential yet trading below their fair value.

```html

Over the last five years, AGNC Investment's shares have delivered a total return of 100.74%. This period has seen several key episodes of growth and corporate actions. AGNC's commitment to consistent dividends, both on common and preferred stocks, has contributed significantly to its appeal among income-focused investors. The company announced dividends regularly, even amidst larger economic challenges, maintaining an attractive yield.

Additionally, AGNC's substantial profit growth, with earnings rising very sharply in the past year, underscores its operational strength and market resilience. Despite experiencing a setback with a net loss in Q3 2023, the company bounced back efficiently with a net income of US$718 million in Q2 2023. While AGNC underperformed the US market over the past year, it exceeded the US Mortgage REITs industry returns, highlighting its superior sector performance.

```This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade AGNC Investment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AGNC

AGNC Investment

Provides private capital to housing market in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives