- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

How Investors Are Reacting To Affirm Holdings (AFRM) Expanding Wayfair and Fanatics Retail Partnerships

Reviewed by Sasha Jovanovic

- In October 2025, Affirm announced expanded partnerships with leading retailers Wayfair and Fanatics, offering flexible pay-over-time options to shoppers in-store and online ahead of major seasonal shopping events.

- These integrations aim to make Affirm available across a wider range of retail checkout experiences, potentially increasing transaction volumes as consumer interest in payment flexibility accelerates during high-traffic periods.

- We'll examine how Affirm's broadened retail partnerships, especially the direct Wayfair integration, may reinforce its growth outlook and investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Affirm Holdings Investment Narrative Recap

To own shares in Affirm today, you’d need to believe the company can turn widespread adoption of buy now, pay later into a thriving, sustainable business, outpacing both economic headwinds and rising competition. The recent Wayfair and Fanatics partnerships put Affirm’s payment platform in front of even more shoppers, lining up closely with key holiday spending. While this broadens retail reach and may drive more transactions short-term, the risk of losing a large enterprise partner could still weigh on Affirm’s growth in the coming quarters.

The expanded Wayfair integration is especially relevant, as it directly addresses Affirm’s opportunity to capture higher transaction volumes in high-traffic retail events. By embedding Affirm as a seamless option at checkout both online and in stores, the company aims to boost shopper adoption during seasonal surges, a central catalyst for near-term performance, even as longer-term revenue questions remain.

On the other hand, investors should be aware that a sudden loss of a key merchant partner could force a reset for Affirm’s revenue growth...

Read the full narrative on Affirm Holdings (it's free!)

Affirm Holdings' outlook anticipates $6.0 billion in revenue and $756.6 million in earnings by 2028. This is based on 22.9% annual revenue growth and a $704.4 million increase in earnings from $52.2 million today.

Uncover how Affirm Holdings' forecasts yield a $96.48 fair value, a 30% upside to its current price.

Exploring Other Perspectives

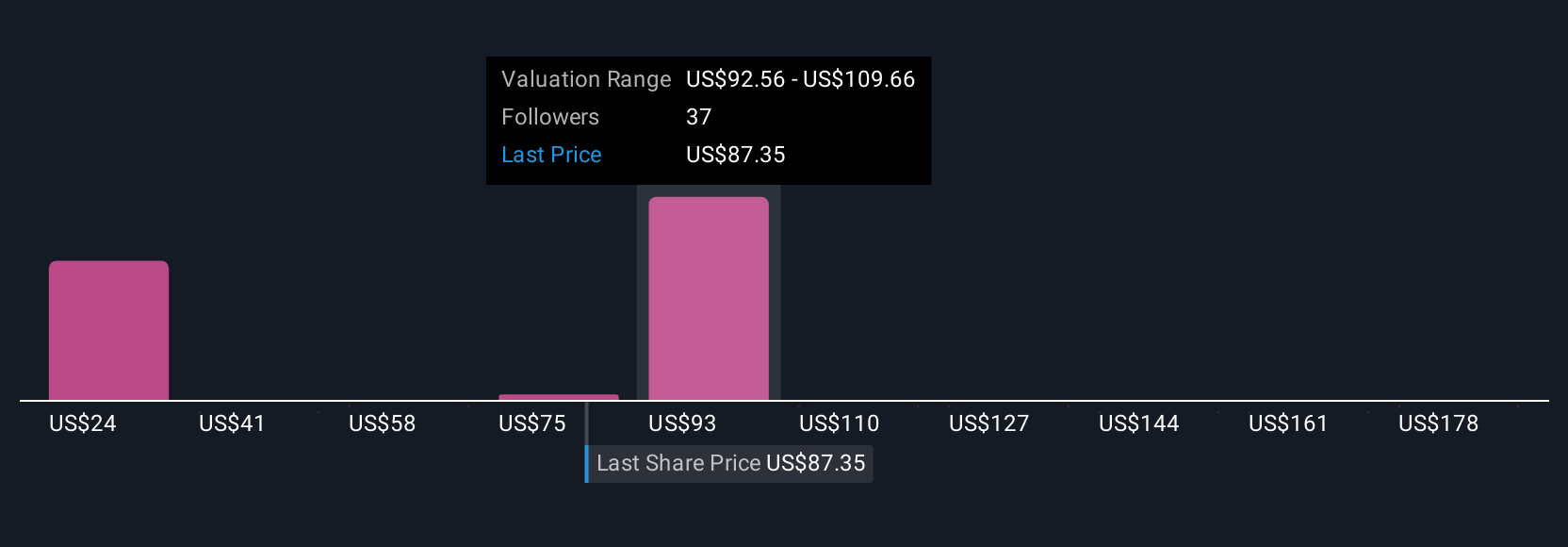

Seventeen Simply Wall St Community members estimate Affirm’s fair value anywhere from US$24.27 to US$140 per share. While some see considerable upside, ongoing merchant partner risks could sway opinions about Affirm’s long-term earnings strength, explore how these different views might factor into your own analysis.

Explore 17 other fair value estimates on Affirm Holdings - why the stock might be worth less than half the current price!

Build Your Own Affirm Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Affirm Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Affirm Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Affirm Holdings' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives