- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Affirm Holdings (NasdaqGS:AFRM) Reports US$2.8M Net Income In Third Quarter Earnings

Reviewed by Simply Wall St

Affirm Holdings (NasdaqGS:AFRM) experienced a robust price increase of nearly 49% over the last month, likely spurred by a combination of its recent strong third-quarter earnings report and strategic moves. The company's sales revenue and net income improvements contributed to positive investor sentiment. Additionally, Affirm's new client partnerships, such as with UATP, product innovations like AdaptAI, and its credit reporting expansion supported this upward momentum. Despite broader market volatility with concerns over tariffs and mixed performances among tech stocks, Affirm's solid earnings performance and strategic growth initiatives distinguished its market positioning during this period.

Every company has risks, and we've spotted 1 risk for Affirm Holdings you should know about.

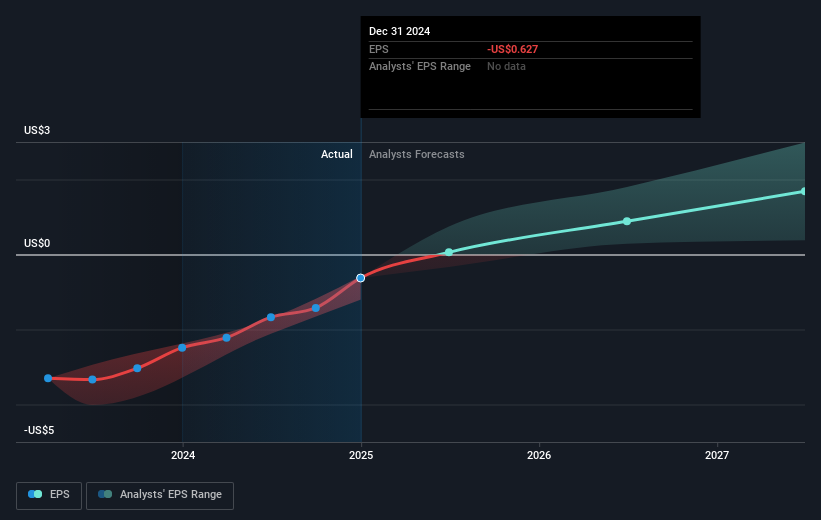

The recent upswing in Affirm Holdings' share price reflects optimistic investor sentiment spurred by strong quarterly earnings and strategic initiatives. These developments hint at possible benefits for Affirm's narrative of leveraging 0% APR loans and AI to redefine consumer lending. Such strategic growth efforts may bolster revenue and earnings potential, aligning with analyst forecasts projecting substantial revenue growth and a transition to profitability. The price surge could foster a positive outlook on Affirm's ability to meet those optimistic projections.

Over the past three years, Affirm's total return of 200.78% underscores its significant growth story, painting a picture of success despite recent market volatilities. In comparison to the industry, Affirm outperformed the US Diversified Financial industry, which returned 20% over the past year, indicating its robust market presence and investor appeal.

The 49% monthly increase in Affirm's share price brings it closer to the consensus price target of US$67.85. As of today, it remains 26% below this target. This movement suggests room for further gains if Affirm continues to execute on its growth strategy effectively. The alignment of its recent successes with future growth assumptions improves investor confidence in Affirm's ability to achieve the projected 26.1% revenue growth annually and expand profit margins from 7.1% to 12.4% over the next three years.

Learn about Affirm Holdings' future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives