- United States

- /

- Diversified Financial

- /

- NasdaqGS:AFRM

Affirm (AFRM) Holiday BNPL Surge and Pacsun Deal: What It Means for the Stock’s Valuation

Reviewed by Simply Wall St

Affirm Holdings (AFRM) is riding a holiday tailwind, with total buy now, pay later transactions up 52% year over year and a fresh Pacsun partnership sharpening its pitch to budget conscious shoppers.

See our latest analysis for Affirm Holdings.

That holiday surge in buy now, pay later volume and the Pacsun deal are landing against a choppier tape. A 30 day share price return of 7.65 percent and a much stronger three year total shareholder return of 499.56 percent suggest longer term momentum remains firmly intact even as near term sentiment cools.

If Affirm’s ride has your risk radar buzzing, this is a good moment to scan the broader fintech and payments landscape and discover fast growing stocks with high insider ownership.

Yet with shares still up nearly fivefold over three years and trading well below analyst targets, investors face a key question: is this recent pullback a rare entry point, or is the market already baking in tomorrow’s growth?

Most Popular Narrative: 26.8% Undervalued

Against Affirm Holdings last close of $67.99, the most followed narrative sees fair value materially higher and frames today’s price as a sizable discount.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 56.5x on those 2028 earnings, down from 532.4x today. This future PE is greater than the current PE for the US Diversified Financial industry at 16.4x.

Want to know why a fast rising earnings profile still commands a rich future multiple, even after a major reset? Curious which growth levers and margin upgrades must perform perfectly to keep that premium alive? The full narrative walks through the forecast playbook step by step and shows how those moving parts stack up to reach its fair value call.

Result: Fair Value of $92.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a key merchant loss or a sharper consumer slowdown could quickly test those growth assumptions and force a rethink of today’s optimistic valuation.

Find out about the key risks to this Affirm Holdings narrative.

Another Lens On Valuation

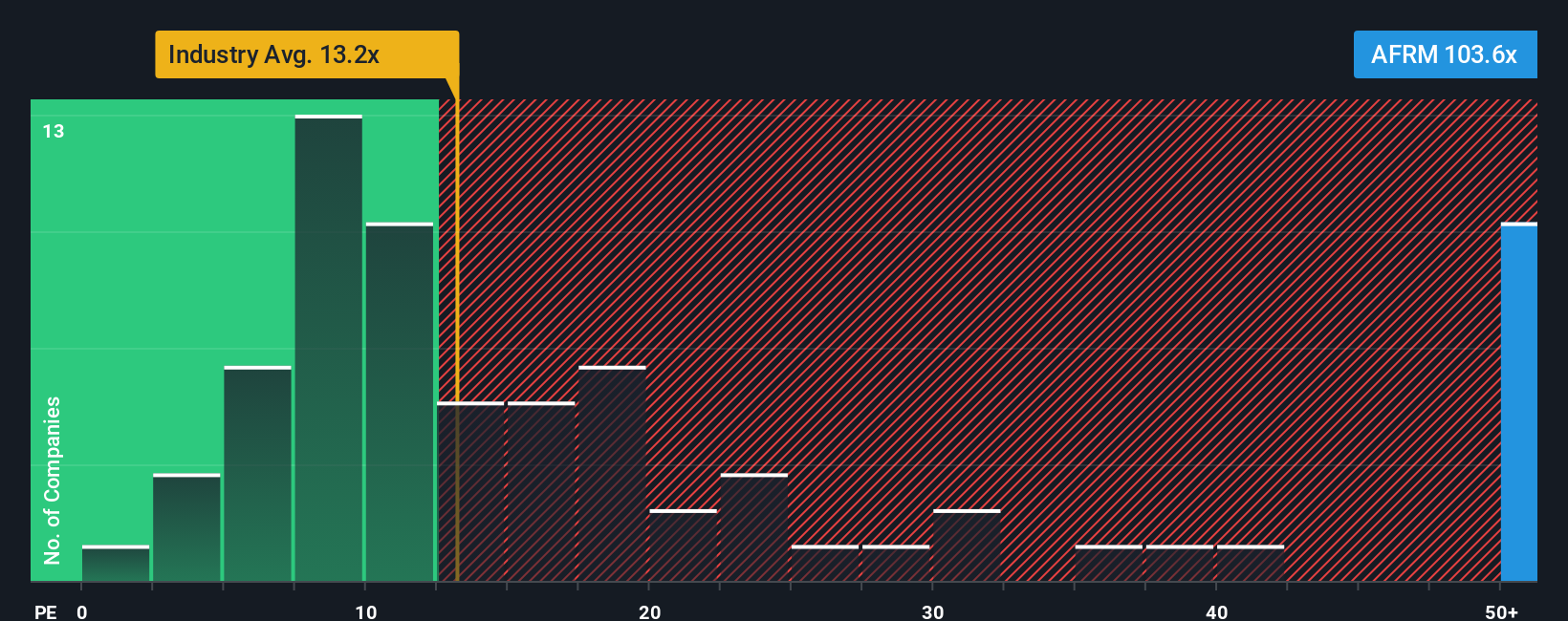

Step away from the narrative fair value and the earnings multiple paints a very different picture. At roughly 96 times earnings, Affirm trades at about three times both peers at 30.2 times and its own 30.8 times fair ratio, suggesting meaningful valuation risk if growth expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Affirm Holdings Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Affirm Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may want to scan fresh opportunities on Simply Wall St so potential ideas do not slip past your watchlist.

- Explore potential upside in beaten down names with these 3574 penny stocks with strong financials that pair low share prices with relatively solid financial foundations.

- Consider exposure to the AI theme by reviewing these 26 AI penny stocks that combine innovation with notable growth characteristics.

- Identify potentially attractive entry points using these 908 undervalued stocks based on cash flows that highlight companies trading at prices that may not fully reflect their cash flow profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AFRM

Affirm Holdings

Operates payment network in the United States, Canada, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026