- United States

- /

- Diversified Financial

- /

- NasdaqGS:ACTG

Investors Aren't Entirely Convinced By Acacia Research Corporation's (NASDAQ:ACTG) Revenues

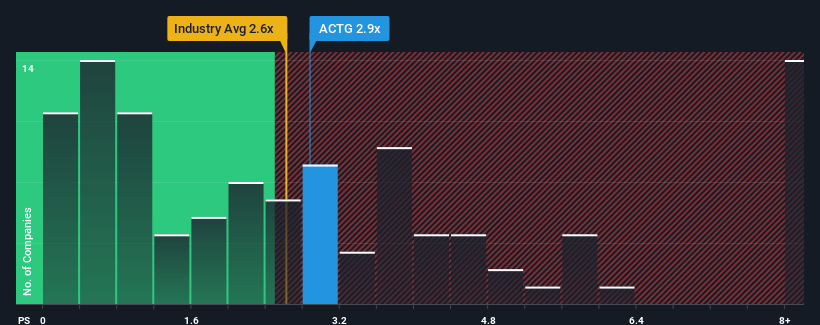

With a median price-to-sales (or "P/S") ratio of close to 2.6x in the Diversified Financial industry in the United States, you could be forgiven for feeling indifferent about Acacia Research Corporation's (NASDAQ:ACTG) P/S ratio of 2.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Acacia Research

How Acacia Research Has Been Performing

While the industry has experienced revenue growth lately, Acacia Research's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Acacia Research.Is There Some Revenue Growth Forecasted For Acacia Research?

Acacia Research's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.2%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 39% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 83% as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 4.2% growth forecast for the broader industry.

With this information, we find it interesting that Acacia Research is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Acacia Research's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Acacia Research currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Acacia Research that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ACTG

Acacia Research

Operates as an acquirer and operator of businesses across industrial, energy, and technology sectors in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives