- United States

- /

- Diversified Financial

- /

- NasdaqGS:ACTG

Discovering Three Hidden Gems In The US Market

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet it has experienced a remarkable 37% increase over the past year with earnings forecasted to grow by 15% annually. In such a dynamic environment, identifying stocks that offer unique value and potential for growth can be crucial for investors seeking opportunities beyond well-known names.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Bank First (NasdaqCM:BFC)

Simply Wall St Value Rating: ★★★★★★

Overview: Bank First Corporation operates as a holding company for Bank First, N.A., providing a full range of consumer and commercial financial institution services with a market capitalization of $919.25 million.

Operations: Bank First generates revenue primarily from its consumer and commercial financial services, totaling $184.22 million.

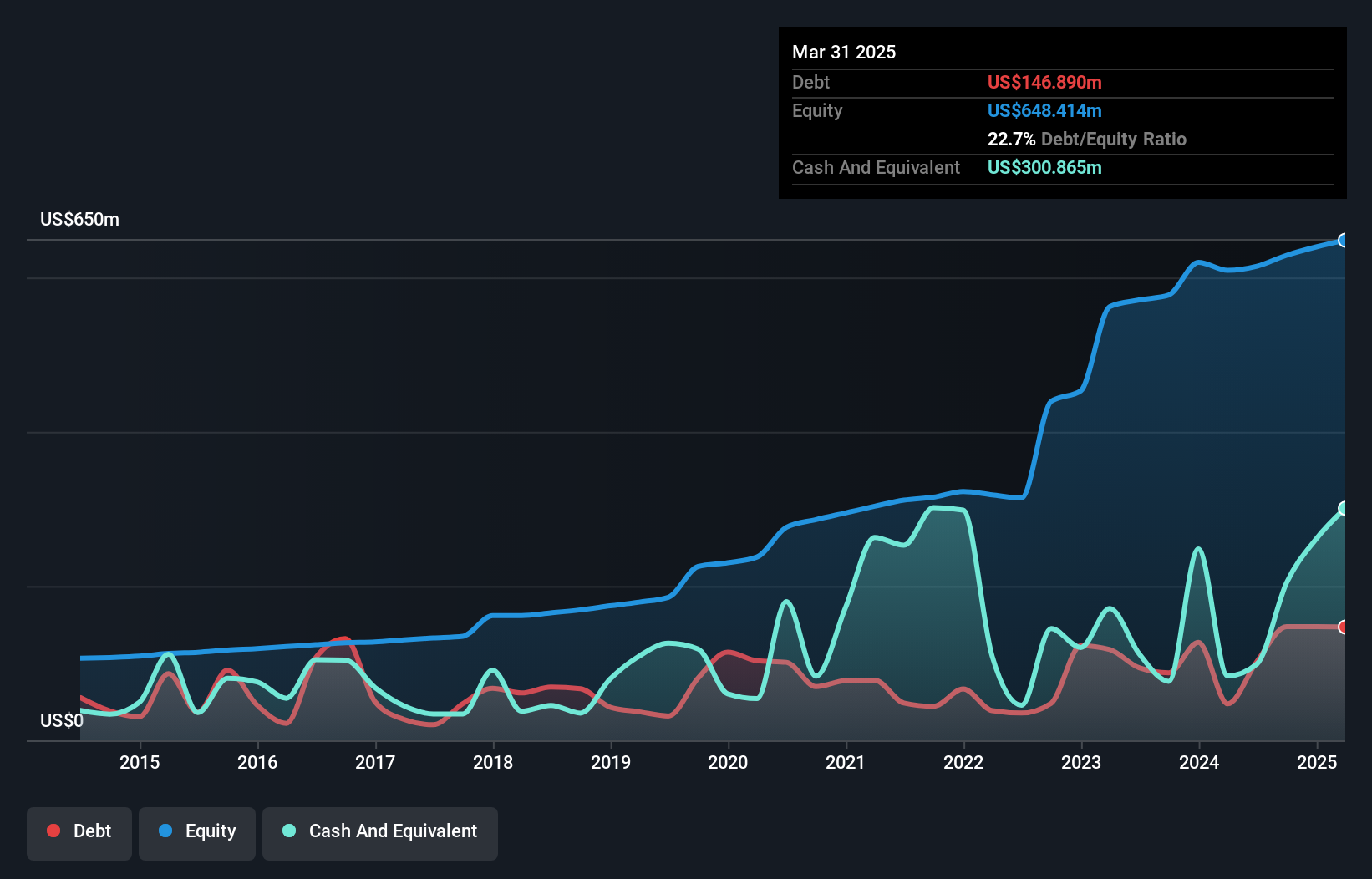

Bank First, a smaller player in the banking sector with total assets of US$4.3 billion and equity of US$628.9 million, demonstrates robust fundamentals. The bank holds a sufficient allowance for bad loans at 0.3% of total loans and boasts a net interest margin of 3.7%. Its recent earnings growth outpaced the industry, climbing 58.2% over the past year compared to an industry average decline of 15.6%. Additionally, Bank First's stock trades at about 20% below its estimated fair value, suggesting potential undervaluation while maintaining high-quality earnings and primarily low-risk funding sources at 95%.

- Delve into the full analysis health report here for a deeper understanding of Bank First.

Evaluate Bank First's historical performance by accessing our past performance report.

Viemed Healthcare (NasdaqCM:VMD)

Simply Wall St Value Rating: ★★★★★★

Overview: Viemed Healthcare, Inc. offers home medical equipment and post-acute respiratory healthcare services across the United States, with a market capitalization of $357.97 million.

Operations: Viemed Healthcare generates revenue primarily from its Sleep and Respiratory Disorders Sector, amounting to $205.70 million.

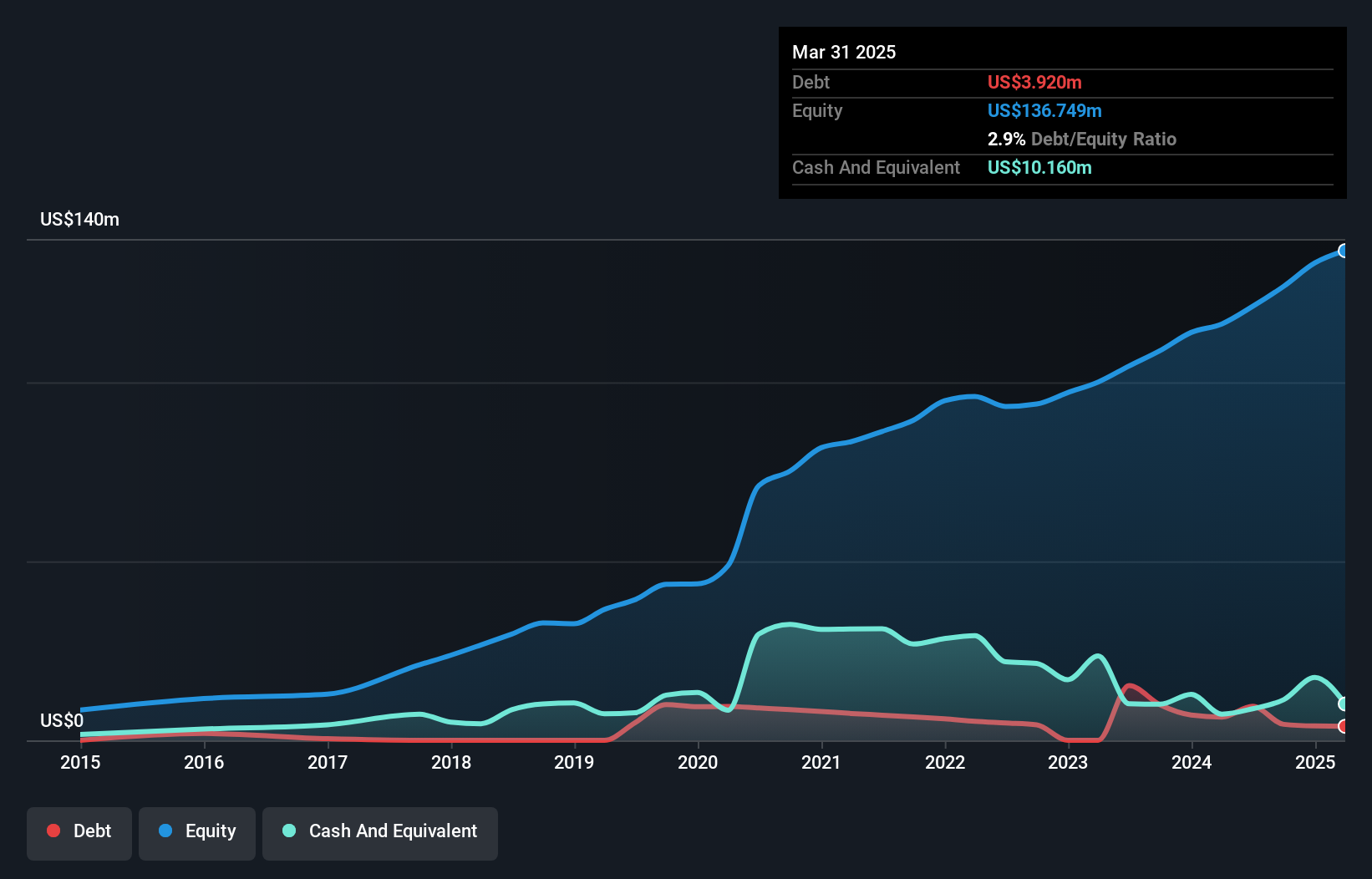

Viemed Healthcare, a nimble player in the healthcare sector, is making strategic moves to boost its growth trajectory. The firm reported sales of US$54.97 million for Q2 2024, up from US$43.31 million the previous year, though net income dipped to US$1.47 million from US$2.33 million. With a satisfactory net debt to equity ratio of 0.6% and interest payments well covered by EBIT at 19 times, Viemed's financial health seems robust enough to support expansion efforts like leveraging Phillips' ventilator recall and investing in machine learning for cost efficiencies. Analysts forecast revenue growth at 12.5% annually over three years with profit margins rising from 4.6% to 7.9%.

Acacia Research (NasdaqGS:ACTG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Acacia Research Corporation specializes in acquiring and managing companies within the technology, energy, and industrials sectors, with a market capitalization of approximately $480.80 million.

Operations: Acacia Research generates revenue primarily from its Intellectual Property Operations, contributing $103.54 million, and Industrial Operations, adding $32.14 million. The company's net profit margin is a key indicator of its financial health and efficiency in managing costs relative to revenue.

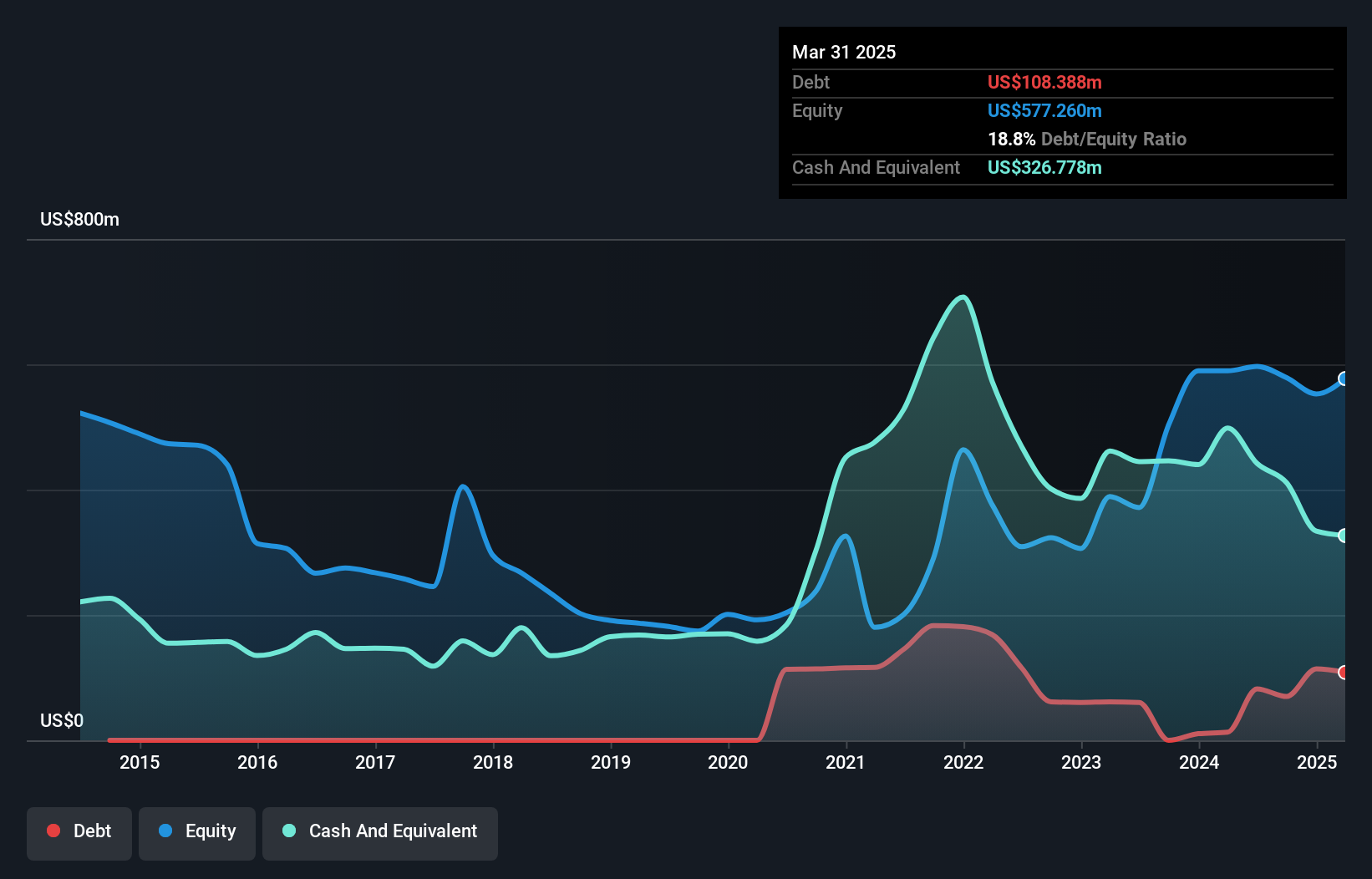

Acacia Research, a small-cap player in the diversified financial sector, has seen its net loss shrink to US$8.45 million for Q2 2024 from US$18.78 million a year ago, while revenue jumped to US$25.84 million from US$7.9 million. Despite becoming profitable last year and having more cash than total debt, Acacia's earnings are forecasted to drop significantly over the next three years by an average of 166% annually due to declining revenue and shrinking profit margins from 39% to 7%. Trading at roughly 72% below estimated fair value suggests potential upside if challenges like integration issues and fluctuating patent valuations are managed effectively.

Taking Advantage

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 220 more companies for you to explore.Click here to unveil our expertly curated list of 223 US Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACTG

Acacia Research

Operates as an acquirer and operator of businesses across industrial, energy, and technology sectors in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives