- United States

- /

- Diversified Financial

- /

- NasdaqGS:ACT

Should Enact Holdings’ (ACT) Expanded $435 Million Credit Facility Influence Investor Thinking?

Reviewed by Sasha Jovanovic

- Enact Holdings, Inc. announced on September 30, 2025, that it has entered into a new US$435 million five-year senior unsecured revolving credit facility, replacing its previous US$200 million facility.

- This significant increase in available credit highlights improved lender confidence and may provide additional resources for Enact Holdings' working capital and general corporate needs.

- We’ll now explore how Enact Holdings’ expanded credit facility could impact its investment outlook and future financial flexibility.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Enact Holdings Investment Narrative Recap

To be a shareholder in Enact Holdings, investors need to believe in the durability of US mortgage demand, the company’s discipline in risk selection, and its ability to return capital to shareholders even as the mortgage insurance market faces headwinds. The recently expanded US$435 million credit facility strengthens Enact’s liquidity, but does not materially shift the short-term catalyst for the stock, which remains tied to mortgage origination volumes and housing market conditions. The key near-term risk continues to be the trajectory of mortgage interest rates and their effect on new insurance written.

The company’s completion of a substantial share buyback program earlier in 2025 stands out as particularly relevant. With additional credit flexibility now in place, Enact has greater capacity to support future share repurchases or dividends, both important for supporting its investment thesis if top-line growth is pressured. These corporate actions underscore management’s ongoing focus on maintaining capital returns amidst uncertain market expansion, while investors look for signals of improving mortgage credit demand.

In contrast, investors should also be aware that ongoing regional home price softness could...

Read the full narrative on Enact Holdings (it's free!)

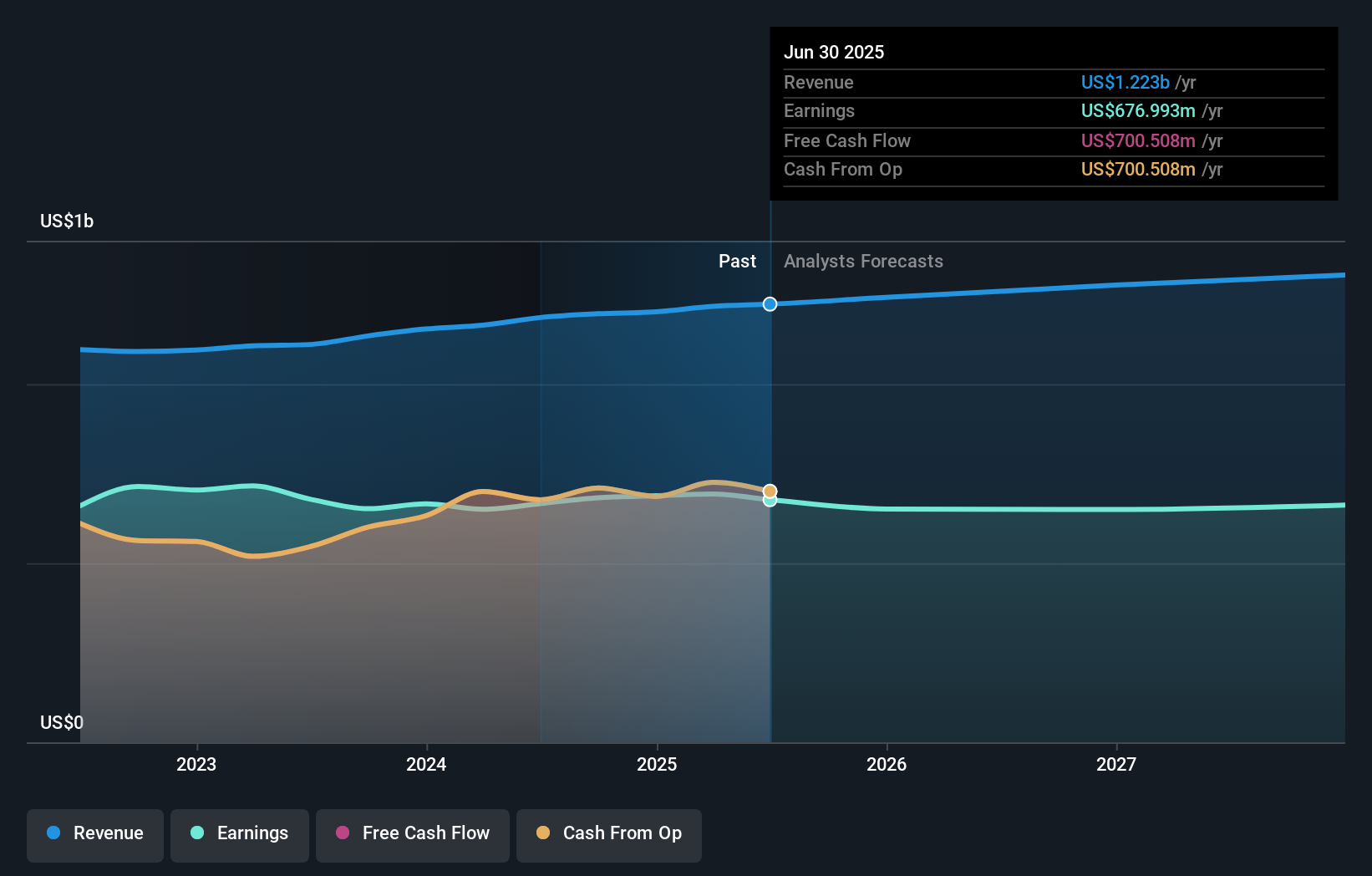

Enact Holdings is projected to reach $1.3 billion in revenue and $650.7 million in earnings by 2028. This outlook assumes a 2.7% annual revenue growth rate, but a decrease in earnings of $26.3 million from the current $677.0 million.

Uncover how Enact Holdings' forecasts yield a $40.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community contributed two fair value forecasts for Enact Holdings, spanning from US$85 to over US$29,900 per share. While some see deep undervaluation, others are attuned to risks like sustained elevated interest rates limiting revenue growth, reminding you to review varied outlooks for a fuller picture.

Explore 2 other fair value estimates on Enact Holdings - why the stock might be worth just $85.14!

Build Your Own Enact Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enact Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Enact Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enact Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enact Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACT

Enact Holdings

Operates as a private mortgage insurance company in the United States.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives