- United States

- /

- Hospitality

- /

- OTCPK:LKNC.Y

Is Luckin Coffee Poised for Growth After Bold New York City Expansion in 2025?

Reviewed by Bailey Pemberton

If you are staring at Luckin Coffee's stock and asking yourself, "Do I get in now or wait for a better entry?" you are definitely not alone. The company has been serving up returns at a pace that would give anyone pause: year-to-date, shares are up 46.7%, and the one-year gain sits at a remarkable 69.9%. Over the last five years, holders have seen the stock surge more than 790%. That said, in just the past week, shares pulled back by 4.4%. This kind of movement can feel like whiplash. It also looks a lot like the market recalibrating its expectations after some big headlines.

Recently, Luckin Coffee made waves with a bold move: opening its first store in New York City, right on Starbucks' turf and just steps from one of the coffee giant's locations. It's a signal of intent from a company that, in just six years, managed to overtake Starbucks as China's largest coffee chain. With competition heating up and Luckin’s innovative approach, such as a streamlined app and aggressive store rollout, growth stories like this often launch runs much like what we've seen in Luckin's chart.

But before you decide to dive in or pass, let's talk numbers. On a valuation front, Luckin scores a 4 out of 6, showing that it's currently undervalued across most of the standard checks. Does that mean it's a screaming buy, or are there risks lurking just beneath those headline returns?

Next, we will take a closer look at each valuation method to see how Luckin measures up, and stick around, because there is an even more insightful angle on valuation that you will not want to miss at the end of this article.

Approach 1: Luckin Coffee Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's worth by projecting its future cash flows and discounting them back to today's value. This approach focuses on the fundamental drivers of value, rather than just current profits or revenues.

For Luckin Coffee, the latest reported Free Cash Flow (FCF) stands at approximately CN¥3.6 Billion. Analysts expect this number to grow steadily, reaching about CN¥4.7 Billion by the end of 2027. While direct analyst estimates run out after five years, the numbers for the following years, such as a projected CN¥9.2 Billion in 2035, are extrapolated based on growth rates by Simply Wall St. This long-term forecast reflects the company's strong expansion and operational efficiency in the Chinese market.

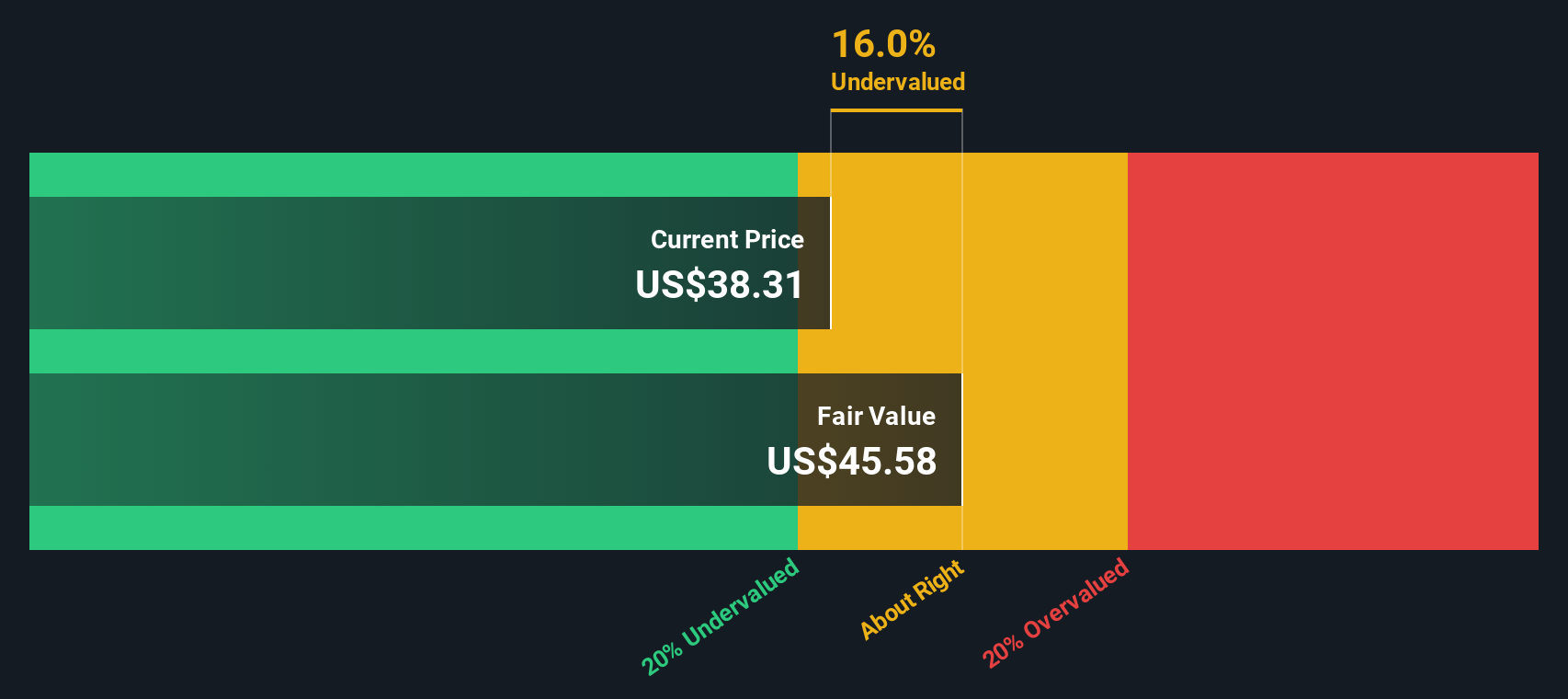

Based on these projections, the DCF model calculates an intrinsic value per share of $46.14. With the current share price sitting at a 14.4% discount to this value, the analysis suggests the stock is notably undervalued compared to what its future cash flows imply.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Luckin Coffee is undervalued by 14.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Luckin Coffee Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing profitable companies, since it tells you how much investors are willing to pay for each dollar of reported earnings. Using earnings removes much of the noise that can affect other ratios, making it especially useful for assessing established businesses like Luckin Coffee.

What is considered a "normal" or "fair" PE ratio can vary depending on how quickly a company is expected to grow its earnings and the perceived risks around those future profits. Higher growth often supports a higher PE, while higher risk or lower expected growth usually pulls it lower.

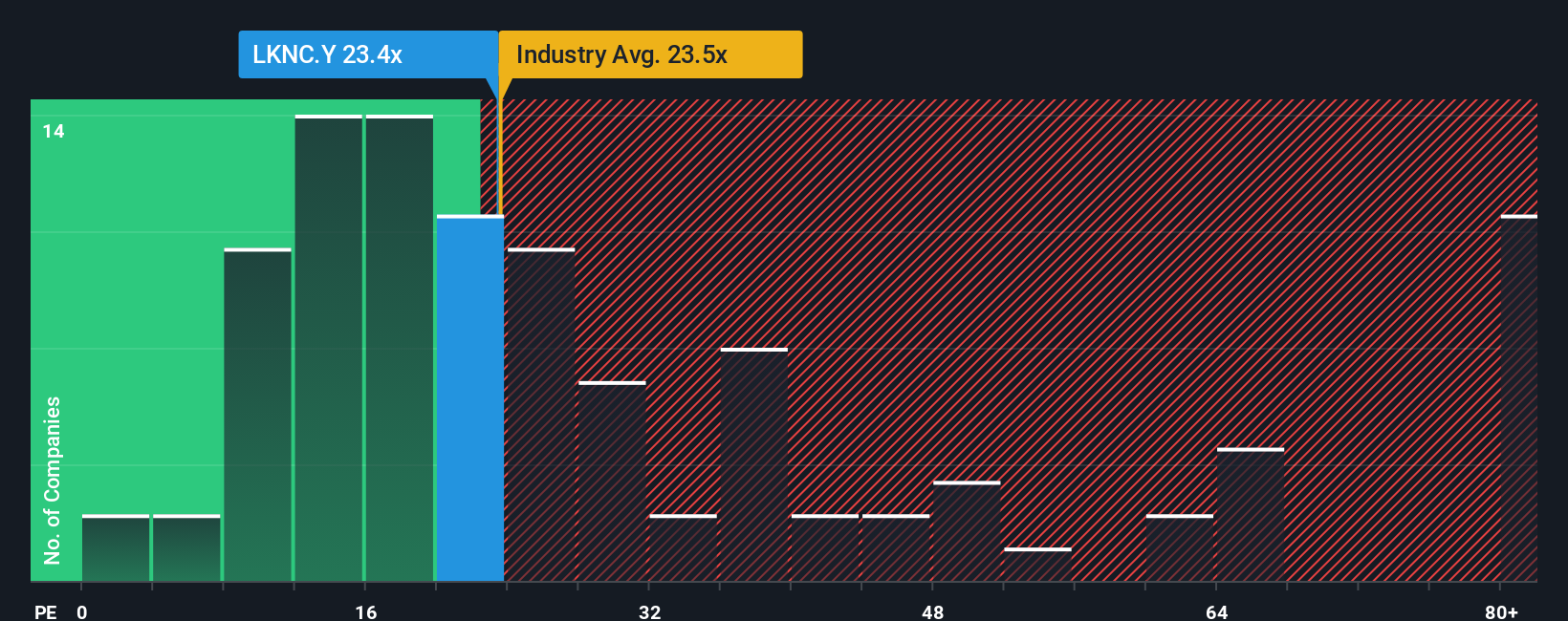

Currently, Luckin Coffee is trading at a PE ratio of 23x. For context, the average PE ratio in the Hospitality industry is around 23.8x, while key peers command an average of 59.9x. At first glance, Luckin appears reasonably valued or even cheap compared to major peers.

However, Simply Wall St’s "Fair Ratio" goes a step further by calculating the multiple you would expect given Luckin’s specific circumstances. The calculation factors in its growth outlook, industry dynamics, profitability, size, and risk profile. This approach is designed to be more relevant than just looking at peers or the straight industry average, which may not capture the nuances behind Luckin’s business story.

Luckin’s Fair PE Ratio is estimated to be 29.7x. With the actual PE at 23x, this means the stock is trading below what would be justified by its fundamentals, suggesting the market is underpricing its true earnings power compared to similar businesses with similar growth and risk characteristics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Luckin Coffee Narrative

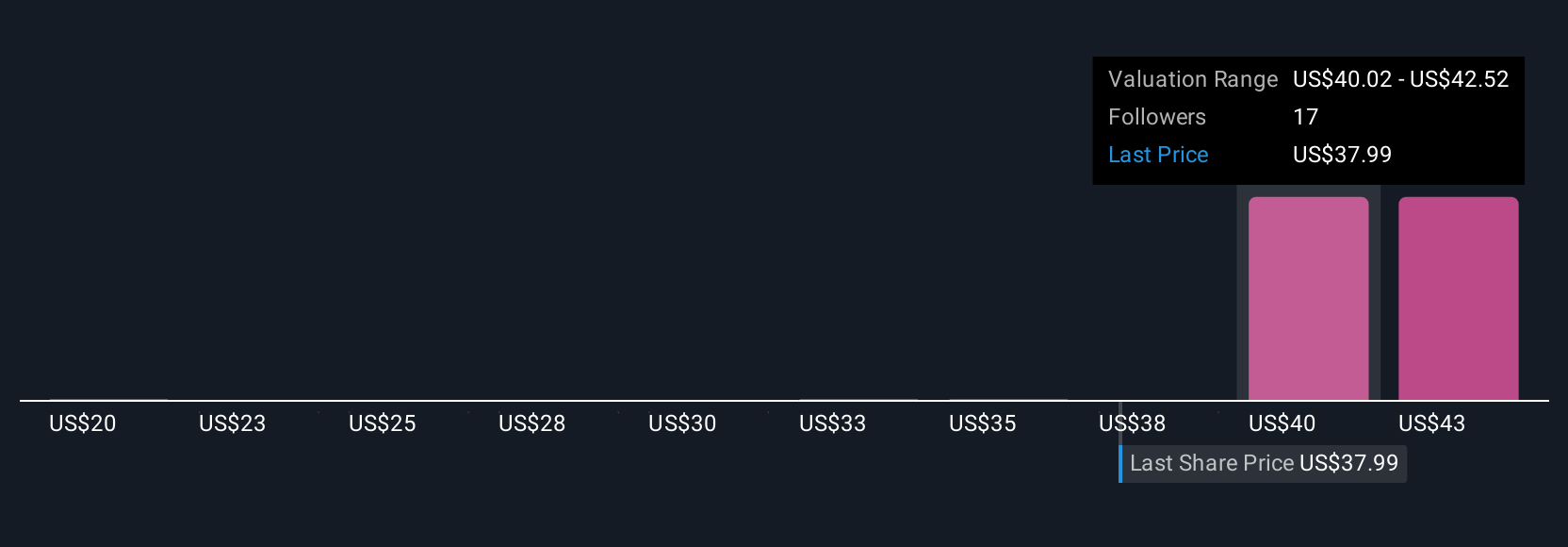

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple story you create about a company. It is your perspective on its business and future direction, combined with your estimates for its future revenue, earnings, and margins. Instead of just relying on averages or analyst views, a Narrative helps you connect the dots between what you believe about Luckin Coffee’s market, strategy, or innovation and how that translates into financial forecasts and a calculated fair value per share.

On Simply Wall St’s Community page, Narratives make it easy for any investor, even beginners, to express their viewpoint and see in real time how their story compares to others, as millions of users do. This tool empowers you to make smarter decisions: compare your Fair Value result with the actual market price and decide if now is the time to buy, hold, or sell. Narratives update automatically as new news, earnings, or forecasts arrive, so your view stays relevant and informed.

For example, among Luckin Coffee Narratives right now, one sees soaring digital engagement and market expansion driving a fair value of $46.89, while another warns that operational risks and fierce competition could justify a value as low as $37.90. Narratives let you weigh the range of possibilities and choose the story and investment strategy that makes the most sense to you.

Do you think there's more to the story for Luckin Coffee? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:LKNC.Y

Luckin Coffee

Offers retail services of freshly brewed drinks, and pre-made food and beverage items in the People's Republic of China.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives