- United States

- /

- Hospitality

- /

- OTCPK:LKNC.Y

Is Luckin Coffee Fairly Priced After New York Store Opens Near Starbucks?

Reviewed by Bailey Pemberton

Thinking about what to do with Luckin Coffee stock? You are not alone. The buzz around this bold challenger, now China’s largest coffee chain, is spreading far beyond Shanghai and Beijing. In fact, Luckin recently planted its flag in New York City, opening a store barely 200 feet from a Starbucks. This suggests fierce competition is moving onto the global stage. It is moves like these that have pushed Luckin Coffee’s shares up by a staggering 13.2% in the past week and nearly 18% over the last month. If you take a longer view, the numbers become even harder to ignore: up 59.8% year-to-date and an incredible 835.4% in the last five years.

These runs do not happen without reason, and they often signal heightened investor confidence or a new narrative in play, such as a disruptive company redefining an entire market. But big gains also ignite questions about value, especially if you are trying to decide whether to hold on, buy in, or take your profits. According to our valuation framework, Luckin is undervalued in three out of six key metrics, giving it a value score of 3. But before you make your next move, it is smart to weigh these valuation checks and, even more importantly, to consider if there is a smarter way to judge the company’s true worth. Let’s break down exactly how we arrive at that score, and then explore what might be an even better measure for investors who want the full picture.

Approach 1: Luckin Coffee Discounted Cash Flow (DCF) Analysis

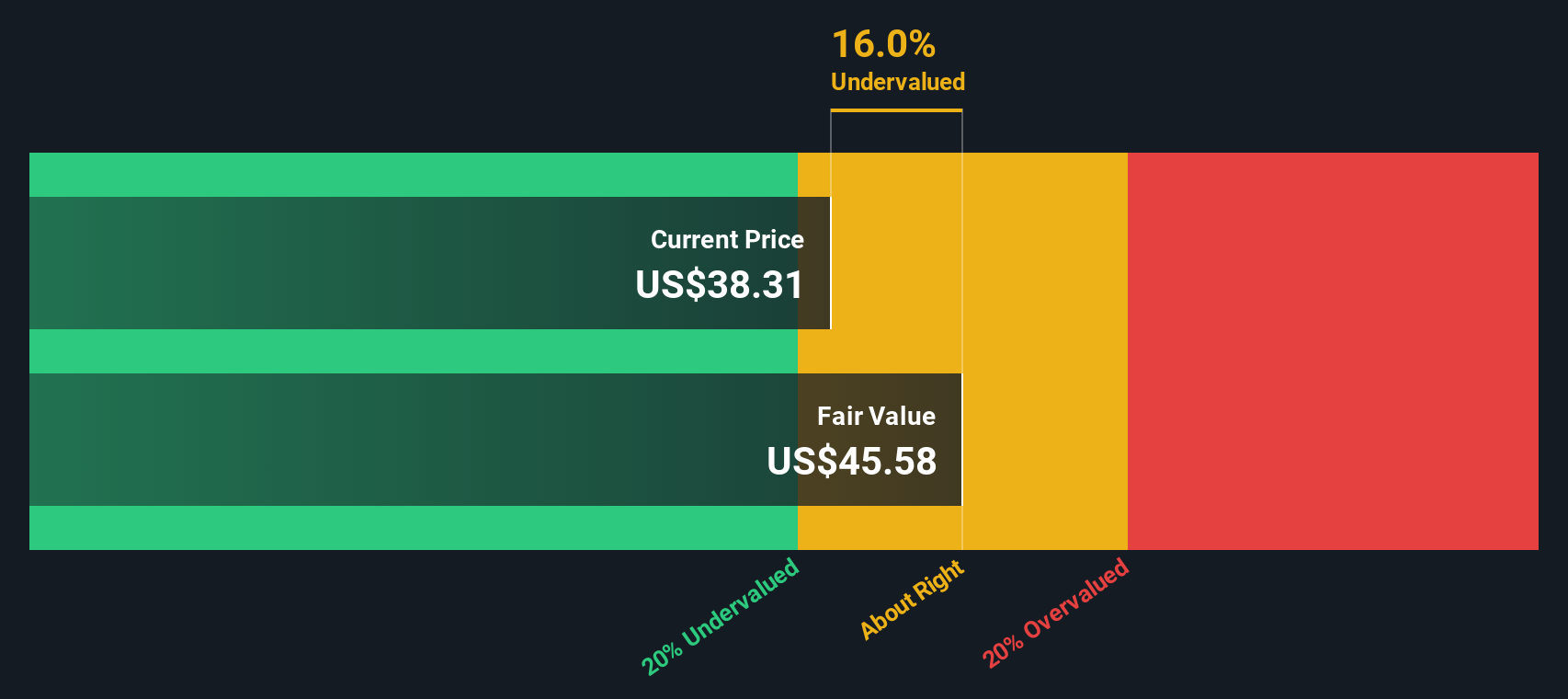

The Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to present value. In Luckin Coffee’s case, this approach uses recent performance and analyst assumptions to predict how much cash the company will generate and what that is worth to shareholders right now.

Luckin Coffee reported trailing twelve month free cash flow of roughly CN¥3.6 billion, with projections from analysts and further estimates suggesting this could climb to more than CN¥9.2 billion by 2035. These forecasts reflect expectations of sustained growth, with key milestones such as CN¥4.7 billion forecast for 2027 and steady increases each year thereafter, based on both analyst data and continued growth assumptions.

Based on these projections, the DCF model calculates a fair value of $46.21 per share, which is 6.9% above the recent trading price. In short, the intrinsic value estimate puts Luckin Coffee’s shares right in line with the market, neither a major bargain nor overpriced.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Luckin Coffee's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

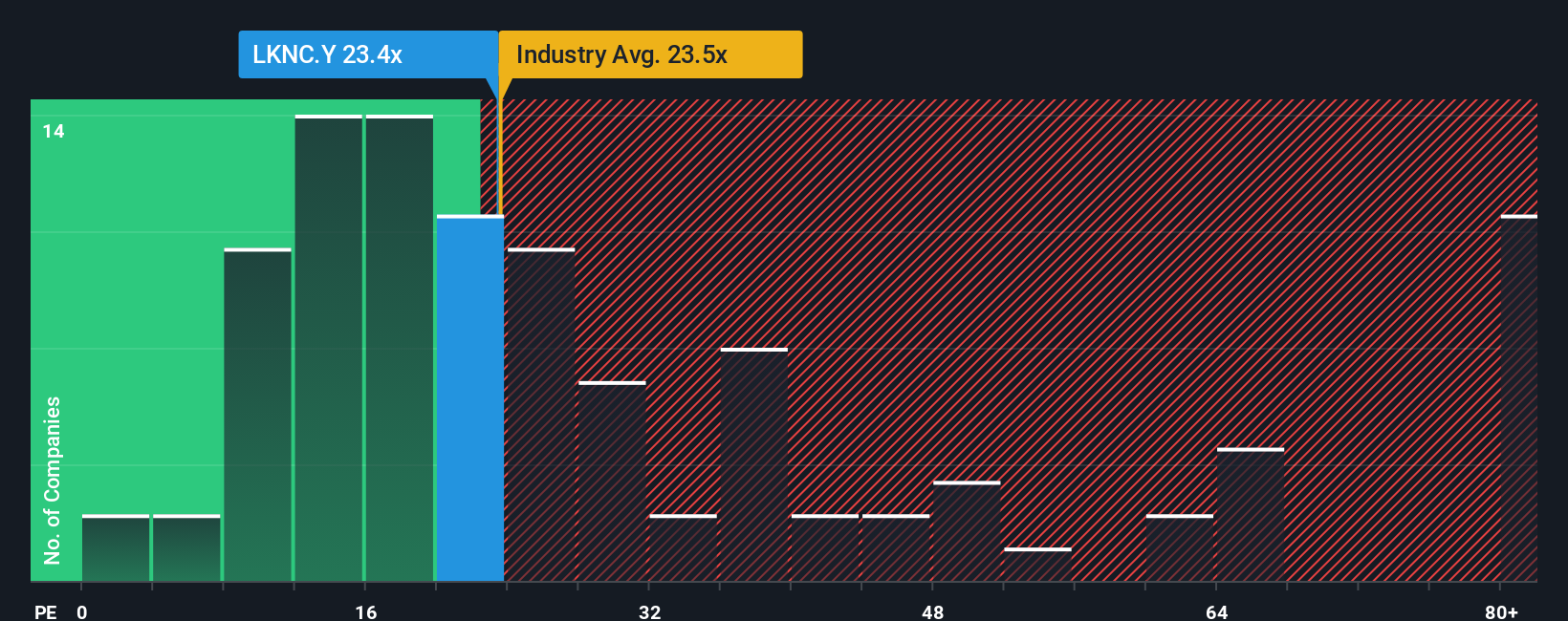

Approach 2: Luckin Coffee Price vs Earnings

For profitable companies like Luckin Coffee, the Price-to-Earnings (PE) ratio is often considered the go-to yardstick for valuation. This is because the PE ratio captures how much investors are willing to pay for each dollar of a company’s current profits, making it especially relevant as the business generates substantial and growing earnings.

What counts as a “normal” or “fair” PE ratio can depend heavily on factors such as expected growth and perceived risk. Higher growth prospects usually support a higher PE, while greater uncertainty or risk can drag that multiple down. It is all about what investors believe future profits will look like, and how confident they are those profits will actually materialize.

Luckin Coffee’s current PE ratio stands at 25x, which is right in line with the broader hospitality industry average of 24.8x. Compared to global peers, where the average PE is substantially higher at 55.4x, Luckin trades at a significant discount. However, Simple Wall St’s Fair Ratio, an advanced benchmark taking into account not just comparisons but also Luckin’s unique growth prospects, profit margins, risk factors, industry conditions and its own market cap, indicates a fair PE of 29.8x.

This tailored Fair Ratio reduces the noise from one-size-fits-all comparisons and focuses instead on whether the current valuation accurately reflects Luckin Coffee’s unique situation. Since the stock’s actual PE is only slightly below the Fair Ratio and the difference is small, Luckin Coffee shares currently look about right from a PE perspective.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

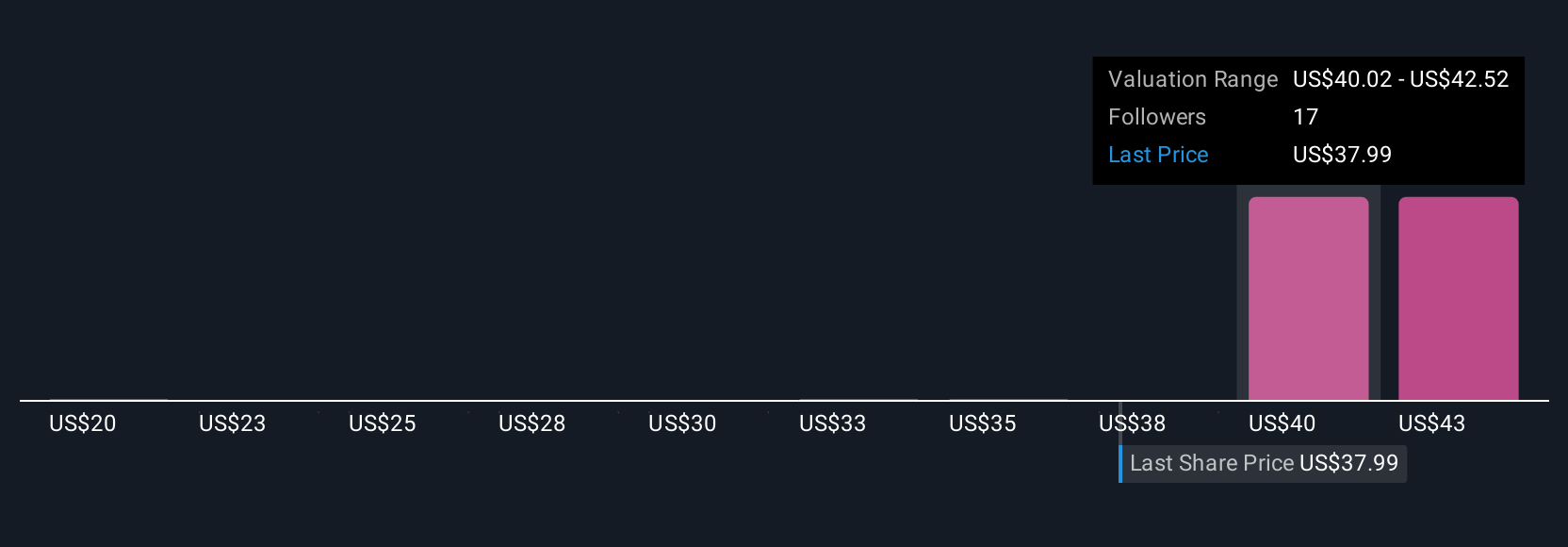

Upgrade Your Decision Making: Choose your Luckin Coffee Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. These are simple, dynamic stories that allow you to connect your own perspective about a company’s future, such as your assumptions for Luckin Coffee’s fair value, revenue, earnings, and profit margins, with real numbers and financial forecasts.

A Narrative ties together your beliefs or thesis about a business with a forecast model and translates it into a precise fair value, helping you see not just what you think could happen, but also what that means for the stock’s current price. Narratives are accessible and easy to use right within Simply Wall St’s Community page, trusted by millions of investors. This makes it straightforward to compare your views with others and see how your forecast stacks up in real time.

They take the guesswork out of decision making by telling you, based on your assumptions, whether a stock looks undervalued, overvalued, or fairly priced now. Narratives are updated automatically whenever new information or news is released.

For example, one investor might be optimistic, forecasting booming revenues and rising profit margins that drive a fair value estimate of $46.89. Another might be more cautious, projecting competitive pressures and thinner margins that imply a lower value. Narratives let you see and track both instantly, so you can confidently decide when to buy or sell.

Do you think there's more to the story for Luckin Coffee? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:LKNC.Y

Luckin Coffee

Offers retail services of freshly brewed drinks, and pre-made food and beverage items in the People's Republic of China.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives