- United States

- /

- Hospitality

- /

- NYSE:VIK

Viking Holdings (NYSE:VIK) Valuation in Focus After New Mekong River Ship Expands Southeast Asia Growth Potential

Reviewed by Kshitija Bhandaru

Viking Holdings (NYSE:VIK) just made waves with the delivery of its newest river cruise ship, the Viking Tonle, built specifically for Southeast Asia’s Mekong River. The ship, tailored for the scenic 15-day Magnificent Mekong itinerary, joins the Viking Saigon in this region and adds 80 guest staterooms to Viking’s fleet. For investors, this move is more than a ribbon-cutting; it signals both tangible growth and an ambition to capture more of the booming Asian river cruise market.

This launch comes at a time when Viking Holdings’ momentum is hard to ignore. Over the past year, the stock has surged 81 percent, with gains picking up pace in the past 3 months. Alongside double-digit revenue and even stronger net income growth, it is clear the company is not just expanding its fleet but also delivering meaningful business results. The addition of capacity on the Mekong follows similar moves across other markets, positioning Viking as a serious player with global ambition.

After this stretch of share price gains and operational expansion, the question stands: does Viking Holdings still offer upside for new investors, or is the market already factoring in all this promising growth?

Most Popular Narrative: 6% Undervalued

The leading narrative sees Viking Holdings as notably undervalued, anticipating that the company’s rapid expansion and strong demand position it for significant upside.

Broad-based capacity expansion into new geographies such as India, Egypt, and China, along with continued penetration of the U.S. market, positions Viking to capitalize on global population aging and growing affluence among travelers seeking premium, culturally enriching experiences. This is expected to support significant long-term revenue growth.

Interested in understanding what’s driving the excitement behind Viking Holdings’ premium valuation? The answer lies in ambitious financial targets, robust revenue forecasts, and bold margin improvements. Have you wondered which future profit projections and market assumptions make analysts confident in this valuation? The complete narrative reveals the financial calculations that may surprise even seasoned investors.

Result: Fair Value of $66.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts in travel preferences among affluent older guests, or unexpected cost pressures, could quickly challenge assumptions behind Viking Holdings’ optimistic outlook.

Find out about the key risks to this Viking Holdings narrative.Another View: A Look Through Market Ratios

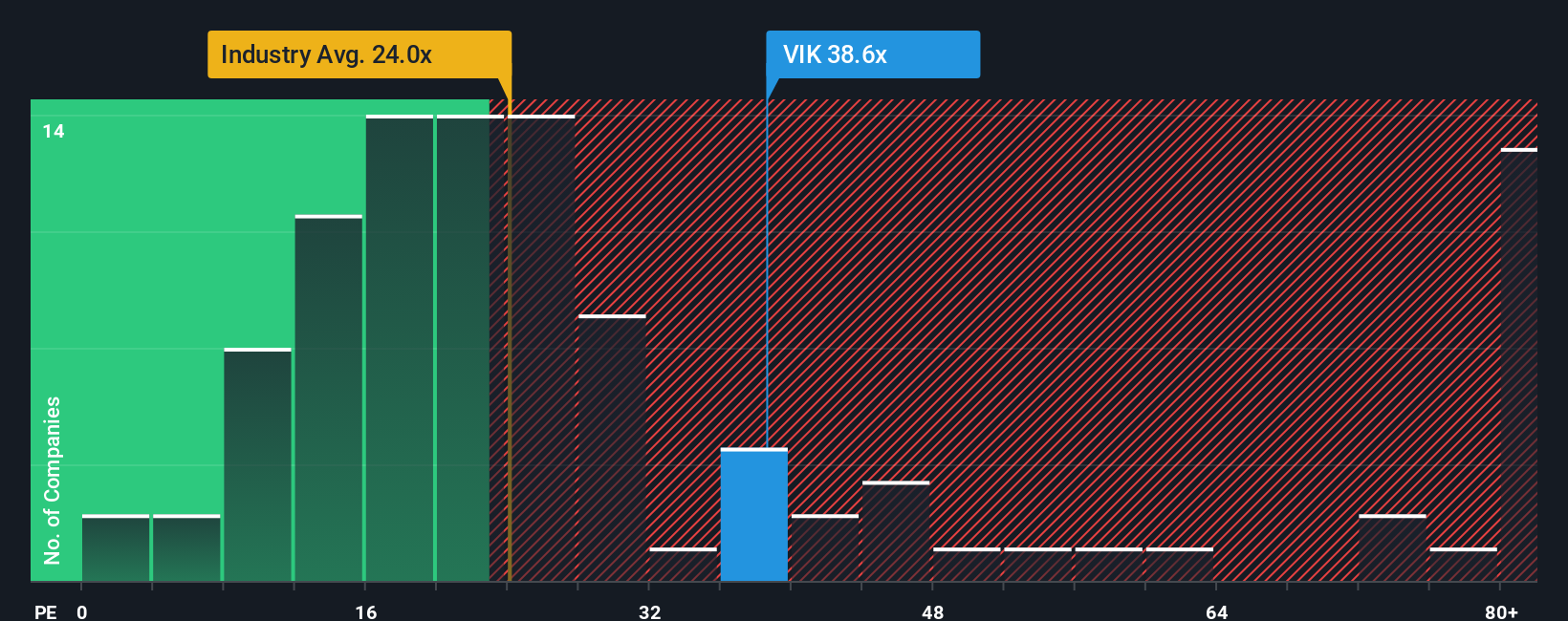

While some models see Viking Holdings as undervalued based on future growth, the company’s current valuation looks expensive when compared to similar businesses in its industry using earnings-based ratios. Could this be a warning sign? Or does the market see things differently?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Viking Holdings to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Viking Holdings Narrative

If you see things differently or want to follow your own line of research, it takes just a few minutes to build your personal narrative and share your perspective. Do it your way

A great starting point for your Viking Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why limit yourself to one opportunity when you can find your next winning stock with a few clicks? Take action now and see what could boost your portfolio.

- Target high payouts and build steady income streams by checking out the latest dividend stocks with yields > 3% with yields above 3 percent.

- Catch the momentum of artificial intelligence innovation with AI penny stocks, highlighting companies shaping the AI-powered future.

- Unearth value and seize possibilities with undervalued stocks based on cash flows, showcasing stocks that may be flying under the radar based on their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIK

Viking Holdings

Engages in the passenger shipping and other forms of passenger transport in North America, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives