- United States

- /

- Hospitality

- /

- NYSE:VIK

Viking Holdings (NYSE:VIK) Valuation in Focus After $1.7 Billion Senior Notes Refinancing Initiative

Reviewed by Kshitija Bhandaru

Viking Holdings (NYSE:VIK) has set plans in motion for a $1.7 billion private offering of 5.875% senior notes due 2033. This marks a substantial refinancing effort as the company aims to redeem existing debt and refinance ship leases.

See our latest analysis for Viking Holdings.

Viking Holdings’ $1.7 billion refinancing plan arrives as the company keeps momentum going. Its 1-year total shareholder return sits at nearly 0.72% and the stock trades at $61.03. The focus on managing debt and ship leases appears to be reassuring investors about long-term growth potential, even if short-term share price moves remain modest.

If you’re interested in spotting what else is catching investor attention lately, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading just below analyst targets and the company refining its balance sheet, the real question becomes whether investors are overlooking potential upside or if the market has already factored in Viking’s growth story.

Most Popular Narrative: 8% Undervalued

With Viking Holdings' fair value pegged at $66.35 by consensus, the current share price of $61.03 places the stock below the crowd’s key valuation benchmark. Market watchers should consider what is driving the optimism and how the company’s evolving footprint could unlock new growth avenues.

Broad-based capacity expansion into new geographies such as India, Egypt, and China, along with continued penetration of the U.S. market, positions Viking to capitalize on global population aging and rising affluence among travelers seeking premium, culturally enriching experiences. This supports significant long-term revenue growth.

Want to see the numbers behind the hype? The story centers on rapid sales growth and a profit leap few expected from a cruise company. Curious how analysts justify that bullish price? Unlock the projections and discover the driving assumptions powering this ambitious fair value estimate.

Result: Fair Value of $66.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory changes or a decline in affluent traveler demand could challenge Viking’s growth story and weaken analysts’ optimistic expectations.

Find out about the key risks to this Viking Holdings narrative.

Another View: Multiple-Based Valuation Raises Caution

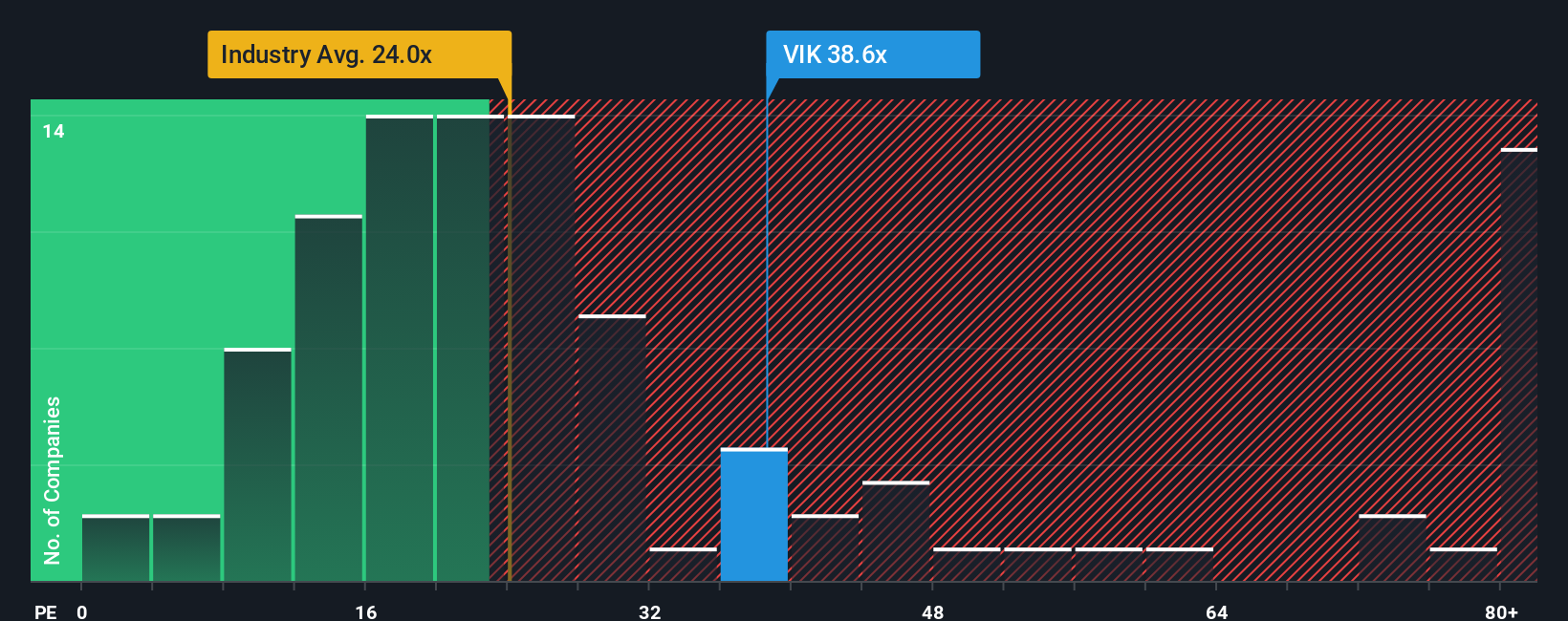

While analyst forecasts suggest Viking Holdings is undervalued, a closer look at its price-to-earnings ratio paints a different picture. The company trades at 39x earnings, well above both the US Hospitality industry average of 24x and its peer average of 22.5x. Even its fair ratio sits at 41.1x. This sizable gap signals valuation risk. Could the optimistic outlook already be priced in, or is there still opportunity if the market catches up to that fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Viking Holdings Narrative

If you think there's more beneath the surface or want to draw your own conclusions from the latest data, you can craft a personalized take on Viking Holdings in just a few minutes, your way with Do it your way.

A great starting point for your Viking Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Set yourself up to spot tomorrow’s big winners. Tap into these premium stock selections trusted by investors who want an edge on every move.

- Pinpoint opportunities with potential for rapid growth and value by checking out these 909 undervalued stocks based on cash flows, offering strong fundamentals at attractive prices.

- Target stable income streams by reviewing these 19 dividend stocks with yields > 3%, which consistently deliver yields above 3% for reliable, long-term returns.

- Get ahead of the curve in tech innovation by uncovering these 26 quantum computing stocks, driving breakthroughs in quantum computing and industry disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIK

Viking Holdings

Engages in the passenger shipping and other forms of passenger transport in North America, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives