- United States

- /

- Hospitality

- /

- NYSE:VIK

Viking Holdings (NYSE:VIK): Assessing Valuation After Major Fleet Expansion Milestone

Reviewed by Simply Wall St

Viking Holdings (NYSE:VIK) just hit a major milestone by naming nine new river ships and surpassing 100 vessels in its fleet. This latest expansion highlights the company’s sustained growth and presence in the global cruise industry.

See our latest analysis for Viking Holdings.

Following this milestone, Viking Holdings’ share price momentum has been impressive, with a 40% year-to-date share price return and a robust 54.9% total shareholder return over the past year. The recent announcement has reinforced positive sentiment and reflects the market’s growing confidence in its long-term growth story.

If Viking’s expansion has you thinking bigger, consider broadening your search and discover fast growing stocks with high insider ownership

But after such strong returns and expansion news, is Viking Holdings still trading at an attractive price, or has the market already baked in the company’s future growth potential? Could there be more upside, or is it all priced in?

Most Popular Narrative: 7.6% Undervalued

According to the most widely followed narrative, Viking Holdings’ fair value is estimated at $66.35, a premium over the recent closing price of $61.34. This signals that many analysts anticipate more room for upside should the company deliver on its ambitious growth trajectory.

Advanced bookings for core products remain exceptionally strong, with 96% of 2025 capacity and 55% of 2026 capacity already sold at higher rates. This indicates durable repeat demand and allows for mid-single-digit pricing growth that directly benefits company earnings and net margins.

Curious what’s fueling this bullish target? The narrative’s calculation is based on a blend of high future earnings expectations, bold margin expansion, and a re-rating usually reserved for industry leaders. Want to know which projections set this apart from the crowd? Dive in for the full breakdown that could surprise you.

Result: Fair Value of $66.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in retirement travel demand or tightening environmental regulations could quickly challenge these optimistic growth assumptions and impact future earnings.

Find out about the key risks to this Viking Holdings narrative.

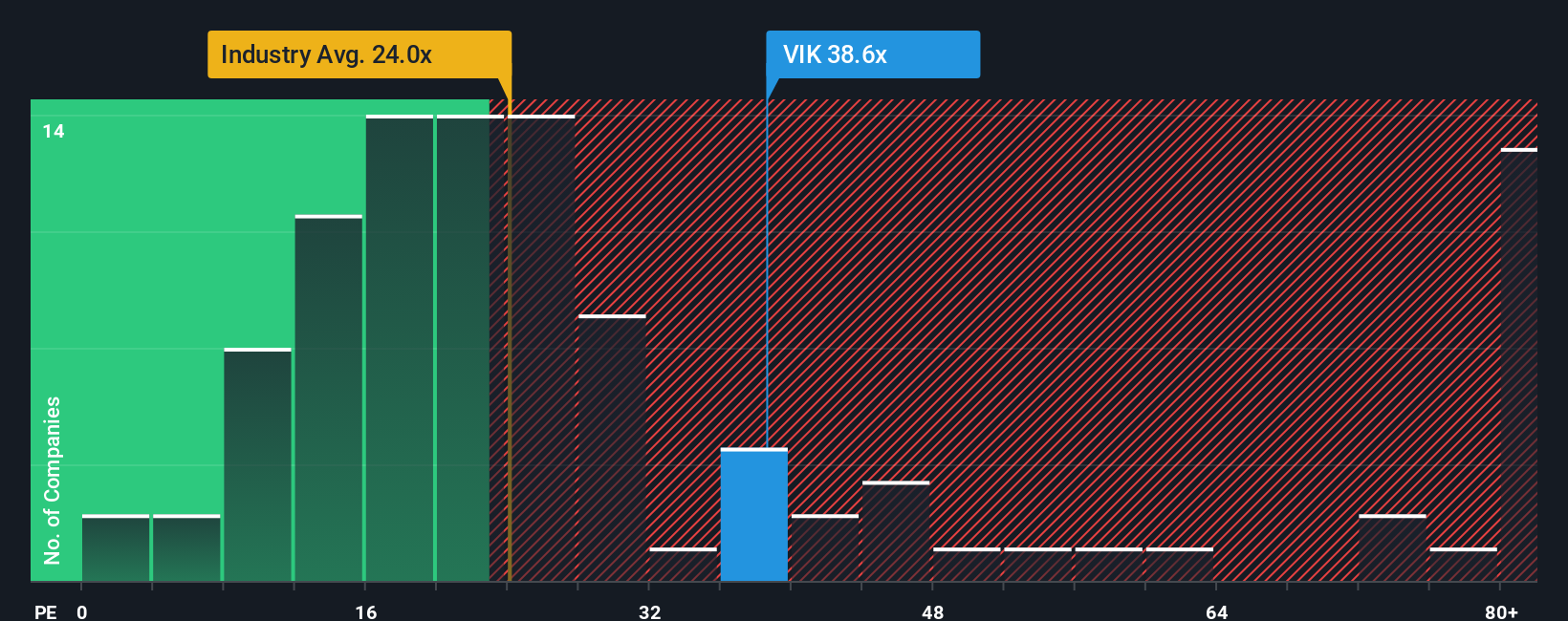

Another View: Market Multiple Sends a Different Signal

Looking at Viking Holdings through the lens of its price-to-earnings ratio tells a different story. The company trades at a much higher multiple than both its industry average and its peer group. While this reflects optimism, it also introduces greater valuation risk if expectations shift or growth stumbles. Could the market be a little too confident?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Viking Holdings Narrative

If these perspectives spark your own ideas or you’d rather dig into the numbers yourself, you can create a personalized narrative in under three minutes. Do it your way

A great starting point for your Viking Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investing is all about getting ahead of the crowd. Don’t let great companies slip by unnoticed. Make your next move before the rest catch on. Use the Simply Wall Street Screener to zero in on opportunities tailored to your strategy and unlock new growth stories today.

- Capitalize on high yields and safeguard your portfolio by checking out these 17 dividend stocks with yields > 3% offering consistently strong returns and robust fundamentals.

- Spot the disruptors harnessing artificial intelligence by browsing these 24 AI penny stocks delivering groundbreaking innovation across every industry.

- Uncover remarkable value by reviewing these 879 undervalued stocks based on cash flows positioned with attractive prices and solid future prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VIK

Viking Holdings

Engages in the passenger shipping and other forms of passenger transport in North America, the United Kingdom, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives