- United States

- /

- Consumer Services

- /

- NYSE:UTI

Universal Technical Institute (UTI): Is the Stock Undervalued After 100% Share Price Surge?

Reviewed by Kshitija Bhandaru

See our latest analysis for Universal Technical Institute.

Universal Technical Institute’s share price momentum is hard to ignore, with a 23% climb since January following a remarkable 103% surge over the past year. The latest gains signal growing market interest, and with a 1-year total shareholder return also topping 100%, it is clear momentum is building as investors look for signs of sustained growth or further surprises ahead.

If UTI’s rapid gains have you rethinking your watchlist, now is a smart time to consider expanding your search and discover fast growing stocks with high insider ownership

With shares soaring and the price still about 19% below analyst targets, there is real debate over whether Universal Technical Institute stock is undervalued or if the market has already factored in the company’s future growth. Does this strong run signal more upside, or are investors arriving late to the party?

Most Popular Narrative: 16.8% Undervalued

Universal Technical Institute’s fair value according to the most widely followed narrative stands well above its last close, suggesting the market may be underestimating its growth potential. A close comparison of future growth drivers versus current price levels sets the scene for deeper exploration.

Strategic investments in campus expansion, new program rollouts (notably in HVAC, aviation, and allied health), and digitization efforts are expected to support top-line expansion. The consolidation of core systems should facilitate operating efficiencies, driving long-term margin improvement beyond the near-term investment cycle.

Want to know the secret sauce behind this valuation? The narrative hinges on bold forecasts for future growth, major investments, and a profit outlook that rivals some of the most ambitious companies. Craving the exact numbers and strategic bets powering this price target? See the quantitative catalysts shaping this fair value now.

Result: Fair Value of $37.6 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing dependence on auto programs or a slowdown in enrollment from new campuses could quickly put this growth narrative to the test.

Find out about the key risks to this Universal Technical Institute narrative.

Another View: Looking Through the Lens of Earnings Ratios

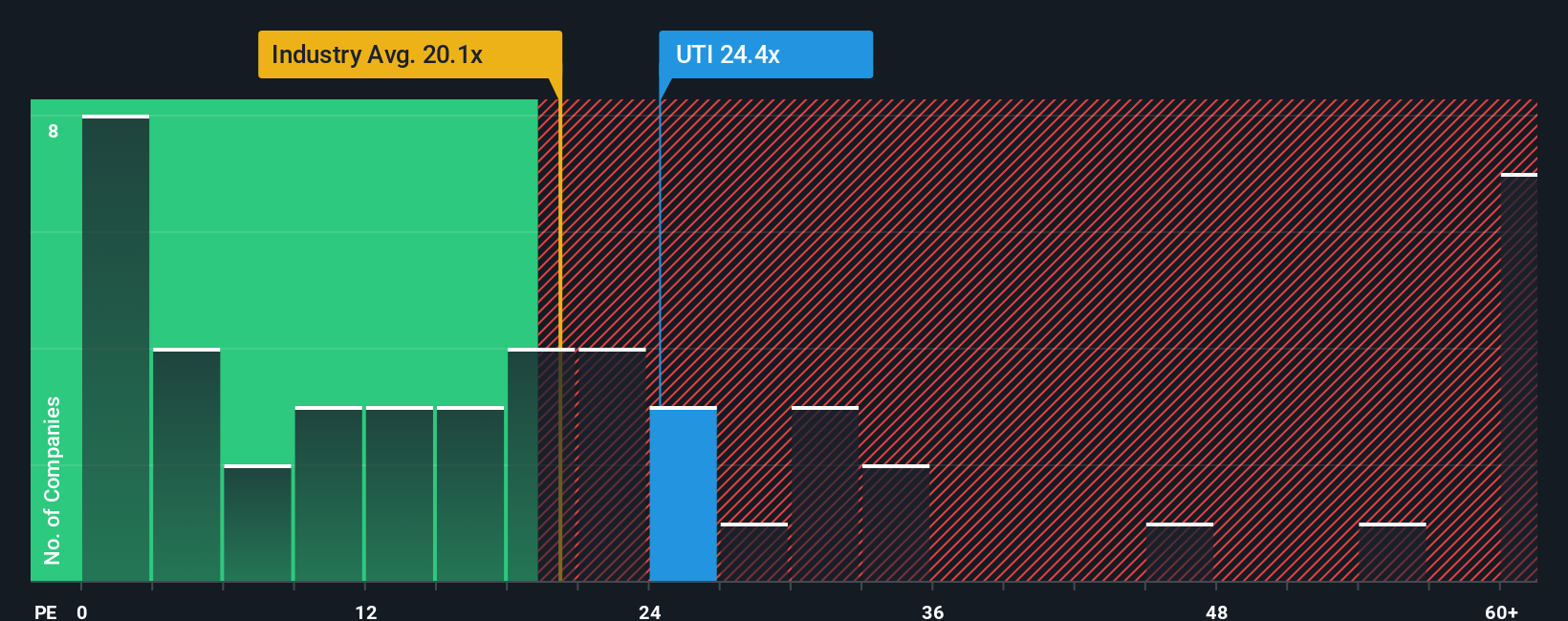

While the previous fair value points to Universal Technical Institute as undervalued, a quick look at its current price-to-earnings ratio tells another story. Shares trade at 27 times earnings, which is noticeably higher than both the Consumer Services industry average of 18.3x and the peer group’s 19.9x. Even when compared with a fair ratio of 14x, the stock’s premium stands out. This raises a big question: is the market betting too much on UTI’s future, or could growth still surprise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Universal Technical Institute Narrative

If you want to dig deeper or draw your own conclusions, you can assemble a custom narrative in just a few minutes, your way. Do it your way.

A great starting point for your Universal Technical Institute research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let your search stop at Universal Technical Institute. Simply Wall Street’s powerful Screener helps you pinpoint fresh investment themes and stocks that fit your goals.

- Unlock income potential and reliable cash flow by checking out these 19 dividend stocks with yields > 3% with yields that reward your portfolio every quarter.

- Get ahead of market trends by finding innovation leaders using these 24 AI penny stocks and see which companies are creating the future with artificial intelligence.

- Cement your edge by spotting hidden value. Seize opportunities in these 896 undervalued stocks based on cash flows and see which stocks might be trading below their true potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UTI

Universal Technical Institute

Provides transportation, skilled trades, and healthcare education programs in the United States.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives