- United States

- /

- Hospitality

- /

- NYSE:TNL

Travel + Leisure (TNL) Discounted Valuation Reinforces Bullish Narrative Despite Margin Compression and Growth Concerns

Reviewed by Simply Wall St

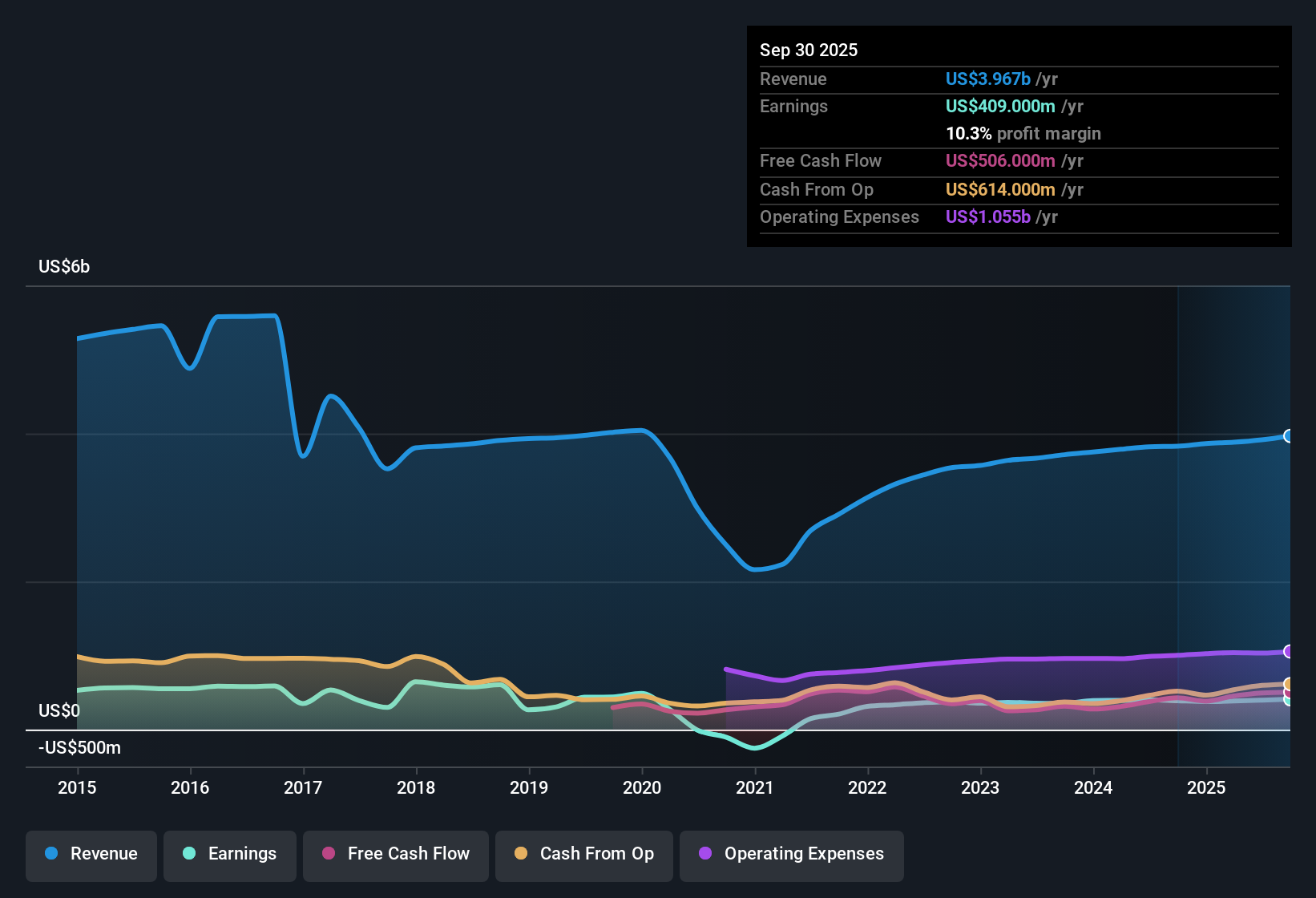

Travel + Leisure (TNL) finished the year with net profit margins of 10.1%, a slight dip from 10.5% the year prior. Earnings growth turned negative after an impressive five-year run averaging 31.8% a year. Despite recent margin compression and softer near-term growth prospects, the company is drawing investor attention thanks to its low 11.4x price-to-earnings ratio. This stands out sharply against both the US hospitality industry average of 24.2x and the peer group’s 28.6x. The stock’s value play is now front and center, even as margin trends and payout sustainability remain front-of-mind for the market.

See our full analysis for Travel + Leisure.Next, we will see how these headline numbers compare with the major narratives investors have followed in the market. Some long-held views could be confirmed, while others may face new questions in light of these results.

See what the community is saying about Travel + Leisure

Steady Recurring Revenue at 75% of Total

- More than 75% of Travel + Leisure's revenue comes from recurring sources like owner upgrades, management fees, and financing activities. This supports dependable cash flow and earnings stability.

- Analysts’ consensus view sees this recurring revenue mix as a key strength, especially as the $20 billion ten-year revenue pipeline and 3.9% revenue growth forecast help offset the risk of slower top-line growth compared with the broader US market.

- This focus on predictable revenues is reinforced by the company’s asset-light development strategy and growing engagement from Millennials and Gen Z, with 65% of new buyers coming from these groups.

- Consensus narrative notes that tech investments, including AI-powered personalization and improved mobile apps, should further increase direct booking rates and support higher margins as operational efficiency improves.

- See why Wall Street thinks this recurring revenue engine could tip the scales for Travel + Leisure investors. 📊 Read the full Travel + Leisure Consensus Narrative.

Margin Guidance Points to Recovery

- While net profit margins slipped to 10.1% this year, down from last year's 10.5%, analysts expect margins to expand to 11.5% within three years. This suggests management’s strategic initiatives in operational tech and capital efficiency are starting to gain traction.

- According to the analysts' consensus view, the company’s commitment to an asset-light business model, paired with increasing recurring revenue streams, is expected to gradually support net margin construction despite current headwinds.

- Investments in owner engagement and inventory recovery processes aim to control costs and reduce the company’s dependence on third-party booking channels. This is seen as a key driver for restoring net margins to targeted levels.

- The consensus narrative cautions that persistent structural headwinds in the Travel and Membership segment, including the impact of industry consolidation and disruption from mergers, could still weigh on EBITDA and overall earnings if not properly addressed.

Discounted Valuation vs. Industry Benchmarks

- The current share price of $69.91 places Travel + Leisure at a Price-To-Earnings ratio of 11.4x, significantly below the US Hospitality industry average of 24.2x and peer group average of 28.6x. This makes it a clear standout on value among sector peers.

- Consensus narrative points out that despite muted growth expectations, with 3.8% revenue expansion forecasted versus the market's 10.1%, the deeply discounted multiple and a fair value estimate that sits far above the share price underline why investors have zeroed in on this stock.

- Analysts' consensus price target is $69.64, which is roughly in line with the current market price. This signals that the market views the stock as fairly valued after the sharp multiple discount is factored in.

- This valuation gap is most compelling if the company can maintain its margin guidance and demonstrate the durability of its recurring membership revenues despite broader industry and demographic risks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Travel + Leisure on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the results? Craft your own story and perspective in just a few minutes: Do it your way.

A great starting point for your Travel + Leisure research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Muted revenue growth and recent margin compression mean Travel + Leisure faces challenges keeping up with faster-growing industry peers and market leaders.

If you want stocks with a record of consistent growth and less earnings volatility, filter for opportunities using our stable growth stocks screener (2093 results) and discover companies delivering steady results across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Travel + Leisure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNL

Travel + Leisure

Provides hospitality services and travel products in the United States and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives