- United States

- /

- Consumer Services

- /

- NYSE:TAL

The Bull Case For TAL Education Group (TAL) Could Change Following New $600 Million Buyback and Analyst Upgrade

Reviewed by Sasha Jovanovic

- TAL Education Group recently announced it will release its unaudited financial results for the second quarter of fiscal year 2026 before the market opens on October 30, 2025, accompanied by a conference call and webcast for investors.

- An analyst upgrade, citing improved deferred revenue, learning tablet sales, operational efficiencies, and a new US$600 million share repurchase program, suggests growing confidence in the company's capital allocation and business outlook.

- Let's explore how TAL's enhanced capital return strategy, and the analyst upgrade triggered by it, could impact its long-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

TAL Education Group Investment Narrative Recap

Owning TAL Education Group means believing in the durable demand for tech-enabled learning in China, particularly as the company expands its AI-powered offerings and smart devices. The latest earnings pre-announcement and analyst upgrade focus on positive signals like capital returns and operational efficiency, but these do not materially change the short-term catalyst: profitable growth in the learning device segment. The biggest risk remains mounting competition and uncertain near-term profitability, particularly as marketing investment continues in this area.

Of TAL's recent updates, the ramped-up US$600 million share repurchase program is most relevant, drawing analyst attention for improving shareholder returns. This decision shows management's allocation of resources while facing pressure to translate investment in learning devices into durable earnings improvement.

Yet, despite improved capital return, investors should be aware that competition in smart devices is intensifying and...

Read the full narrative on TAL Education Group (it's free!)

TAL Education Group's narrative projects $4.5 billion in revenue and $395.9 million in earnings by 2028. This requires 22.8% annual revenue growth and a $291.4 million earnings increase from $104.5 million currently.

Uncover how TAL Education Group's forecasts yield a $12.99 fair value, a 18% upside to its current price.

Exploring Other Perspectives

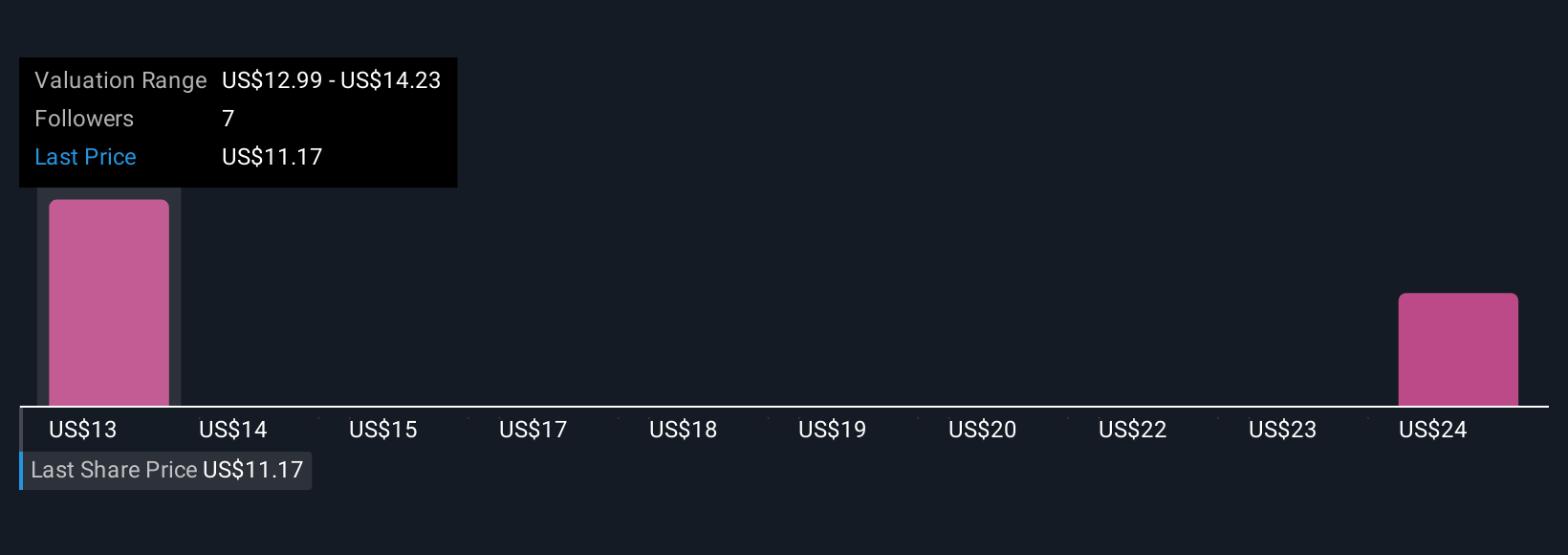

Simply Wall St Community members project fair values for TAL Education Group from US$12.99 to US$25.54, based on just two opinions. While many see upside, ongoing margin pressure in the learning device segment may affect how the business sustains earnings as growth shifts.

Explore 2 other fair value estimates on TAL Education Group - why the stock might be worth over 2x more than the current price!

Build Your Own TAL Education Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TAL Education Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TAL Education Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TAL Education Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TAL Education Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TAL

TAL Education Group

Provides K-12 after-school tutoring services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives