- United States

- /

- Hospitality

- /

- NYSE:SHCO

Is Soho House a Hidden Opportunity After 69% Share Price Surge and Improved Profit Outlook?

Reviewed by Bailey Pemberton

If you are looking for the next move on Soho House & Co stock, you have probably noticed its eye-catching trajectory. This is not a slow and steady story, but one with dramatic swings and the kind of big numbers that spark conversation. Just over the past year, Soho House & Co’s shares have surged 69.1%. If you stretch that lens out to three years, we are talking 114.5% growth, which is well beyond what most lifestyle or hospitality names can boast. Even in recent months, the stock has kept its head above water, with a modest but positive 0.1% return in the past week and month, and an impressive 19.7% return year to date.

Much of this momentum seems to reflect not just shifts in the market’s appetite for exclusive hospitality brands, but changing perceptions about Soho House’s risk profile. Investor enthusiasm has held strong as the company continues to stand out in a sector that can be unpredictable and cyclical. While headlines about evolving consumer trends and market conditions have swirled around the industry, Soho House & Co has managed to maintain its allure, signaling to plenty of onlookers that growth may be more than a passing phase here.

If you are wondering just how undervalued this stock might be, our scorecard gives Soho House & Co a value score of 4 out of 6. This means it checks the “undervalued” box in four separate valuation tests. Next, let’s break down what those valuation approaches actually involve and, more importantly, why the standard tools may only tell part of the story for Soho House’s future potential.

Approach 1: Soho House & Co Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a stock by projecting its future cash flows and discounting them back to today's dollars. This method gives investors a sense of what the business might be worth based on the cash it can generate over time, rather than relying solely on current earnings or book value.

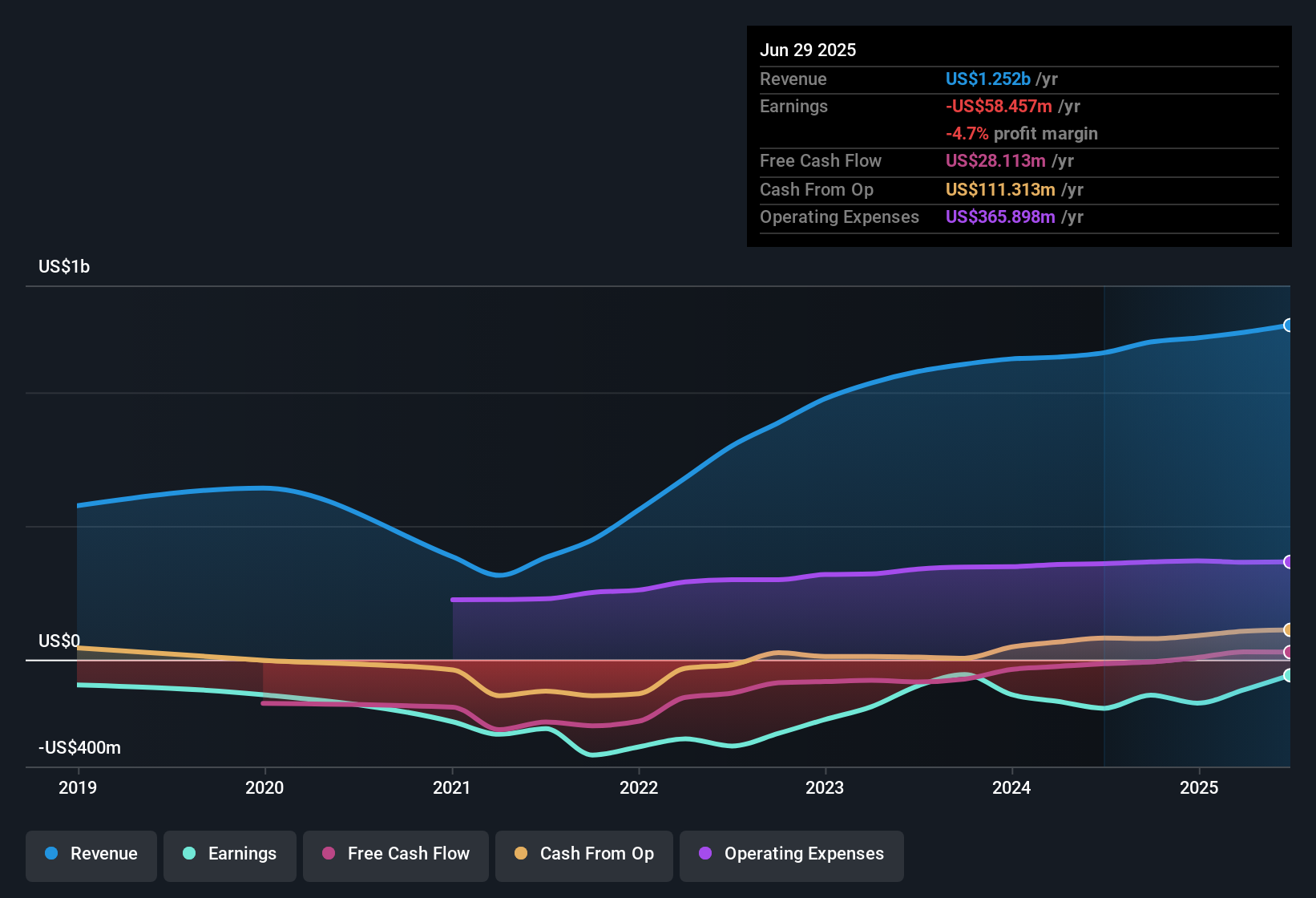

For Soho House & Co, the analysis begins with the company's Last Twelve Months (LTM) Free Cash Flow of $13.44 million. Projections show rapid growth, with cash flow expected to climb sharply to $60.3 million by the end of 2026 according to analyst estimates. Beyond that, extended forecasts suggest a continued climb, with the potential to reach over $550 million in Free Cash Flow by 2035. However, estimates after 2026 rely more on extrapolation than analyst models.

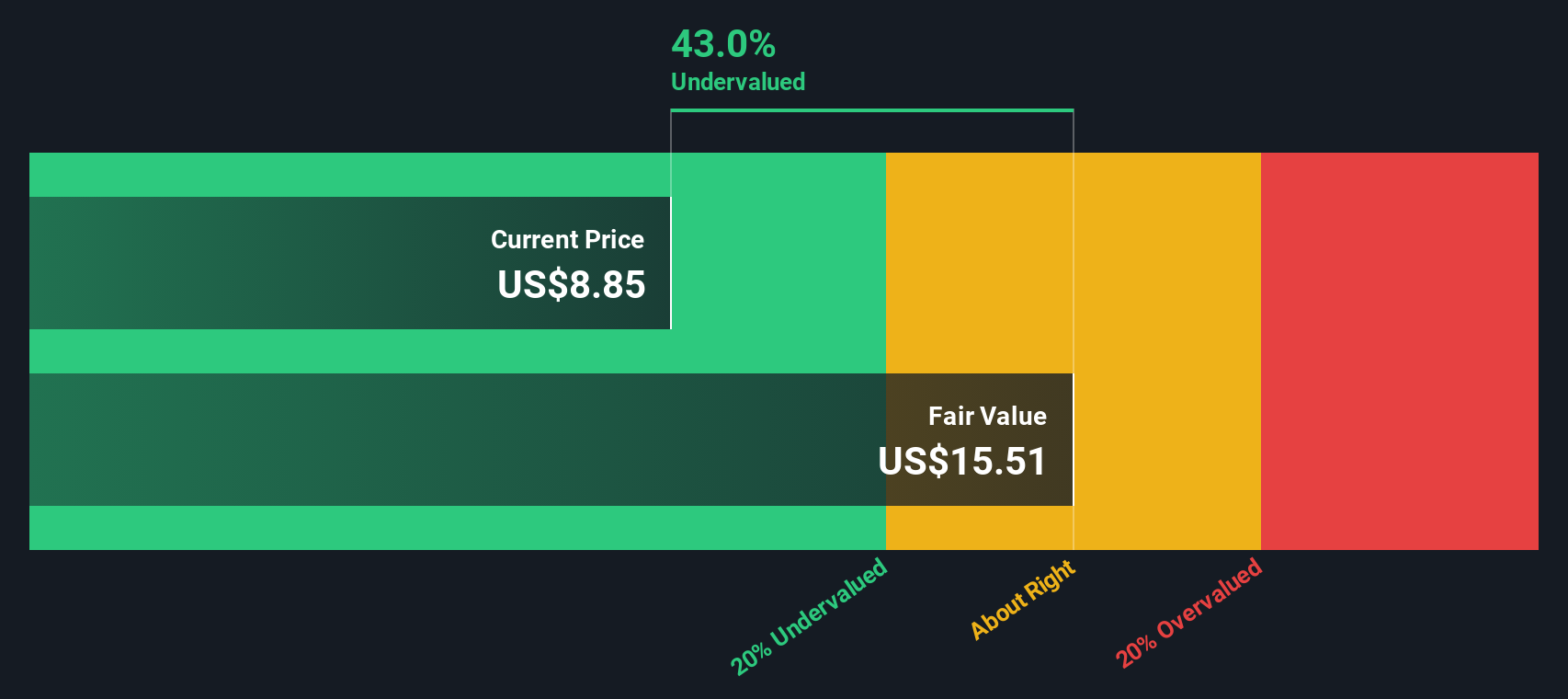

Taking all these projections into account and discounting them to present value using a 2 Stage Free Cash Flow to Equity method, the estimated intrinsic value per share comes to $15.51. Compared with the current share price, this implies the stock is trading at a 42.9% discount to its fair value, suggesting meaningful upside.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Soho House & Co is undervalued by 42.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Soho House & Co Price vs Sales (P/S)

For companies like Soho House & Co that may not post consistent profits yet are demonstrating robust revenue growth, the Price-to-Sales (P/S) ratio is a strong valuation tool. This multiple gives investors a sense of how much they are paying for each dollar of the company’s revenue, making it especially useful when earnings are negative or volatile.

Market expectations for a "normal" or "fair" P/S ratio change depending on a company’s growth prospects and risk profile. High-growth companies or those with disruptive business models often command higher sales multiples. In contrast, more mature or riskier names typically trade at lower valuations.

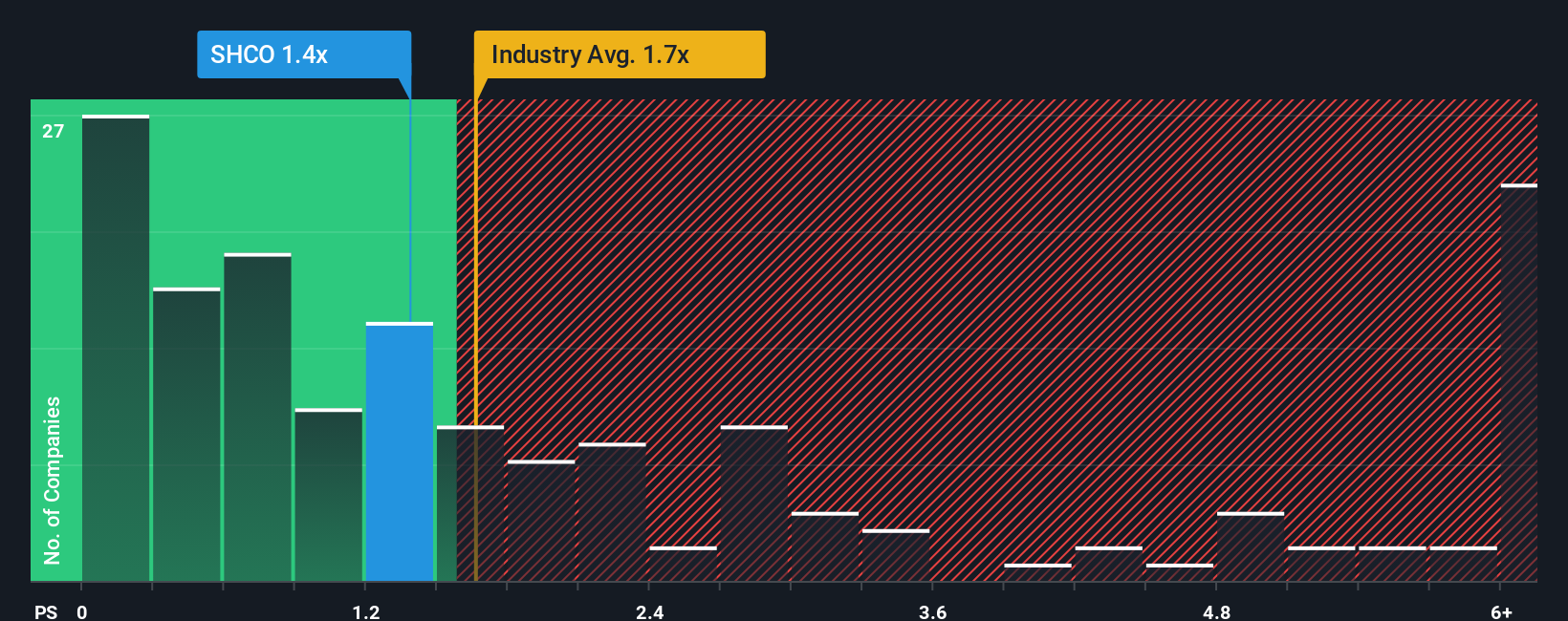

Currently, Soho House & Co trades at a P/S ratio of 1.38x. This is slightly below the Hospitality industry average of 1.70x and slightly higher than its peer average of 0.89x. On its own, that gap could signal the market sees either greater growth potential or less risk here compared to direct competitors, but perhaps more caution than the broader industry.

To go deeper, Simply Wall St’s proprietary “Fair Ratio” for Soho House is 1.60x. Unlike basic industry or peer comparisons, the Fair Ratio considers not just revenue but also factors like expected growth, profit margins, risks, market cap, and the company’s specific positioning within its industry. This gives retail investors a more complete picture when figuring out if a stock is reasonably valued.

Since the current P/S multiple (1.38x) is below both the industry average (1.70x) and, more importantly, the Fair Ratio (1.60x), it suggests that Soho House & Co may be undervalued relative to its outlook and fundamentals.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Soho House & Co Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, intuitive way for investors to connect a company's story, including their unique perspective on its future strengths, challenges, and potential, to real financial forecasts and a fair value estimate.

Rather than only relying on standard valuation tools, Narratives help you articulate why you believe in a company's future by tying your outlook, such as assumptions for revenue growth, future margins, and earnings, directly to projected financials and what that means for today's stock price.

Narratives are available to everyone on Simply Wall St's Community page, where millions of investors build and share their viewpoints, compare fair values to the latest share price, and decide when to buy or sell.

As new information is released, like earnings reports or industry news, Narratives are updated dynamically, so your story and the numbers evolve together.

For Soho House & Co, for example, some investors build a bullish Narrative driven by confident forecasts for global expansion and cost improvements, resulting in a fair value above $15. Others see downside risks from financial misstatements and strategic uncertainty, and land closer to $9.

Do you think there's more to the story for Soho House & Co? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHCO

Soho House & Co

Operates a global membership platform of physical and digital spaces that connects a group of members in the United Kingdom, the Americas, Europe, and internationally.

Good value with moderate growth potential.

Market Insights

Community Narratives