- United States

- /

- Hospitality

- /

- NYSE:SHAK

How Shake Shack’s (SHAK) New Chief Brand Officer Could Influence Its Growth and Marketing Strategy

Reviewed by Sasha Jovanovic

- Shake Shack recently appointed Michael Fanuele as Chief Brand Officer, expanding its leadership to strengthen brand strategy and marketing, following his earlier consulting role focused on strategic brand positioning and agency selection.

- This leadership change introduces a seasoned creative executive who has guided brand transformation for major companies and signals a renewed emphasis on marketing and innovation at Shake Shack.

- We'll examine how the addition of an experienced Chief Brand Officer could shape Shake Shack's evolving investment narrative and growth strategy.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Shake Shack Investment Narrative Recap

To own Shake Shack stock, an investor needs to believe that the company’s investments in brand, menu innovation, and urban expansion can translate into sustainable sales growth and margin improvement, even as fluctuations in guest traffic and input costs remain the biggest near-term challenges. The appointment of Michael Fanuele as Chief Brand Officer brings seasoned marketing expertise but is not likely to materially shift the key short-term catalyst of comp sales growth or address the primary risk of pressured traffic trends.

Among recent announcements, Shake Shack’s partnership to open its first Downtown Atlanta location as part of a major redevelopment is especially relevant. This move highlights the company’s ongoing commitment to expanding its urban footprint, one of its most important growth catalysts, supporting the case for long-term revenue opportunities even as near-term competitive and economic pressures persist.

By contrast, many investors might overlook how heavy marketing and development costs could weigh on margins if sales momentum does not...

Read the full narrative on Shake Shack (it's free!)

Shake Shack's narrative projects $2.0 billion revenue and $107.9 million earnings by 2028. This requires 14.8% yearly revenue growth and a $88 million earnings increase from $19.9 million today.

Uncover how Shake Shack's forecasts yield a $132.48 fair value, a 37% upside to its current price.

Exploring Other Perspectives

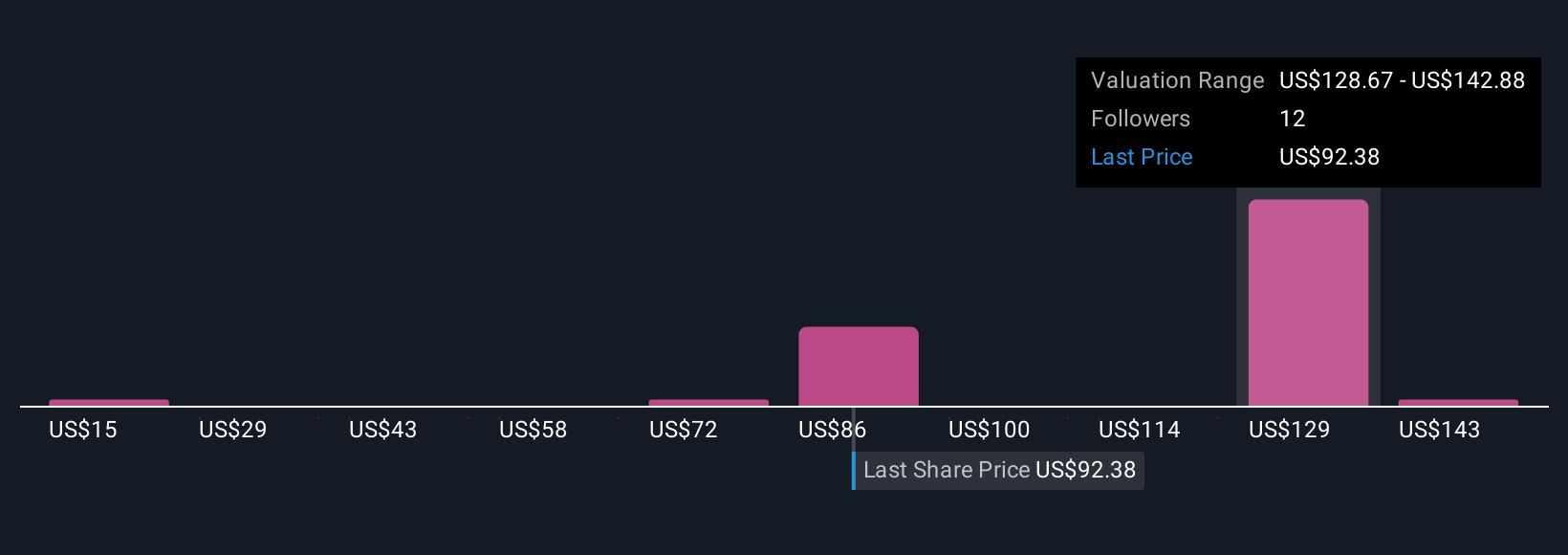

Five individual investors in the Simply Wall St Community offered fair value estimates for Shake Shack between US$15 and US$157.09 per share. While some believe rapid menu and digital innovation will drive growth, others point to the risks if sales do not keep pace with rising costs, giving you plenty of diverse viewpoints to explore.

Explore 5 other fair value estimates on Shake Shack - why the stock might be worth as much as 62% more than the current price!

Build Your Own Shake Shack Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shake Shack research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Shake Shack research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shake Shack's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHAK

Shake Shack

Owns, operates, and licenses Shake Shack restaurants (Shacks) in the United States and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives