- United States

- /

- Hospitality

- /

- NYSE:SGHC

Could Super Group’s Triple Digit Rally in 2025 Still Have Room to Run?

Reviewed by Bailey Pemberton

Are you wondering if Super Group (SGHC) stock deserves a spot in your portfolio, or if its best days are already behind it? You are not alone. Lately, there has been a lot of buzz around this company, and anyone watching its price chart would be hard pressed to ignore the explosive moves: up an eye-popping 119.5% year-to-date and a jaw-dropping 269.7% over the last twelve months. Even more impressive, the return over three years has reached 272.9%. Just in the last week and month, Super Group’s shares stayed hot with gains of 1.3% and 8.8%, respectively. These moves have clearly caught the market’s attention, and some investors are wondering if recent changes in risk perception, industry trends, or global betting regulations are at play.

But sharp rallies often leave investors wrestling with a classic question: is the current price justified, or has the story run ahead of reality? Looking at our fundamental valuation scorecard, Super Group checked the box as undervalued in 3 out of 6 categories, giving it a valuation score of 3. That result is decent, though the numbers only tell part of the story. There are multiple ways to look at valuation, and in the coming sections, we will peel back the layers to explore each approach. Plus, I’ll share what I believe is the most insightful lens of all for judging whether the stock is truly a bargain or something to be wary of.

Approach 1: Super Group (SGHC) Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a stock's intrinsic value by projecting the future cash flows a company will generate and discounting them back to today’s dollars. Essentially, it aims to answer: if Super Group (SGHC) keeps producing and growing its cash flows at a steady pace, what should its current value be?

For Super Group, the latest figures show its Free Cash Flow stands at $259.5 Million. Analysts expect this to grow robustly, with projections reaching $484.2 Million by 2027 and continuing to climb. By 2035, extrapolated estimates place annual Free Cash Flow just shy of $800 Million. The underlying model used here is the 2 Stage Free Cash Flow to Equity approach, which blends near-term analyst expectations with longer-term growth assumptions.

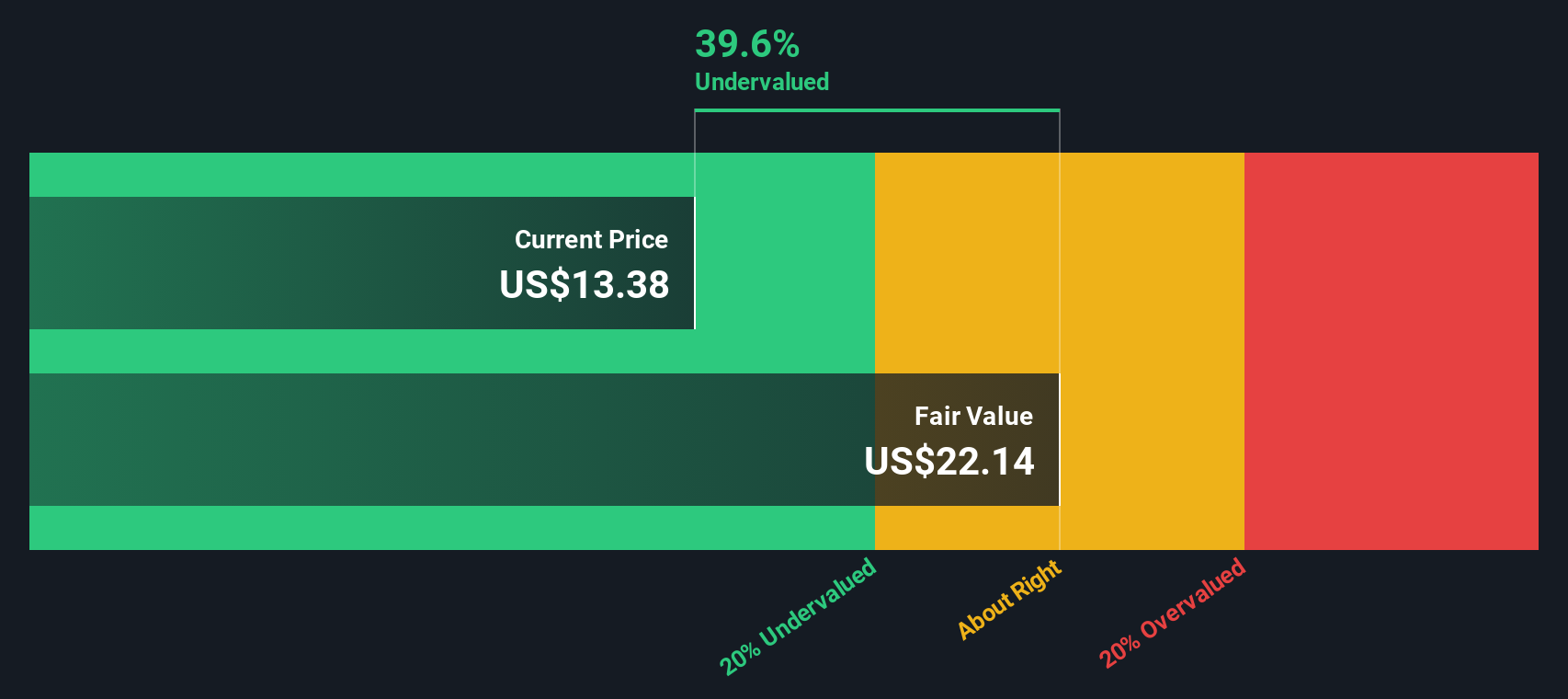

All these projections, discounted to today’s value and summed together, result in an estimated intrinsic share value of $22.16. Compared to the current market price, this DCF analysis indicates Super Group (SGHC) is trading at a 37.9% discount to its intrinsic value, meaning the stock appears to be significantly undervalued through the lens of cash flow fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Super Group (SGHC) is undervalued by 37.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Super Group (SGHC) Price vs Earnings

The Price-to-Earnings (PE) ratio is often considered the most relevant metric for valuing profitable companies like Super Group (SGHC) because it directly links a company's share price to its earnings, giving investors a sense of how much they are paying for each dollar of profit. In a nutshell, the higher a company’s expected growth and the lower its perceived risk, the more justified it is to pay a higher PE ratio. The opposite is true as well.

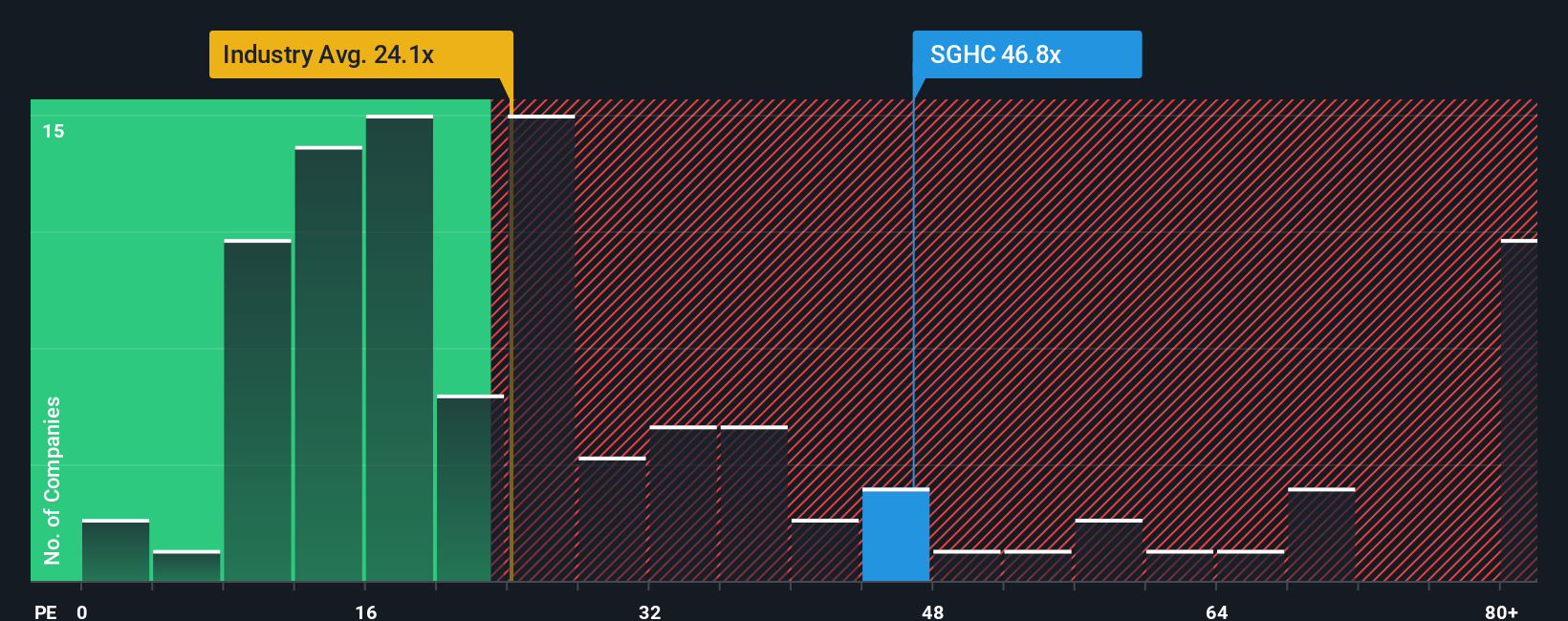

Super Group’s current PE ratio stands at 48.2x, which is noticeably above the hospitality industry average of 24.9x and its key peer average of 26.7x. These benchmarks can help frame what investors are typically willing to pay for similar companies, but they do not account for factors unique to SGHC.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio for Super Group is calculated at 37.8x, which reflects a more nuanced view. It considers not just raw industry averages, but also the company’s growth prospects, risk exposure, profit margins, and market cap. Unlike a simple peer comparison, the Fair Ratio gives a more balanced, company-specific signal for valuation.

SGHC’s actual PE of 48.2x sits significantly above its Fair Ratio. This suggests the market is pricing in very strong future growth, perhaps more so than what the fundamentals alone support, making the stock look expensive on this basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Super Group (SGHC) Narrative

Earlier, we alluded to an even better way to understand valuation, so let’s introduce you to Narratives, a powerful concept that puts your perspective at the heart of investment decisions. In plain terms, a Narrative is the story that connects your view of a company’s future to real numbers: your beliefs about revenue growth, profit margins, and risks get translated into a financial forecast and ultimately into a personal fair value estimate.

Narratives are simple and accessible, available right on Simply Wall St’s Community page, where millions of investors use them to sketch out how and why they think a stock is worth buying or selling. They help you compare your Fair Value directly to the current price, making it easier than ever to spot when an opportunity or a risk arises. And because news and earnings arrive frequently, your Narrative and its fair value update dynamically whenever fresh information becomes available.

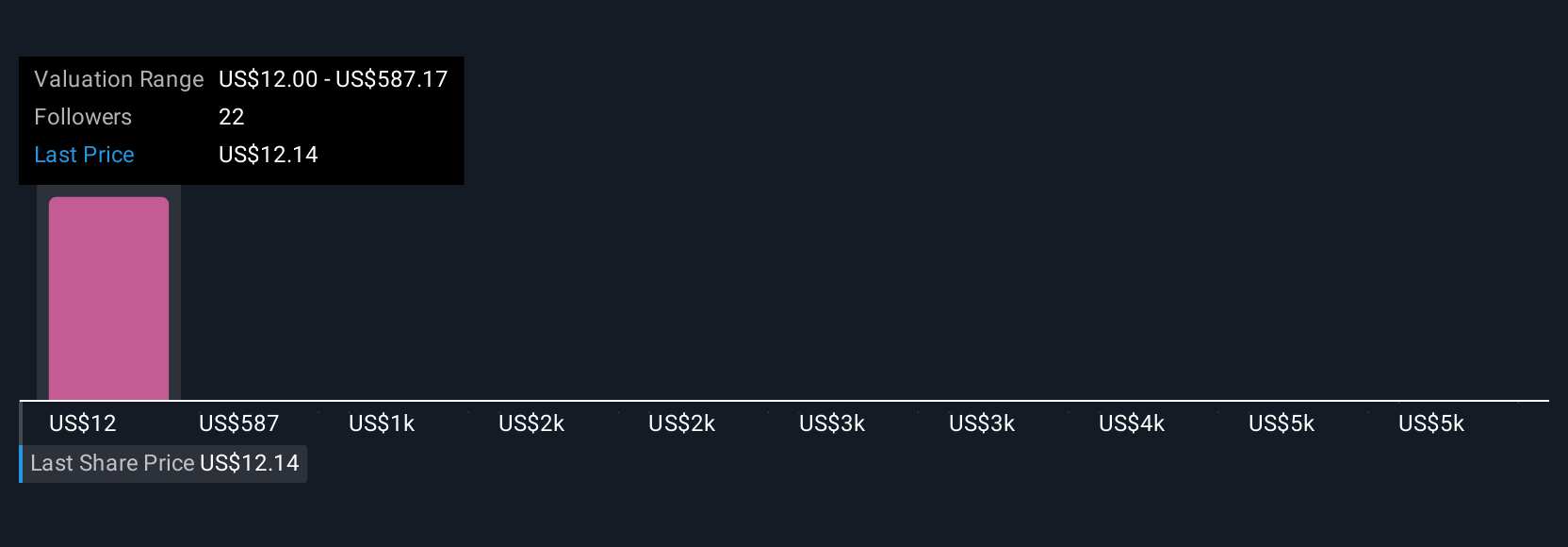

For Super Group (SGHC), one investor might see a bright future, expecting geographic expansion and innovative products to unlock value, justifying a bullish fair value of $17.00. Another, more cautious investor might be wary of competitive pressure and regulatory risks, and set their own fair value far lower at $14.00. Whichever view you take, Narratives give you the tools and up-to-date data to make and explain your decision, step by step.

Do you think there's more to the story for Super Group (SGHC)? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SGHC

Super Group (SGHC)

Operates as an online sports betting and gaming operator.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives