- United States

- /

- Consumer Services

- /

- NYSE:SCI

Assessing Service Corporation International (SCI) Valuation After Annual Growth and Steady Shareholder Returns

Reviewed by Kshitija Bhandaru

Service Corporation International (SCI) recently reported annual revenue growth of 3% and net income growth of 7%. These two figures have caught the eye of investors looking for steady business performance in specialized consumer services.

See our latest analysis for Service Corporation International.

Despite a modest dip over the past week, Service Corporation International's share price has steadily built positive momentum, with a 5.89% year-to-date share price return and an impressive 10.42% total shareholder return over the past year. The solid long-term record, shown by a 101.99% five-year total shareholder return, suggests that investor confidence remains strong even as market sentiment shifts around recent earnings reports.

If you’re curious to broaden your search beyond the familiar names, now is a great moment to discover fast growing stocks with high insider ownership

With strong financial results and a share price still trading below analyst targets, investors are left to wonder: Is Service Corporation International undervalued right now, or has the market already accounted for future growth?

Most Popular Narrative: 12% Undervalued

Service Corporation International's fair value, according to the most popular narrative, stands at $93.20, notably above the recent closing price of $82.00. With a sizable gap between these two figures, the narrative points to strong drivers that could lift the stock further.

Continued investments in greenfield expansions, digital transformation, and strategic acquisitions (with a robust acquisition pipeline exceeding guidance targets) are expected to support long-term revenue growth, operating leverage, and higher earnings through market consolidation and digital up-selling of services.

Wondering how this narrative justifies such a premium? The explanation centers on aggressive growth bets, future margin expansion, and an earnings target that could eclipse sector norms. Want the precise levers behind the number? See what else powers this bullish outlook.

Result: Fair Value of $93.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are risks to this outlook, including a continued shift toward lower-margin cremation services and volatility in preneed sales volumes.

Find out about the key risks to this Service Corporation International narrative.

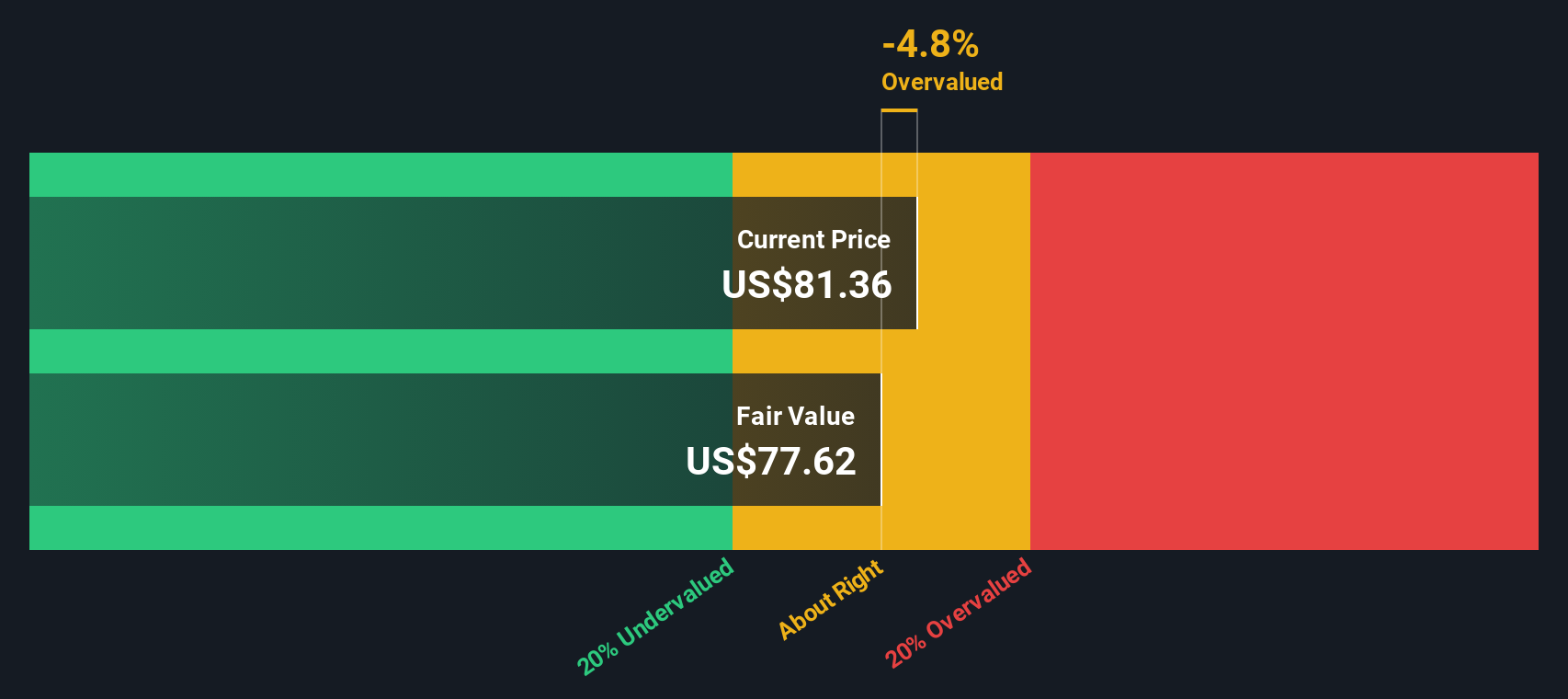

Another View: DCF Tells a Different Story

While analysts see Service Corporation International's shares as undervalued based on expected earnings and multiples, our DCF model suggests a different view. According to this approach, the stock trades slightly above its fair value estimate. This highlights that future cash flows might not fully support the current price.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Service Corporation International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Service Corporation International Narrative

If you have a different perspective or prefer to dig into the numbers yourself, it only takes a few minutes to craft your own take, too. Do it your way

A great starting point for your Service Corporation International research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why settle for what everyone else is watching? Take charge of your portfolio and open up new opportunities by targeting stocks built for tomorrow’s growth.

- Uncover companies reshaping healthcare by tapping into breakthroughs with these 33 healthcare AI stocks. This gives you a front-row seat to AI innovation in medicine.

- Amplify your returns by securing these 18 dividend stocks with yields > 3% that deliver robust yields and help boost income even in shifting markets.

- Ride the next surge in technology by spotting these 25 AI penny stocks that are poised to make headlines and disrupt entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SCI

Service Corporation International

Provides deathcare products and services in the United States and Canada.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives