- United States

- /

- Hospitality

- /

- NYSE:RSI

What Rush Street Interactive (RSI)'s BetRivers Debit Launch Means for Digital Experience Innovation

Reviewed by Simply Wall St

- Earlier this week, Sightline Payments and Rush Street Interactive launched the gaming industry's first integrated debit payments solution, debuting the BetRivers Debit program to deliver secure, seamless access to player account balances with advanced responsible gaming features.

- This pioneering integration sets a new benchmark for customer convenience in online gaming by enabling instant access to funds while incorporating FDIC insurance and enhanced financial transparency tools for BetRivers users.

- Let's explore how this industry-first payment integration could influence Rush Street Interactive's investment narrative, especially regarding its commitment to digital user experience innovation.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Rush Street Interactive Investment Narrative Recap

To believe in Rush Street Interactive as a shareholder, you need confidence in the ongoing shift from offline to online gaming and the company's ability to lead innovation in user experience. The debut of the BetRivers Debit program marks a meaningful step forward for digital player convenience, but does not meaningfully shift the most important short-term catalyst, continued user growth and revenue acceleration in core North American markets, nor does it mitigate the biggest risks from regulatory or tax headwinds.

Among recent announcements, the June launch of BetRivers Poker in additional states ties directly to the catalyst of expanding user engagement and market share, reinforcing RSI’s efforts to grow its addressable audience and cross-sell across digital products. However, with aggressive expansion also comes the risk of rising regulatory scrutiny or tax pressures, which remain key watch points for investors even amid promising product developments.

By contrast, one important factor all investors should be aware of is the risk that new and higher taxes in core markets could weigh on future profit margins if...

Read the full narrative on Rush Street Interactive (it's free!)

Rush Street Interactive's outlook forecasts $1.5 billion in revenue and $44.7 million in earnings by 2028. This implies a 13.2% annual revenue growth rate and a $19.5 million increase in earnings from the current $25.2 million.

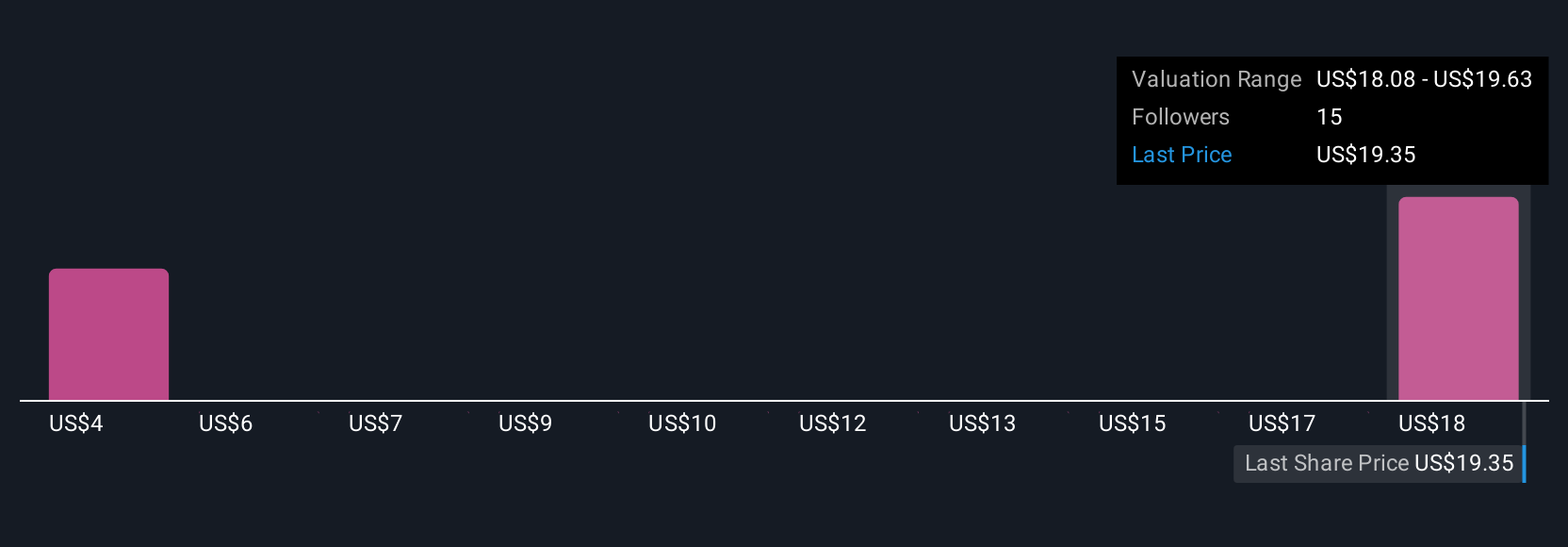

Uncover how Rush Street Interactive's forecasts yield a $20.75 fair value, a 6% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have estimated RSI's fair value between US$20.75 and US$22.33 from 2 analyses. With user growth in key jurisdictions still central to the company's outlook, consider how shifts in regulatory or tax policy could impact actual results before forming your own view.

Explore 2 other fair value estimates on Rush Street Interactive - why the stock might be worth 6% less than the current price!

Build Your Own Rush Street Interactive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rush Street Interactive research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Rush Street Interactive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rush Street Interactive's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSI

Rush Street Interactive

Operates as an online casino and sports betting company in the United States, Canada, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives