- United States

- /

- Hospitality

- /

- NYSE:RSI

Rush Street Interactive (RSI): Examining the Stock’s Valuation Following Recent Trading Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Rush Street Interactive.

After bouncing around for several months, Rush Street Interactive’s share price has recently shown modest upward momentum. While the stock’s 1-year total shareholder return sits at just 0.8%, its recent price action hints at incremental optimism among investors, likely sparked by better revenue and profit growth. Overall, short-term trading is picking up slightly compared to a fairly muted long-term return.

If you’re keeping an eye on digital entertainment trends, now is a good time to widen your search and uncover fast growing stocks with high insider ownership

But with shares hovering close to analyst price targets and recent gains reflecting improving fundamentals, the question remains: is Rush Street Interactive still undervalued, or is the market already factoring in future growth?

Most Popular Narrative: 7% Undervalued

According to the widely followed narrative, Rush Street Interactive’s fair value estimate is higher than its latest closing price, which reflects analyst confidence in the company’s potential to outperform. This leads to an examination of the high-conviction reasons behind the valuation, such as expansion plans and technology strengths.

The digitalization of entertainment is accelerating migration from offline to online gaming. With record-high monthly active users (MAUs) growing over 30% in North America and more than 40% in Latin America, Rush Street Interactive is well-positioned to capture this expanding addressable market, supporting sustained future revenue growth.

Are you interested in the numbers powering expectations of long-term growth? There is a bold earnings projection and a margin boost forecast that have attracted attention. The narrative relies on unusually optimistic targets. Discover which key financial assumptions fuel this surprising fair value call before the market digests them.

Result: Fair Value of $20.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty around Latin American regulatory changes and rising competition could undermine earnings growth. These factors pose real challenges for Rush Street Interactive’s outlook.

Find out about the key risks to this Rush Street Interactive narrative.

Another View: Price Multiples Raise a Red Flag

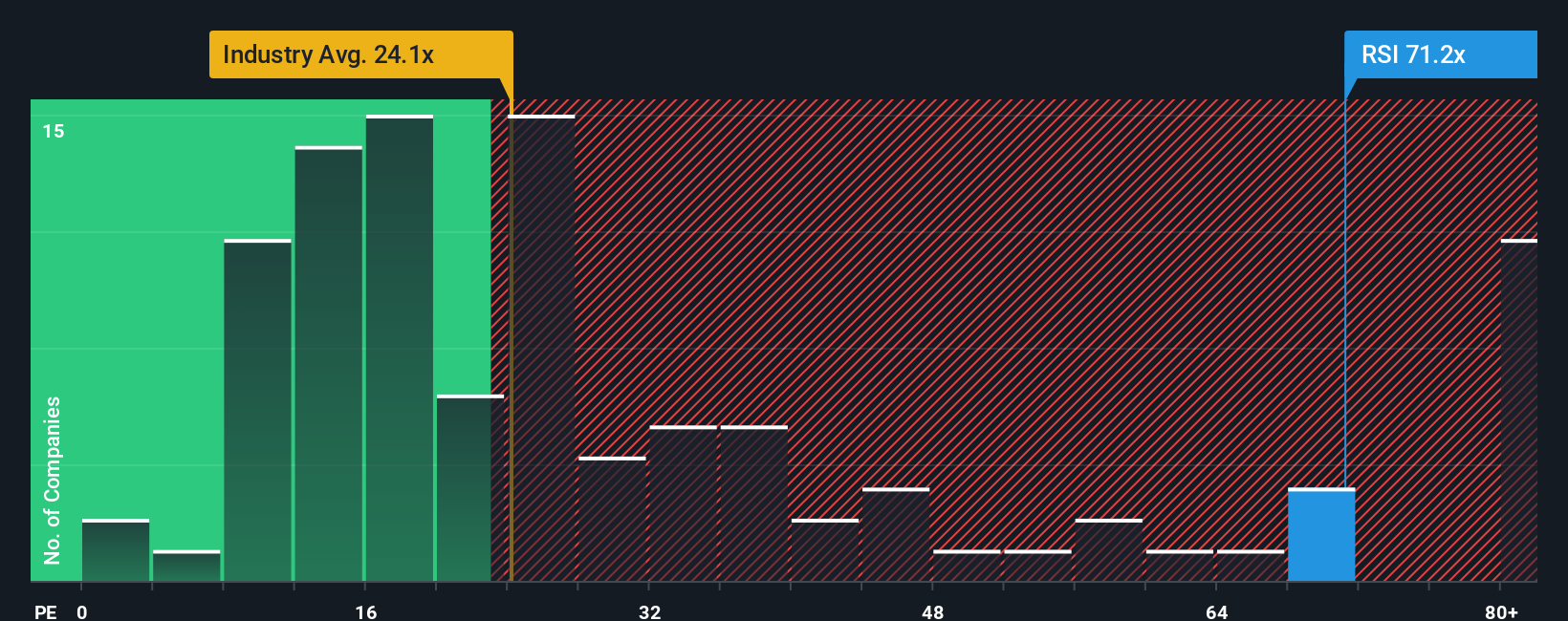

Looking at how Rush Street Interactive is valued by the market, the current price-to-earnings ratio stands at 72.8x. This is roughly double the average ratio for its peers at 36.6x, and nearly three times above the US Hospitality industry at 24.4x. Even compared to an estimated fair ratio of 24.4x, RSI looks expensive. This significant gap suggests investors may expect exceptional growth, or they may be overlooking the risks of a sharp market correction.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rush Street Interactive Narrative

If you want to dig deeper or challenge these perspectives, you can explore the data and assemble your own narrative in under three minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Rush Street Interactive.

Looking for More Investment Ideas?

Don’t limit yourself to one company when there are fresh opportunities waiting. Level up your portfolio by taking action with a few of the market’s most exciting themes:

- Tap into strong income potential by checking out these 19 dividend stocks with yields > 3%, which features reliable stocks with yields above 3% and sturdy business models.

- Accelerate your search for cutting-edge tech by browsing these 26 quantum computing stocks, a list packed with innovators in quantum computing and transformative digital breakthroughs.

- Uncover value others might miss by scanning these 896 undervalued stocks based on cash flows for stocks that look attractively priced relative to their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RSI

Rush Street Interactive

Operates as an online casino and sports betting company in the United States, Canada, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives