- United States

- /

- Hospitality

- /

- NYSE:RCL

Does Royal Caribbean's New Paradise Island Club Signal a Shift in Luxury Strategy for RCL?

Reviewed by Sasha Jovanovic

- Royal Caribbean has announced it will open the new Royal Beach Club Paradise Island in Nassau, Bahamas, on December 23, 2025, giving cruise guests exclusive access to custom ferries, themed cabanas, oceanfront pools, and Bahamian cultural experiences.

- This move reflects Royal Caribbean's emphasis on expanding premium shore offerings to elevate guest experiences and further differentiate its cruise vacations.

- We'll explore how the focus on exclusive shore destinations, like Paradise Island, shapes the company's investment outlook and growth opportunities.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Royal Caribbean Cruises Investment Narrative Recap

To be a shareholder in Royal Caribbean Cruises, you need to believe in the enduring appeal of cruise vacations and the company’s ability to drive guest spending through distinctive offerings, like the new Royal Beach Club Paradise Island. While this new destination enhances their premium shore portfolio and experience-based differentiation, it is unlikely to materially change the main short-term catalyst: strong consumer demand and booking trends. The biggest risk remains sensitivity to shifts in discretionary spending, especially if economic conditions deteriorate.

Of the recent announcements, the unveiling of the 2027-28 Caribbean vacation lineup stands out for its relevance, as it showcases how new destinations such as Paradise Island are woven into multiple high-profile itineraries, amplifying both onboard and destination-linked revenue opportunities. These expansions are central to Royal Caribbean’s efforts to maintain yield growth and maximize per-passenger spend through enhanced guest experiences and added value, reinforcing their focus amid a competitive environment.

Yet, against the excitement over new attractions, investors should be aware of the company’s ongoing exposure to...

Read the full narrative on Royal Caribbean Cruises (it's free!)

Royal Caribbean Cruises' outlook anticipates $22.4 billion in revenue and $5.9 billion in earnings by 2028. This reflects an expected annual revenue growth rate of 9.2% and a $2.3 billion increase in earnings from the current $3.6 billion.

Uncover how Royal Caribbean Cruises' forecasts yield a $336.08 fair value, a 26% upside to its current price.

Exploring Other Perspectives

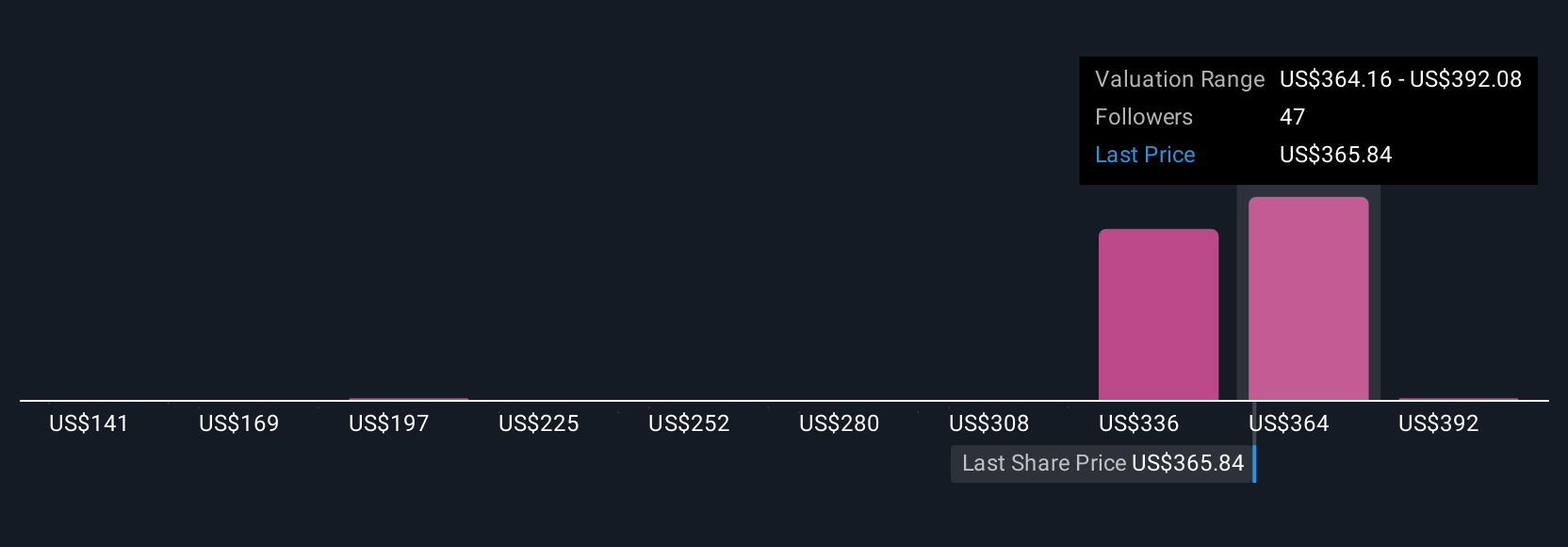

Ten members of the Simply Wall St Community place Royal Caribbean's fair value between US$214 and US$440.34 per share. With guest spending a key catalyst, you can see how opinions about future performance widely differ and should take time to explore additional viewpoints before making any decisions.

Explore 10 other fair value estimates on Royal Caribbean Cruises - why the stock might be worth 19% less than the current price!

Build Your Own Royal Caribbean Cruises Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royal Caribbean Cruises research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Royal Caribbean Cruises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royal Caribbean Cruises' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RCL

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.