- United States

- /

- Hospitality

- /

- NYSE:QSR

Is There an Opportunity in Restaurant Brands International After Recent Tech Investment Strategy?

Reviewed by Bailey Pemberton

If you are wondering whether this is the right moment to make a move on Restaurant Brands International, you are far from alone. The stock has seen its fair share of twists lately; it’s down 2.4% in the past week, but up a healthy 4.6% over the past month. And while the year-to-date performance sits at 3.2%, shares are still trading about 4.4% lower than they were a year ago. It’s a bit of a patchwork, right? Yet, if you zoom out even further, Restaurant Brands International has climbed 29.9% over three years and a notable 52.6% across five. Clearly, there’s resilience and long-term momentum, even if the pace can be choppy.

Behind these numbers, recent headlines highlight the company’s strategy of reimagining store formats and making tech-forward investments. Less visible, but just as significant, is how investors are weighing these moves. Sentiment shifts often reflect a broader debate about company risks and growth opportunity, which is a big part of why the valuation question feels especially relevant for RBI right now.

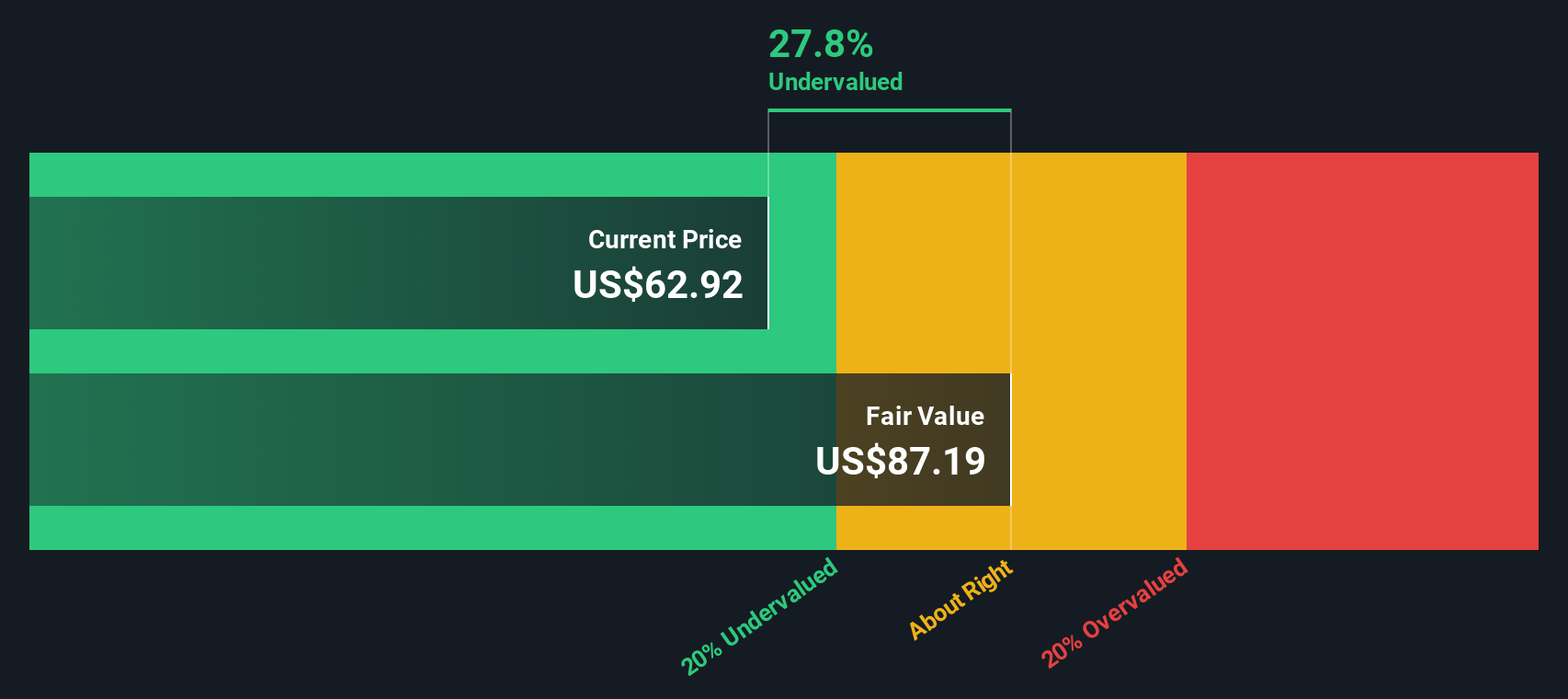

Our look at six major valuation checks gives the company a value score of 2, meaning Restaurant Brands International currently appears undervalued on two fronts. But how meaningful is that, and what do the different metrics really tell us? In the next section, I’ll break down the key valuation methods, and later on, reveal a framework that can give you an even clearer view of RBI’s real worth.

Restaurant Brands International scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Restaurant Brands International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a business by projecting its future cash flows and discounting them to today’s dollars. Simply put, it tries to figure out what those future dollars are worth right now, considering the time value of money.

For Restaurant Brands International, analysts estimate its latest twelve months Free Cash Flow at $1.26 Billion. Projections see this figure rising significantly, reaching approximately $2.39 Billion by 2028. Looking out even further, extrapolations suggest annual Free Cash Flows could top $3.45 Billion by 2035. The DCF uses these figures, drawing on both analyst estimates for the next five years and longer-term forecasts compiled by Simply Wall St, to build a consistent picture over a full decade.

Crunched into the DCF model, all those future cash flows generate an estimated intrinsic value of $81.48 per share for Restaurant Brands International. This value is about 16.9% higher than the current market price, indicating that the stock is trading at a meaningful discount.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Restaurant Brands International is undervalued by 16.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Restaurant Brands International Price vs Earnings

For profitable companies like Restaurant Brands International, the Price-to-Earnings (PE) ratio is a go-to metric for investors. The PE ratio helps gauge how much investors are paying for each dollar of a company's earnings, making it a powerful tool for understanding valuation relative to profit generation.

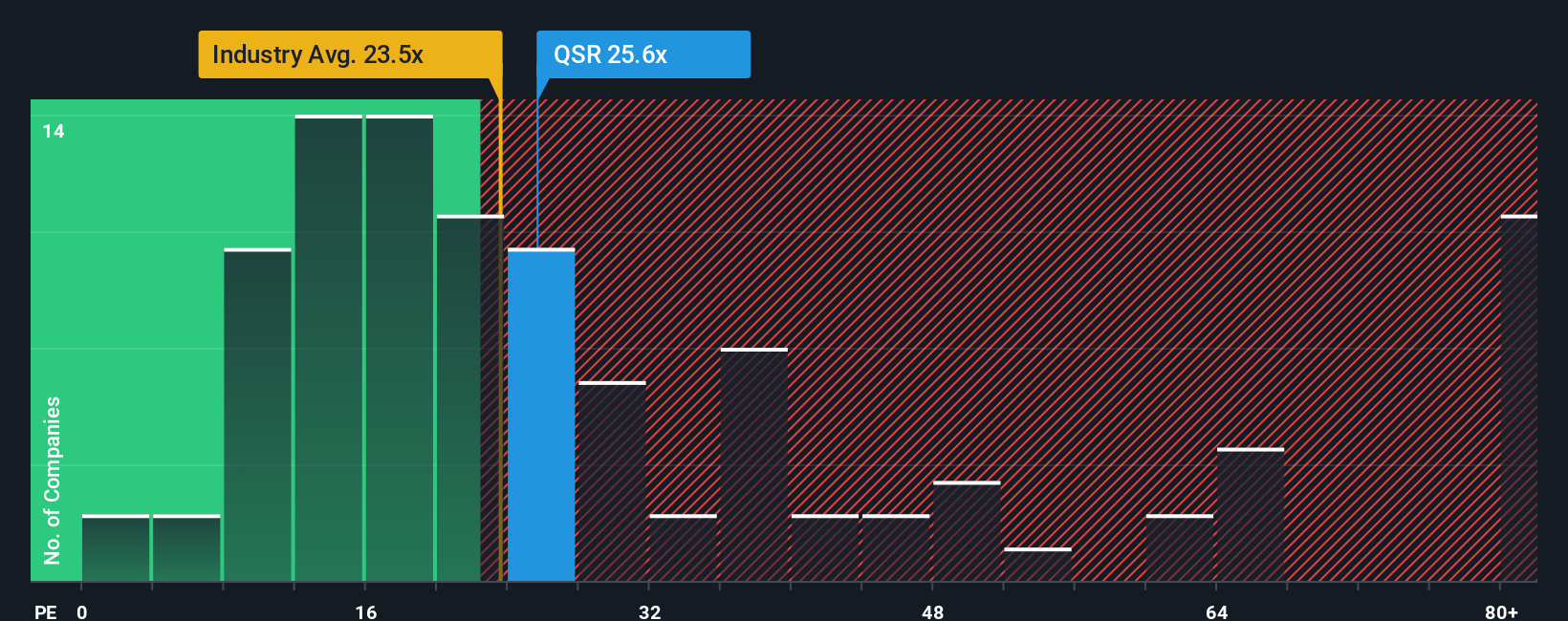

However, what qualifies as a “normal” or “fair” PE ratio depends on more than just earnings. It reflects growth expectations and risk. Companies with strong future growth or lower-than-average risk typically warrant a higher PE, while those with muted prospects or high uncertainty trade at lower multiples. In the Hospitality sector, the industry average PE is 24.3x, and the peer average is 25.6x. Restaurant Brands International currently trades at 25.7x, which is closely in line with these benchmarks.

To get a more tailored perspective, simply comparing with peers isn't always enough. That is where Simply Wall St’s "Fair Ratio" comes in. The Fair Ratio analyzes the company’s earnings growth, profit margins, risk profile, industry, and market cap to estimate the PE ratio the stock should typically command. For Restaurant Brands International, the Fair Ratio stands at 31.5x, notably higher than its current 25.7x. Because the Fair Ratio incorporates much more than just sector medians, it provides a richer, more nuanced view of value.

With Restaurant Brands International’s actual PE well below its Fair Ratio, this suggests the stock is undervalued based on earnings fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Restaurant Brands International Narrative

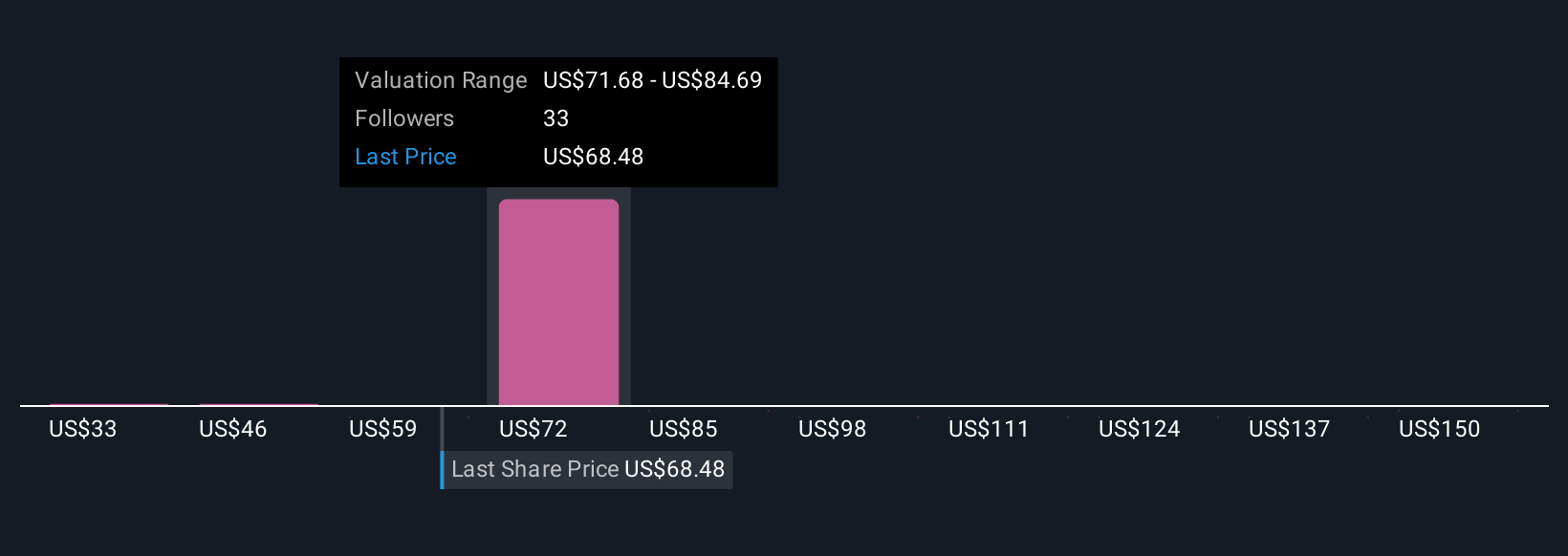

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a story you create about a company that connects your perspective on its business and future, such as what you think revenues, earnings, or profit margins may be, to financial forecasts and a fair value estimate. Narratives let you move beyond just ratios and numbers, linking the company’s strategy, news, or risks to a personalized investment thesis and valuation.

On Simply Wall St’s Community page, Narratives are easy to use (and used by millions of investors). With just a few clicks, you can build your own Narrative, update your numbers as new events unfold, and immediately see how your view compares with the latest Fair Value and the current market Price. This helps you decide whether to buy, hold, or sell based on your own story-driven analysis. Narratives update dynamically with each new announcement or earnings release so your decisions can always reflect the most current information.

For example, some investors see Restaurant Brands International’s digital investments and international franchising driving fair values as high as $93.0, while others, more cautious about competitive or execution risks, estimate values as low as $60.0. This represents a real-time spectrum of perspectives that you can join and refine for yourself.

Do you think there's more to the story for Restaurant Brands International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QSR

Restaurant Brands International

Operates as a quick-service restaurant company in Canada, the United States, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives