- United States

- /

- Hospitality

- /

- NYSE:QSR

A Fresh Look at Restaurant Brands International (NYSE:QSR) Valuation Following Strong Q3 Earnings and Global Expansion Moves

Reviewed by Simply Wall St

Restaurant Brands International (NYSE:QSR) attracted attention after releasing third-quarter earnings that beat expectations. The company also shared news of a joint venture in China and ongoing negotiations over the sale of its Japanese operations.

See our latest analysis for Restaurant Brands International.

After its upbeat earnings and international expansion news, Restaurant Brands International's share price has climbed steadily, hitting a 52-week high and achieving a 14.5% return over the last 90 days. The one-year total shareholder return is 6.8%, suggesting modest gains for long-term holders while momentum has been building recently, driven by renewed growth initiatives and deal activity.

If global expansion stories like this spark your curiosity, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With recent gains and optimistic analyst targets, investors now face a familiar dilemma: is Restaurant Brands International's stock still undervalued, or are future growth prospects already fully priced in?

Most Popular Narrative: 7.7% Undervalued

According to the most widely followed narrative, Restaurant Brands International's fair value is set above its last close, with room for upside. This gap opens a debate over whether the market is pricing in just enough growth or missing the pace of change under the surface.

Rapid international expansion, particularly through the franchise-led model in markets such as China, India, Turkey, Japan, and Brazil, is driving double-digit unit and system-wide sales growth. This directly supports recurring, capital-light revenue streams and higher long-term earnings visibility. Acceleration in menu innovation (notably at Tim Hortons, Burger King, and across international markets) and the revitalization of core brands (for example, new product platforms, premium and value menu balance, high-profile partnerships, ongoing Burger King "Reclaim the Flame" initiatives) have led to consistent increases in same-store sales and customer traffic. These are likely to fuel continued top-line growth and margin expansion.

Curious what’s fueling such optimism? There’s a bold combination of international scale, digital plays, and a surge in operational profits behind this fair value. Want a glimpse of the aggressive forecasts powering analysts’ price targets? Uncover the full narrative and see which future trends could drive this valuation higher.

Result: Fair Value of $78.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation and challenges with international expansion, particularly in key growth markets, could disrupt Restaurant Brands International’s positive momentum in the months ahead.

Find out about the key risks to this Restaurant Brands International narrative.

Another View: Market Multiples Tell a Different Story

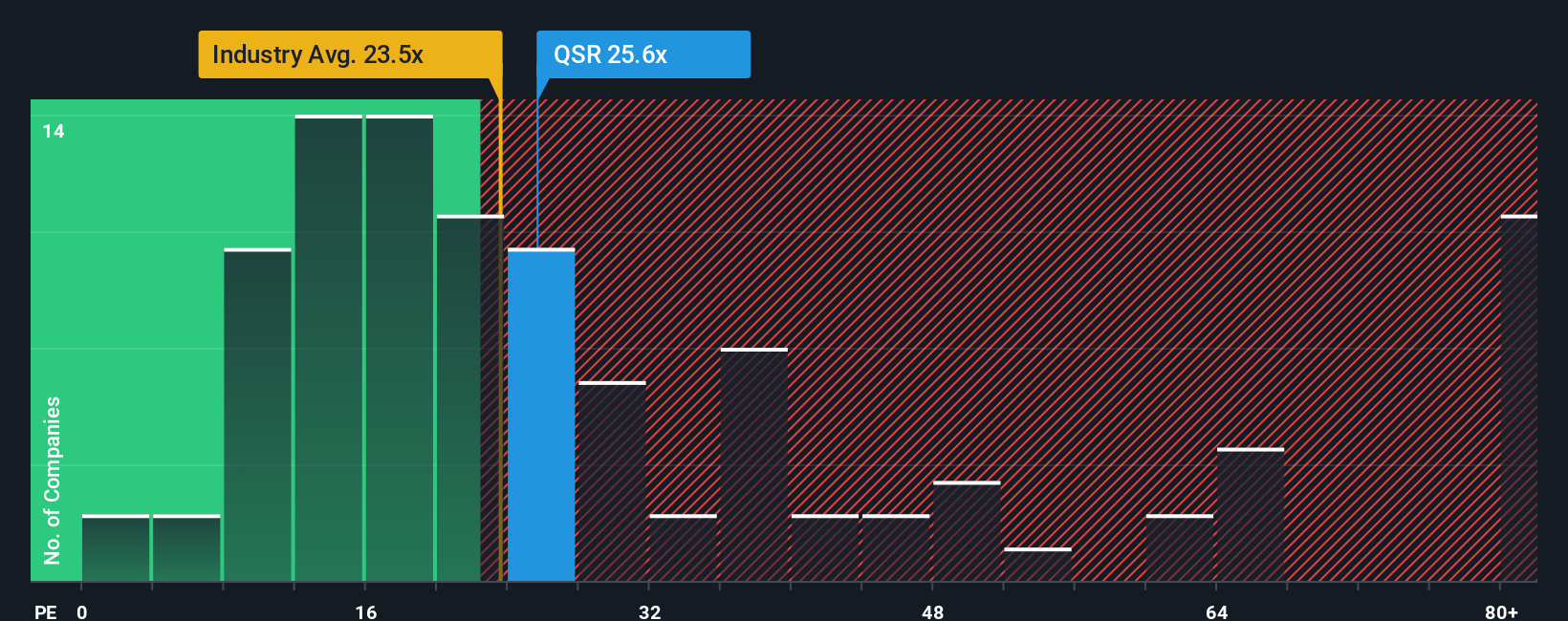

While fair value estimates hint at potential upside for Restaurant Brands International, comparing its price-to-earnings ratio of 25.5x reveals it is trading above both its peer average of 24.2x and the broader US Hospitality sector’s average of 21.2x. However, our fair ratio suggests the market could eventually re-rate closer to a P/E of 29.2x. Does this premium point to higher growth expectations, or could it be setting up the stock for a correction ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Restaurant Brands International Narrative

If you want to dig deeper or believe there’s more to the story, you can shape your own perspective in just a few minutes, starting with Do it your way

A great starting point for your Restaurant Brands International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Thousands of investors use the Simply Wall Street Screener to pinpoint unique opportunities every week. Don’t let your next winning stock slip through your fingers.

- Start building reliable income streams by evaluating these 15 dividend stocks with yields > 3%, which offers yields above 3% and consistent payout histories.

- Jump ahead of the curve and focus on innovation with these 30 healthcare AI stocks, which is driving breakthroughs in medical technology and data-driven health solutions.

- Capitalize on rapid market shifts by targeting these 927 undervalued stocks based on cash flows, which presents compelling value aligned with strong fundamentals right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QSR

Restaurant Brands International

Operates as a quick-service restaurant company in Canada, the United States, and internationally.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success