- United States

- /

- Hospitality

- /

- NYSE:PRKS

Will United Parks (PRKS) Financial Leadership Change Shape Its Approach to Operational Resilience?

Reviewed by Sasha Jovanovic

- In October 2025, United Parks & Resorts announced the resignation of Chief Financial Officer and Treasurer James Mikolaichik, who left to pursue another opportunity, with James W. Forrester, Jr. appointed as Interim CFO and Treasurer effective November 15, 2025. Forrester brings more than 20 years of theme park finance and operations experience, including leadership roles at the Walt Disney Company and Hershey Entertainment & Resorts.

- This leadership transition highlights the company's depth of financial management experience and emphasizes a focus on operational continuity despite recent executive changes.

- With such experienced financial leadership stepping in, we'll examine how this transition may influence United Parks & Resorts' investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

United Parks & Resorts Investment Narrative Recap

To be a shareholder in United Parks & Resorts, an investor needs confidence in the company's ability to drive sustained attendance growth and increase per capita guest spending, underpinned by strong consumer appetite for out-of-home experiences. The recent CFO resignation and interim appointment are not likely to materially affect the company’s near-term operational catalysts, such as strong forward bookings and seasonal event launches; the most important risk remains around weather volatility and regional attendance concentration.

Among recent company initiatives, the launch of new seasonal events at major parks, such as Christmas Town at Busch Gardens, stands out as closely aligned with the key catalyst of capturing robust discretionary spending and supporting higher attendance levels. While executive transitions can be disruptive elsewhere, United’s emphasis on continuity and internal promotion suggests existing strategies around new events and operational execution remain a priority.

However, it is important to keep in mind that, despite this stability, persistent weather-related disruptions could still...

Read the full narrative on United Parks & Resorts (it's free!)

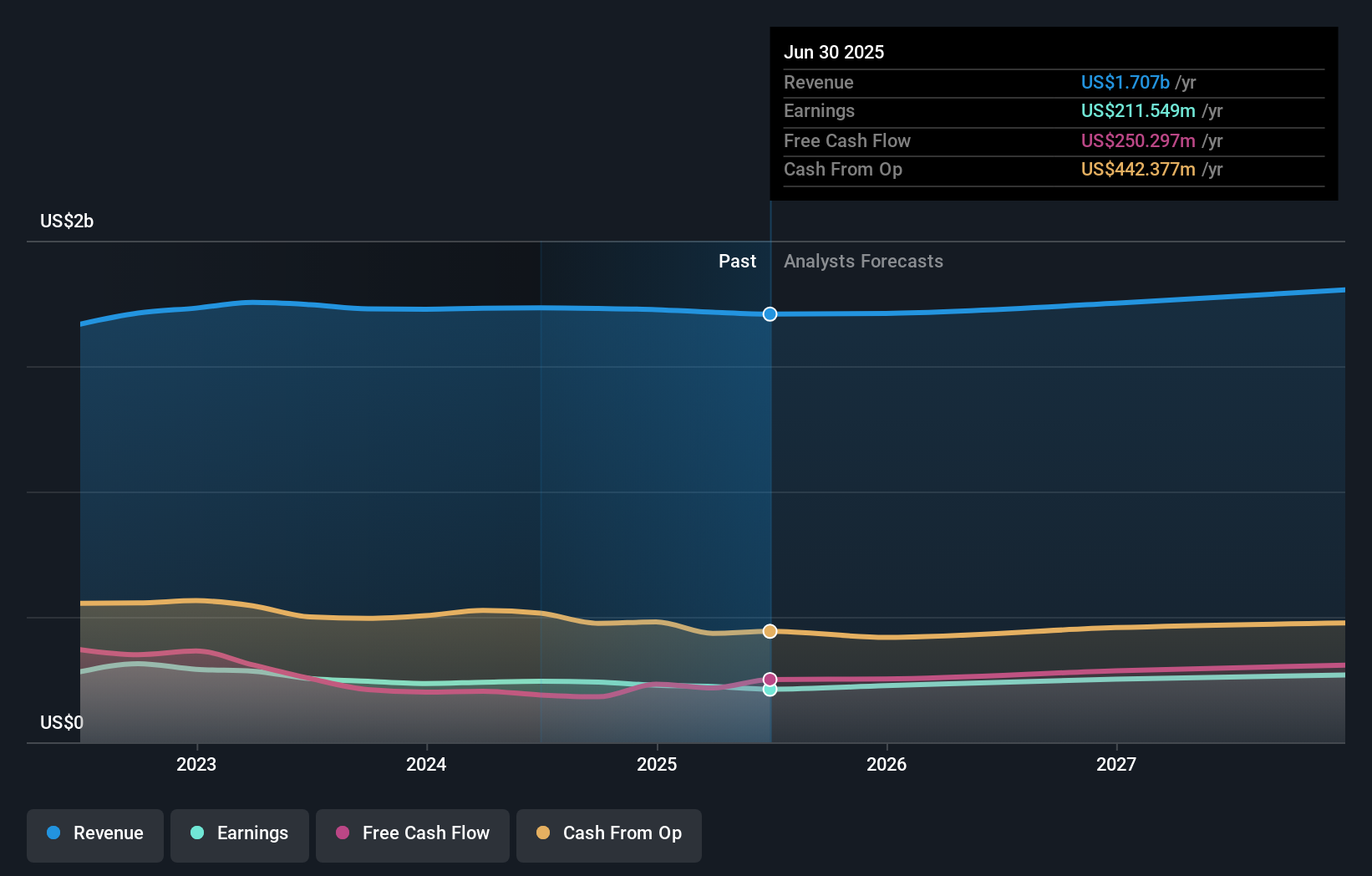

United Parks & Resorts is expected to generate $1.8 billion in revenue and $284.5 million in earnings by 2028. This outlook is based on an anticipated annual revenue growth rate of 2.1% and represents a $73 million increase in earnings from the current level of $211.5 million.

Uncover how United Parks & Resorts' forecasts yield a $57.45 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for United Parks & Resorts all stand at US$57.45 based on 1 independent analysis. While forward bookings and new attractions support optimism, recent attendance softness and regional risks remain topics where opinions can differ among market participants.

Explore another fair value estimate on United Parks & Resorts - why the stock might be worth just $57.45!

Build Your Own United Parks & Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Parks & Resorts research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Parks & Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Parks & Resorts' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRKS

United Parks & Resorts

Operates as a theme park and entertainment company in the United States.

Undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives