- United States

- /

- Hospitality

- /

- NYSE:PLNT

Will Planet Fitness’ (PLNT) Securitized Refinancing and Buyback Capacity Change Its Capital Allocation Narrative?

Reviewed by Sasha Jovanovic

- Planet Fitness, Inc. recently completed a debt refinancing plan in which subsidiaries moved to issue US$750 million–US$850 million of new securitized notes, repay about US$410 million of 2022-1 Class A-2-I Notes, expand variable funding capacity to US$150 million, and support reserve accounts and general corporate uses.

- An interesting aspect is that part of the refinancing proceeds may be directed toward share repurchases, tying the company’s capital structure to potential future capital returns.

- We’ll now examine how this large securitized refinancing, including potential funding for buybacks, could reshape Planet Fitness’s existing investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Planet Fitness Investment Narrative Recap

To own Planet Fitness, you need to believe its low-cost, beginner-friendly model can keep expanding memberships and franchise clubs despite higher churn from online cancellations and intense competition. The planned US$750 million to US$850 million securitized refinancing, including potential buyback funding, mainly tweaks the balance sheet and liquidity rather than the core near term catalyst of membership and club growth, while modestly increasing focus on leverage and refinancing execution risk.

The refinancing plan also lands just after Q3 2025 results and a guidance raise, with Planet Fitness now targeting about 11% revenue growth for the year. That backdrop of rising revenue, higher net income, and ongoing share repurchases provides important context for how any new debt, liquidity capacity, or buyback flexibility could interact with expansion driven catalysts around new clubs, younger member adoption, and format optimization.

But against this progress, investors should still pay close attention to whether click to cancel continues to push member attrition higher than expected and...

Read the full narrative on Planet Fitness (it's free!)

Planet Fitness' narrative projects $1.6 billion revenue and $312.8 million earnings by 2028. This requires 11.6% yearly revenue growth and about a $123.8 million earnings increase from $189.0 million today.

Uncover how Planet Fitness' forecasts yield a $128.94 fair value, a 18% upside to its current price.

Exploring Other Perspectives

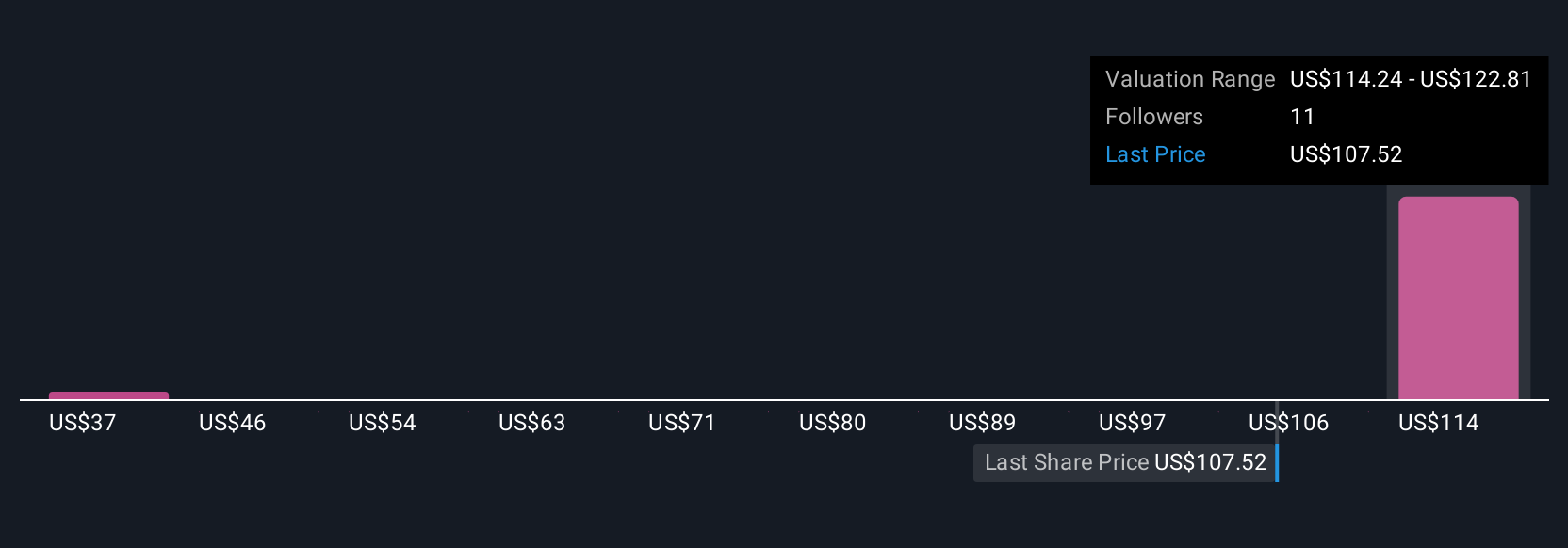

Three fair value estimates from the Simply Wall St Community span a wide US$37.05 to US$128.94 range, showing how far apart individual views can be. As you weigh these perspectives, consider how sustained higher churn from click to cancel could affect the recurring membership engine that underpins Planet Fitness’s long term performance and explore how others are thinking about that risk.

Explore 3 other fair value estimates on Planet Fitness - why the stock might be worth less than half the current price!

Build Your Own Planet Fitness Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Planet Fitness research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Planet Fitness research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Planet Fitness' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLNT

Planet Fitness

Planet Fitness, Inc., together with its subsidiaries, franchises and operates fitness centers under the Planet Fitness brand.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026