- United States

- /

- Hospitality

- /

- NYSE:PLNT

What Planet Fitness (PLNT)'s Record Revenue and Membership Growth Means For Shareholders

Reviewed by Sasha Jovanovic

- Planet Fitness recently reported quarterly results that surpassed analysts’ expectations, with revenues rising year on year and impressive same-store sales growth.

- The company marked its 10-year public anniversary, highlighting the addition of nearly 14 million members and continued global expansion opportunities driven by growing interest in health and wellness.

- We'll examine how Planet Fitness’s stronger-than-expected revenue and membership gains influence the company’s long-term investment narrative.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Planet Fitness Investment Narrative Recap

At its core, Planet Fitness is a bet on the enduring appeal of affordable, accessible fitness for the casual consumer. The strong quarterly results and ongoing membership momentum provide encouraging support for confidence in the company’s core growth drivers. For the immediate term, the biggest catalyst remains the pace of club openings and successful engagement of younger demographics, while the most important risk, persistently higher member attrition rates due to easier online cancellations, remains the key factor to monitor. The recent upbeat earnings do not materially diminish this risk, but they do suggest resilience in the business model.

Among the recent announcements, the commitment to add 160 to 170 new clubs in 2025 stands out. With membership growth and revenue tracking strongly, this expansion plan is directly relevant to Planet Fitness's ability to capture new markets and harness demographic tailwinds, keeping the company firmly focused on both short-term results and long-term scale.

However, even with expansion and revenue beats, investors should be aware that a sustained increase in member attrition rates could...

Read the full narrative on Planet Fitness (it's free!)

Planet Fitness' narrative projects $1.6 billion in revenue and $312.8 million in earnings by 2028. This requires 11.6% yearly revenue growth and a $123.8 million increase in earnings from current earnings of $189.0 million.

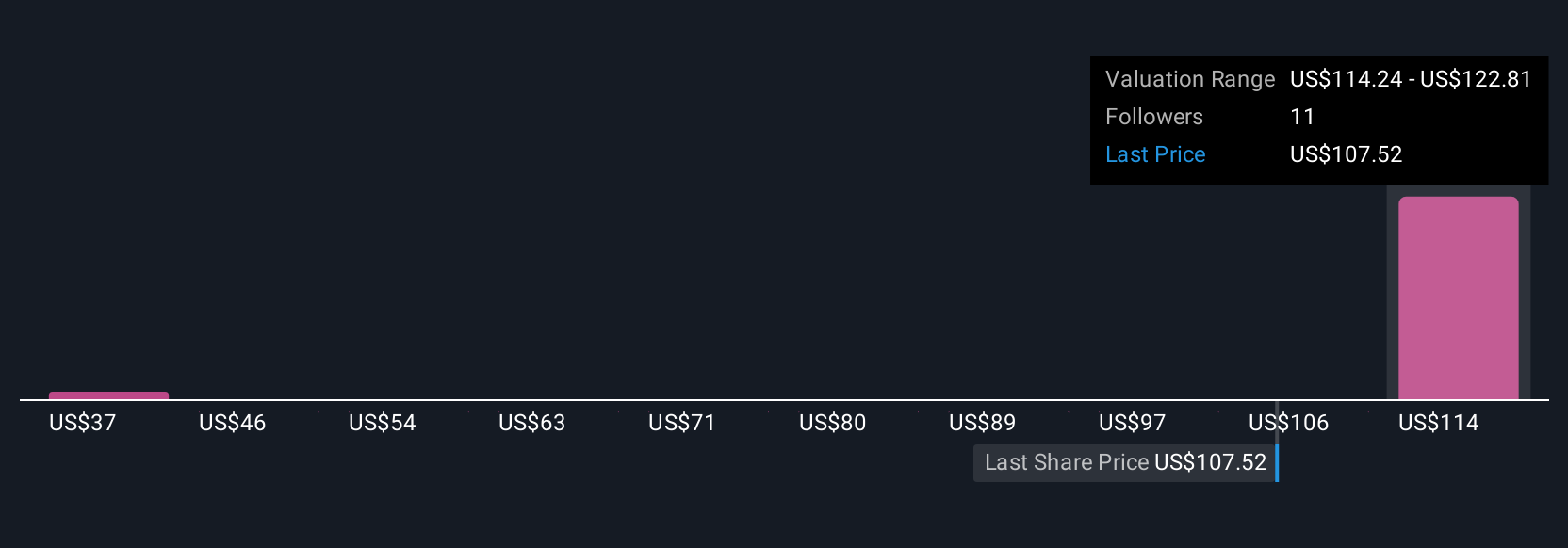

Uncover how Planet Fitness' forecasts yield a $122.81 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate fair values ranging from US$37.05 to US$122.81 across three distinct viewpoints. While expansion plans remain central, the risk of rising member cancellations could affect how these expectations play out over time.

Explore 3 other fair value estimates on Planet Fitness - why the stock might be worth as much as 33% more than the current price!

Build Your Own Planet Fitness Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Planet Fitness research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Planet Fitness research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Planet Fitness' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLNT

Planet Fitness

Planet Fitness, Inc., together with its subsidiaries, franchises and operates fitness centers under the Planet Fitness brand.

Proven track record with limited growth.

Similar Companies

Market Insights

Community Narratives