- United States

- /

- Hospitality

- /

- NYSE:PLNT

Planet Fitness (PLNT): Assessing Valuation as Shares Cool After a Year of Strong Returns

Reviewed by Kshitija Bhandaru

Planet Fitness (PLNT) shares have pulled back slightly in the past week, slipping 2% even as the company continues to post healthy growth numbers. Investors seem to be weighing recent price moves against long-term returns for this gym chain.

See our latest analysis for Planet Fitness.

While Planet Fitness shares have dipped slightly in the past week, the real story is in the longer-term momentum. The gym chain’s one-year total shareholder return stands at a robust 20.7%, signaling that investors who have held on are being rewarded even as recent price action cools off following last year’s stronger run.

If steady performance from fitness plays interests you, now is a great chance to broaden your search and discover fast growing stocks with high insider ownership

With Planet Fitness currently trading about 22% below consensus analyst price targets and delivering double-digit annual growth, the question becomes clear: is the market offering a deal for future returns, or is all the upside already reflected?

Most Popular Narrative: 18.1% Undervalued

Planet Fitness’s fair value, according to the most widely followed narrative, is notably above its recent closing price. This signals analysts are seeing untapped upside and sets the stage for a closer look at what is driving this optimism.

Accelerating engagement from younger, health-conscious demographics (Gen Z and soon Gen Alpha), combined with program successes like the High School Summer Pass, is expanding Planet Fitness's addressable membership base. This drives revenue growth and supports longer-term membership penetration. Ongoing format optimization, with more strength equipment, redesigned layouts, and attention to user preference, is increasing club utilization and member satisfaction. These efforts may improve retention and provide opportunities for pricing power, positively impacting both revenue and net margins.

Curious how this future growth story translates into an ambitious fair value? The most influential narrative rests on bold projections for membership expansion, higher margins, and pricing power. Want to know the key numbers and assumptions supporting this upside? Only by diving deeper can you see the details that justify this valuation.

Result: Fair Value of $122.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising member attrition from easier online cancellations and the gym's limited appeal to advanced users could challenge the bullish growth outlook for Planet Fitness.

Find out about the key risks to this Planet Fitness narrative.

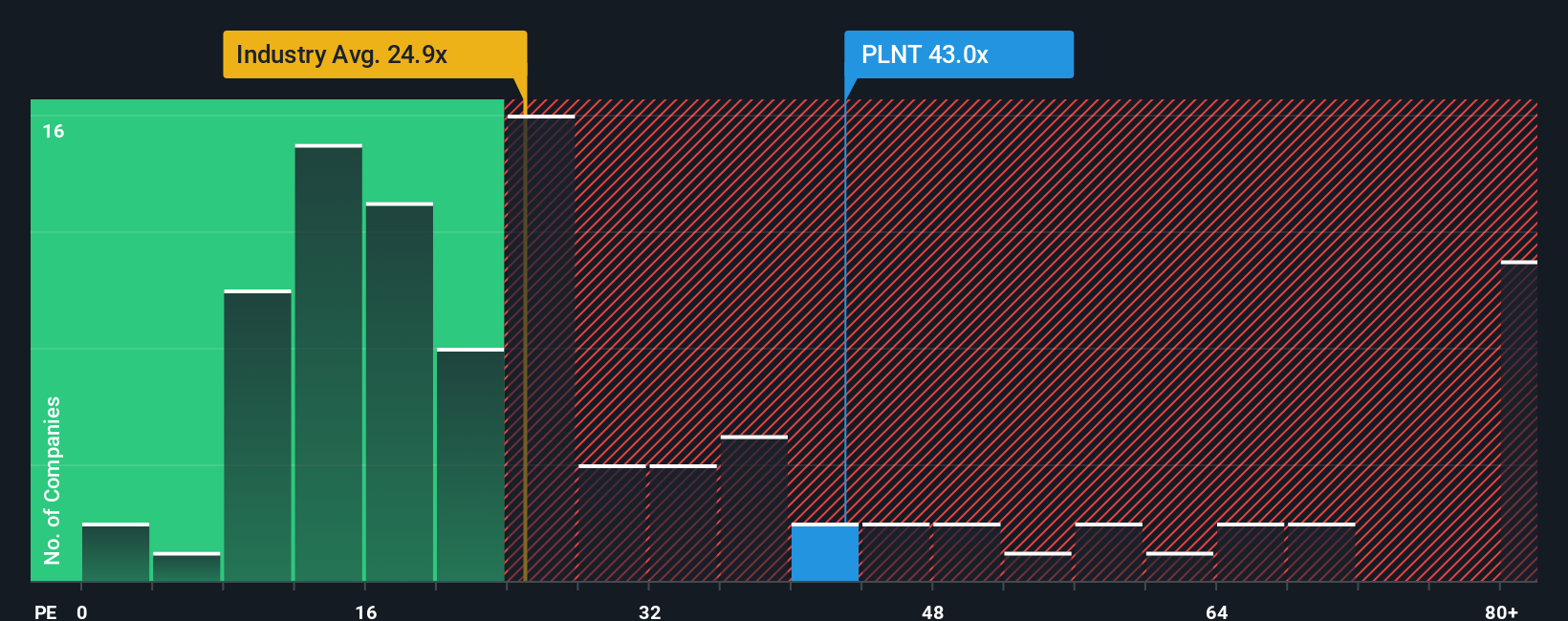

Another View: The Price-to-Earnings Perspective

Looking beyond the fair value narrative, Planet Fitness is currently priced at a hefty 44.7 times earnings. That is well above both the US Hospitality industry average of 24.4x and its closest peer average of 32.1x. The market’s fair ratio estimate is just 25.3x, which suggests a sizeable premium is being paid by investors today. Does this premium reflect confidence, or could it foreshadow future risks if growth expectations fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Planet Fitness Narrative

If you see Planet Fitness differently or want to dig into the numbers yourself, you can build your own narrative in just a few minutes. Do it your way

A great starting point for your Planet Fitness research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great stock opportunities pass you by. If you want to find tomorrow’s winners and diversify your approach, these unique screens can put you ahead of the crowd:

- Uncover cash-generating potential by checking out these 896 undervalued stocks based on cash flows. These are companies whose intrinsic value may not be fully recognized by the market.

- Tap into unstoppable growth by seeing these 24 AI penny stocks. These companies are changing entire industries with artificial intelligence and innovation at their core.

- Collect regular income and put your cash to work through these 19 dividend stocks with yields > 3%. This screen features payouts exceeding 3% and a focus on stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PLNT

Planet Fitness

Planet Fitness, Inc., together with its subsidiaries, franchises and operates fitness centers under the Planet Fitness brand.

Proven track record with limited growth.

Similar Companies

Market Insights

Community Narratives