- United States

- /

- Hospitality

- /

- NYSE:NCLH

Should Norwegian’s New Cross-Brand Loyalty Program and Debt Moves Prompt Action from NCLH Investors?

Reviewed by Sasha Jovanovic

- In recent days, Norwegian Cruise Line Holdings announced the launch of a new cross-brand loyalty status program, enabling guests to have their benefits recognized across Norwegian, Oceania, and Regent Seven Seas Cruises beginning October 15, 2025. This development coincided with improved analyst sentiment driven by debt reduction actions and expectations of strong earnings and revenue growth.

- The introduction of a loyalty status matching program not only enhances guest experience but also aims to encourage broader customer engagement with multiple brands under the company's portfolio.

- We'll examine how improved financial flexibility through significant debt retirement is influencing Norwegian Cruise Line Holdings' investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Norwegian Cruise Line Holdings Investment Narrative Recap

To be a shareholder in Norwegian Cruise Line Holdings, you need to believe in the company's ability to balance guest experience initiatives, such as the new cross-brand loyalty status program, with disciplined financial management. While the loyalty program rollout strengthens long-term brand engagement, the most important near-term catalyst remains the company's planned expansion of its private island and premium offerings, with the single biggest risk still centered on its high leverage and debt obligations, the recent debt retirements help, but do not yet remove this hurdle.

Among recent announcements, the retirement of nearly all 2026 and 2027 Notes stands out as directly impacting Norwegian's biggest risk, persistent high leverage. This move to reduce debt improves financial flexibility and interest expenses, giving management more room to support new guest-focused investments and weather external market pressures.

By contrast, investors should be aware that despite progress on deleveraging, substantial debt maturities in 2026 remain on the horizon and...

Read the full narrative on Norwegian Cruise Line Holdings (it's free!)

Norwegian Cruise Line Holdings is projected to reach $12.6 billion in revenue and $1.7 billion in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 9.5% and requires an increase in earnings of about $980 million from the current $719.2 million.

Uncover how Norwegian Cruise Line Holdings' forecasts yield a $31.12 fair value, a 28% upside to its current price.

Exploring Other Perspectives

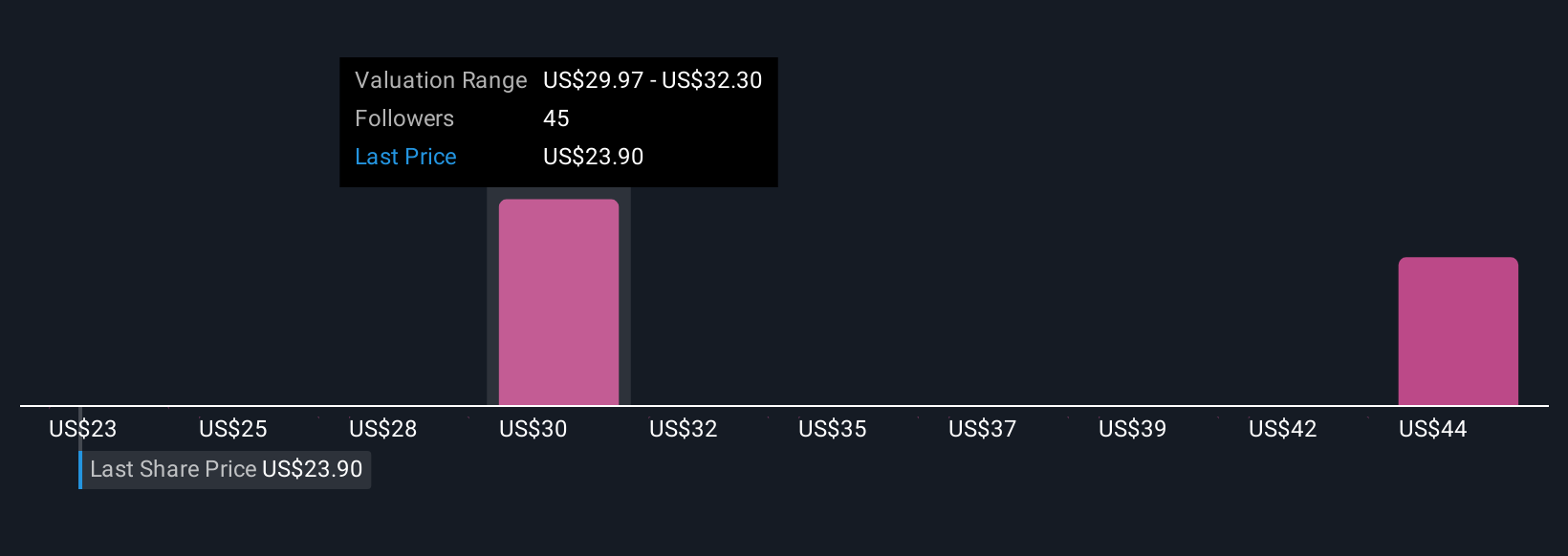

Five different fair value estimates from the Simply Wall St Community range widely, from US$23 to US$46.63 per share. While community forecasts highlight strong upside potential, the company's exposure to large upcoming debt maturities could impact future performance, so it's worth exploring several viewpoints.

Explore 5 other fair value estimates on Norwegian Cruise Line Holdings - why the stock might be worth as much as 92% more than the current price!

Build Your Own Norwegian Cruise Line Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Norwegian Cruise Line Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Norwegian Cruise Line Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Norwegian Cruise Line Holdings' overall financial health at a glance.

No Opportunity In Norwegian Cruise Line Holdings?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norwegian Cruise Line Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NCLH

Norwegian Cruise Line Holdings

Operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives