- United States

- /

- Hospitality

- /

- NYSE:NCLH

Norwegian Cruise Line Holdings (NYSE:NCLH) Unveils Revitalization Plans Amid Mediterranean And Hawaiian Cruises

Reviewed by Simply Wall St

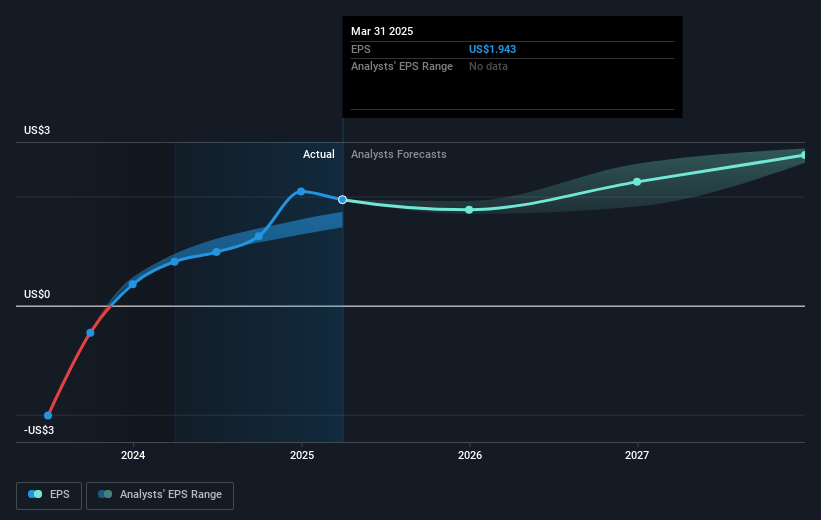

Norwegian Cruise Line Holdings (NYSE:NCLH) announced significant revitalization projects for its Norwegian Epic and Pride of America to enrich guest experiences. This news comes amid the company's stock declining 5% last week, which stands in contrast to the broader market's 1.8% rise. This dip follows the release of challenging first-quarter financial results, with a reported net loss, and amid broader investor enthusiasm driven by positive economic data and trade news. Despite the enhancements to its fleet and promotional offers, these positive developments were insufficient to counteract the weight of disappointing earnings on investor sentiment.

Norwegian Cruise Line Holdings has 1 risk we think you should know about.

The announcement of revitalization projects for the Norwegian Epic and Pride of America is anticipated to bolster guest experiences and could contribute positively to Norwegian Cruise Line Holdings' long-term revenue and earnings projections. These enhancements may serve as a catalyst for attracting more guests, potentially increasing on-board spending and improving operational efficiencies. With innovative features and upgraded services, the company hopes to maintain its competitive edge in the cruise industry, potentially leading to favorable growth in future revenue streams.

Over the past five years, the company's total return, including both share price appreciation and dividends, was 35.5%. Despite this positive longer-term performance, the stock significantly underperformed the US market, which saw a 9.5% rise over the past year. In comparison to the US Hospitality industry, Norwegian Cruise Line Holdings also lagged behind, as the industry posted a 3.3% increase in the same one-year period.

In the context of a recent share price decline of 5%, the stock remains below the analyst consensus price target of US$26.96. Presently, it trades at US$17.38, representing a discount of 35.5% to the price target. This gap suggests potential upside if the company can achieve the anticipated revenue growth and earnings targets, projected at US$1.5 billion, with an earnings per share of US$2.88 by 2028. However, achieving these metrics depends on the successful implementation of fleet and app upgrades, efficient cost management, and navigating macroeconomic pressures effectively.

Review our growth performance report to gain insights into Norwegian Cruise Line Holdings' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norwegian Cruise Line Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NCLH

Norwegian Cruise Line Holdings

Operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives