- United States

- /

- Hospitality

- /

- NYSE:NCLH

Norwegian Cruise Line Holdings (NYSE:NCLH) Debuts Innovative Norwegian Aqua With Exciting New Features

Reviewed by Simply Wall St

Norwegian Cruise Line Holdings (NYSE:NCLH) saw a 7% rise in its stock over the last week, coinciding with the successful launch of its newest ship, the Norwegian Aqua, at Port Canaveral. The ship, boasting unique features like the world’s first hybrid waterslide and roller coaster, began its Caribbean voyages with 3,700 guests on board. Despite broader market volatility that led to declines in tech stocks like Nvidia and Tesla, the upbeat sentiment surrounding NCLH's product announcements and promotional programs may have significantly contributed to its stock performance, aligning well with the market's overall 7% upward trend.

Norwegian Cruise Line Holdings has 1 weakness we think you should know about.

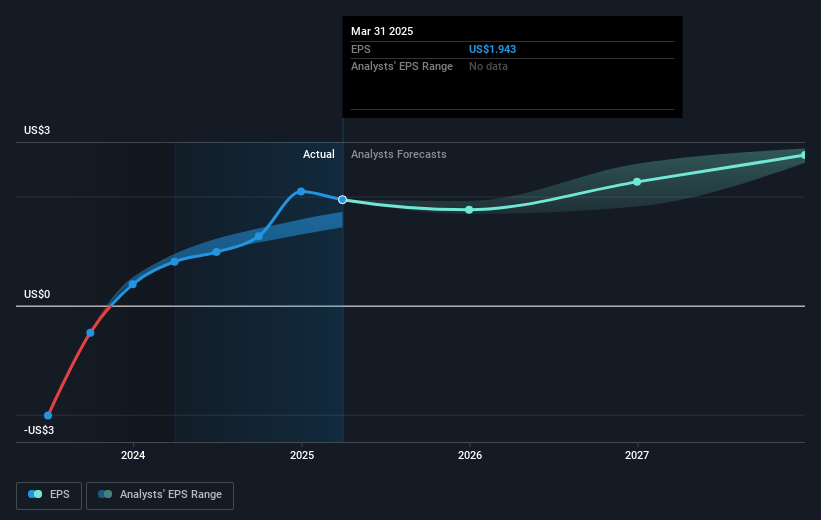

The recent 7% rise in Norwegian Cruise Line Holdings' stock, alongside the launch of its Norwegian Aqua, could be a key element in shaping the company's narrative of enhancing guest experiences. The unveiling of innovative onboard features aligns with the company's broader expansion plans, potentially driving future revenue and earnings growth. Analysts predict revenues and earnings to see substantial growth, supported by these customer-centric enhancements. The launch's positive reception may strengthen these forecasts.

Over a longer five-year period, the company's total shareholder return was 19.32%. This context shows that while there has been recent uptick, achieving consistent, sustainable growth has been a challenge in the past. Over the past year, however, Norwegian Cruise Line Holdings underperformed both the US market and the hospitality industry, which saw returns of 7.5% and 2.8% respectively.

Currently trading at US$16.61, Norwegian Cruise Line Holdings' stock is considered undervalued relative to the consensus price target of US$28.14—indicating a significant 41% potentially attainable upside. The company's focus on capacity expansion, via new ships like the Aqua and an expected US$12.2 billion revenue by 2028, could help bridge this valuation gap. While risks remain, such as currency fluctuations and demand-supply balance, the latest developments present a promising shift in trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norwegian Cruise Line Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NCLH

Norwegian Cruise Line Holdings

Operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives