- United States

- /

- Hospitality

- /

- NYSE:NCLH

Is Norwegian Cruise Stock a Bargain After Missed Q1 Earnings and Soft 2025 Guidance?

Reviewed by Bailey Pemberton

If you’re looking at Norwegian Cruise Line Holdings and asking yourself whether it’s the right time to buy, you’re not alone. Investors have been watching this stock’s journey with a mixture of skepticism and excitement, especially given the roller coaster ride cruise stocks have taken these past few years. Norwegian’s share price recently closed at $22.85 and, while the last year has seen a dip of 5.2%, the longer-term gains are hard to ignore, with an increase of 60.6% over three years and 29.0% over five years. The latest 7-day and 30-day returns, at -1.9% and -10.7%, might look underwhelming, but sometimes short-term nerves in the market open doors for value hunters.

Investors’ sentiment has shifted a few times as the cruise industry finds its footing post-pandemic, and Norwegian has been swept along by every wave. Yet it’s still standing strong. News around travel demand slowly returning has influenced trading patterns, with market confidence shifting as new data emerges about consumer spending and travel habits.

Here’s where it gets especially interesting: Norwegian scores a 6 out of 6 on our valuation checklist, meaning it meets all six undervaluation criteria we follow. That is not something you see every day, and it immediately raises the question of whether the market has been overly pessimistic.

Let’s break down exactly how those valuation methods work and what makes Norwegian stand out. And if you’re looking for an even more insightful approach to understanding value, be sure to stick around for the final section.

Why Norwegian Cruise Line Holdings is lagging behind its peers

Approach 1: Norwegian Cruise Line Holdings Discounted Cash Flow (DCF) Analysis

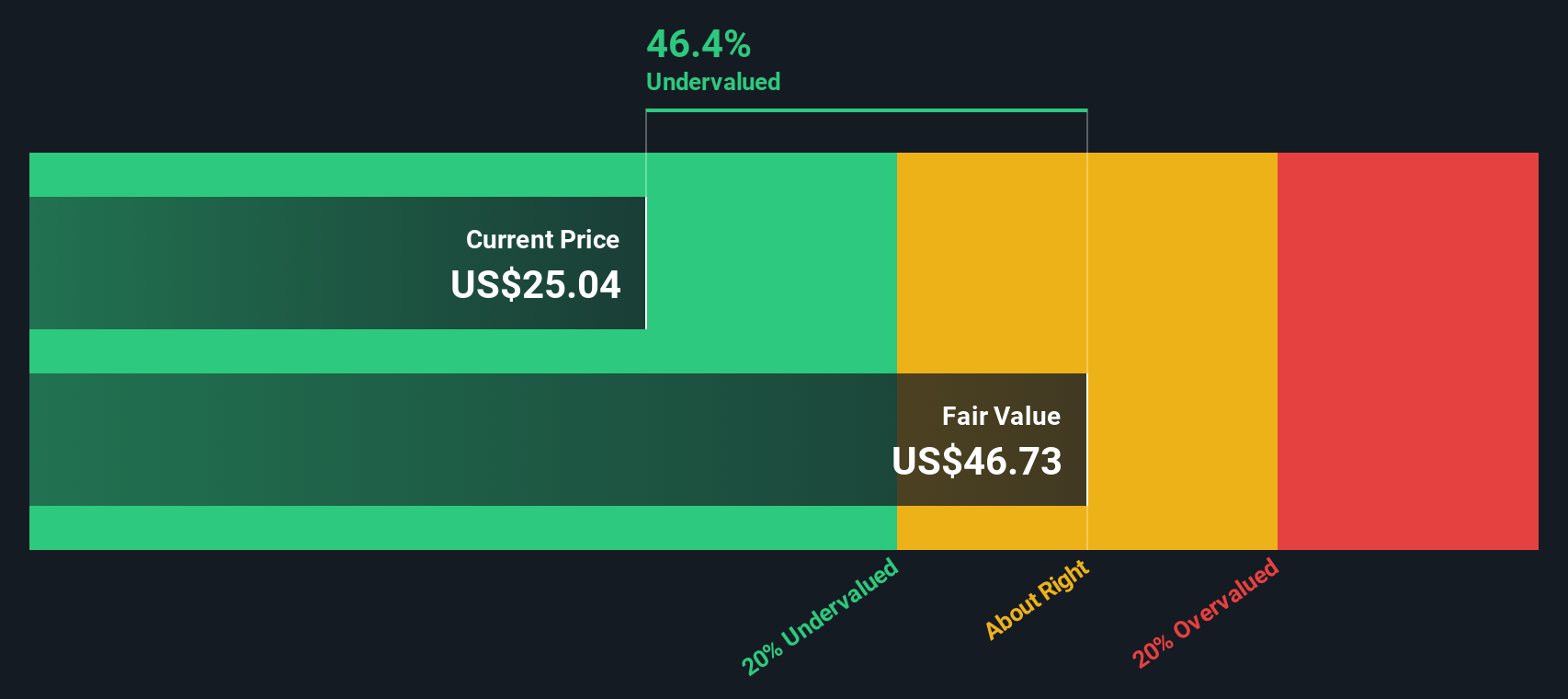

The Discounted Cash Flow (DCF) valuation method works by projecting all future cash flows a business will generate and then discounting those future figures back to their value today. This helps estimate what the company should really be worth, based on its potential to generate profit over time.

For Norwegian Cruise Line Holdings, the DCF analysis uses a 2 Stage Free Cash Flow to Equity model. As of the latest data, the company's trailing twelve months Free Cash Flow sits at -$730 million. While that may seem concerning, projections anticipate a strong turnaround, with analysts expecting FCF to reach $1.97 billion by 2029. Over a ten-year timeframe, Simply Wall St extrapolates further growth, with free cash flow estimates rising each year.

The bottom line is that the intrinsic value per share from this DCF model stands at $45.55, which is notably higher than the closing share price of $22.85. That translates to the stock trading at a 49.8% discount to what the cash flows suggest is fair value.

Norwegian’s rapidly improving cash generation outlook, combined with its current market price, signals a significant disconnect that value investors may want to examine closely.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Norwegian Cruise Line Holdings is undervalued by 49.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Norwegian Cruise Line Holdings Price vs Earnings

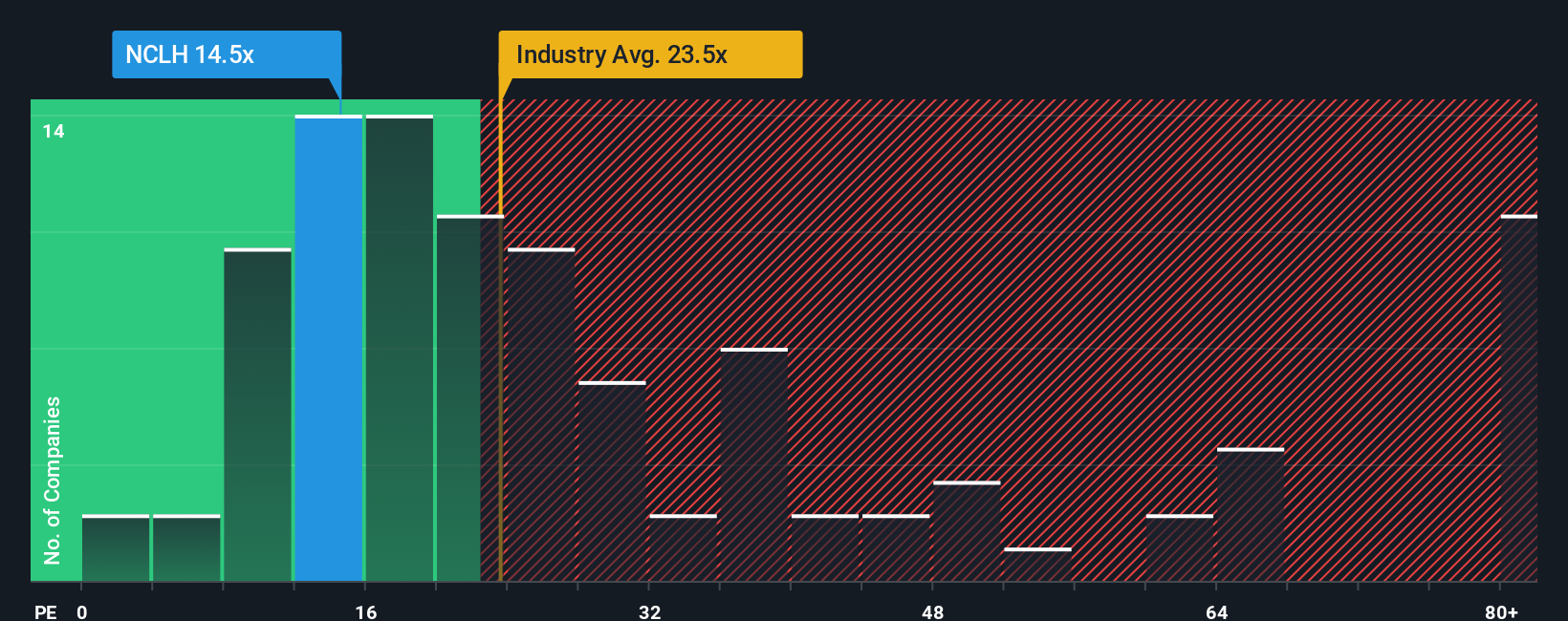

For companies generating positive earnings, the Price-to-Earnings (PE) ratio is one of the most popular ways to value a stock. It reflects what investors are willing to pay for each dollar of profit, making it a go-to benchmark for comparing profitability across businesses. PE ratios can vary widely based on growth prospects and perceived risks. Fast-growing or low-risk companies often trade at higher PE multiples, while businesses in more uncertain situations will have lower ratios.

Norwegian Cruise Line Holdings is trading at a PE ratio of 14.5x, which stands out against the hospitality industry average of 23.8x and a peer group average of 41.0x. This means investors are currently paying significantly less for Norwegian’s earnings in comparison to its competition and the sector at large.

But simply comparing to peers or broad industry numbers is not always precise because company-specific factors like growth, profit margins, risks, and market cap play a big role in what a “fair” PE should be. That is where Simply Wall St’s "Fair Ratio" stands out. This proprietary figure considers Norwegian’s unique combination of characteristics and calculates a fair PE of 37.8x. By personalizing the benchmark, the Fair Ratio provides a clearer and more tailored picture of the company’s valuation.

When we compare Norwegian’s actual PE of 14.5x with its Fair Ratio of 37.8x, the data suggests the stock may be undervalued on this metric as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Norwegian Cruise Line Holdings Narrative

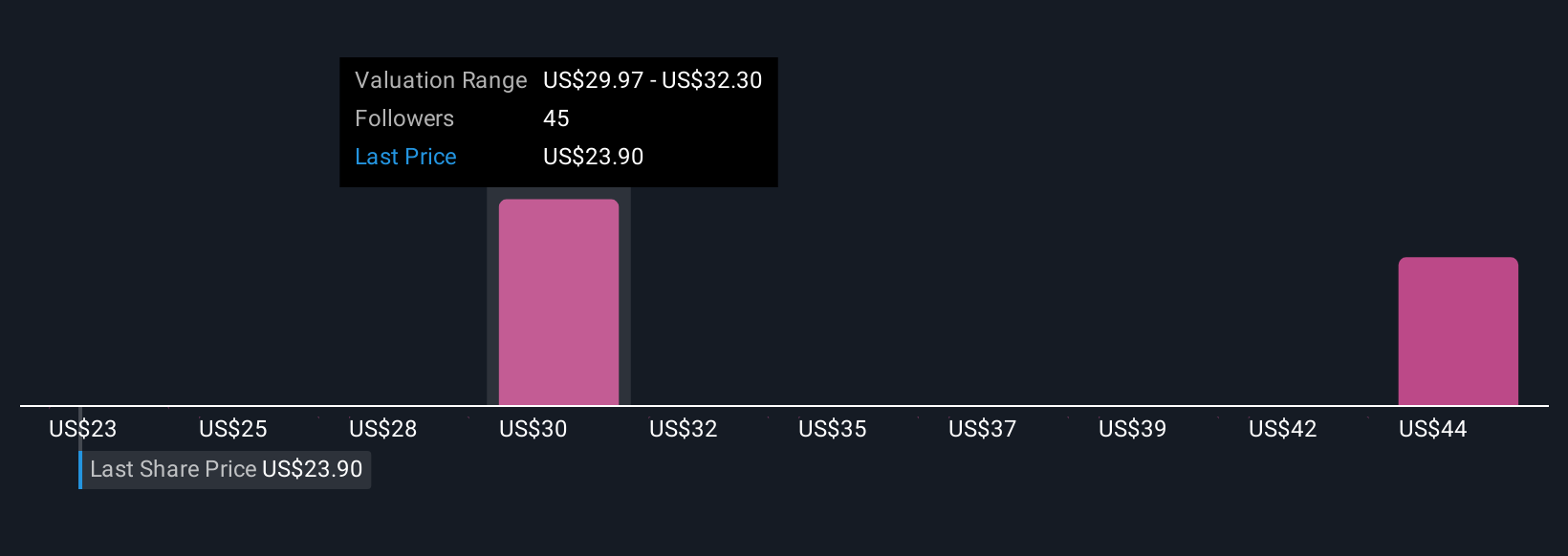

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a story; you bring your own perspective on a company, including what you expect for its fair value, future revenue, earnings, and margins, and tie that story directly to a personalized forecast. Narratives make investing much more dynamic because they connect a company’s journey to your own financial outlook, and estimate what that means for its true worth.

Best of all, Narratives are an easy and accessible tool on Simply Wall St’s Community page, where millions of investors share, update, and debate their own views. With Narratives, you can instantly see if your fair value is above or below today’s price, making it easier to decide when to buy or sell. The platform keeps your Narrative automatically up to date as news and earnings are released.

Take Norwegian Cruise Line Holdings as an example: right now, some investors see catalysts like private island upgrades and luxury fleet expansion and set a high price target of $40, while more cautious voices focus on debt and shifting travel trends, selecting a lower target near $23. Narratives help you visualize and act on the story that best matches your beliefs and risk tolerance.

Do you think there's more to the story for Norwegian Cruise Line Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norwegian Cruise Line Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NCLH

Norwegian Cruise Line Holdings

Operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives