- United States

- /

- Hospitality

- /

- NYSE:NCLH

Has Norwegian Cruise Shares Gotten Ahead of Themselves After Their Double Digit Rally in 2025?

Reviewed by Bailey Pemberton

If you are trying to decide what to do with your Norwegian Cruise Line Holdings stock, or just eyeing the cruise sector as a place for new gains, you are in the right place. This is a stock that keeps investors guessing, and, more often than not, keeps them coming back for another look. While Norwegian’s shares have drifted a little lower in the past week and month (down -2.6% and -6.1%, respectively), zooming out paints a more intriguing picture. Over the past year, the stock has surged an impressive 20.0%, and its three-year gain stands at 102.4%. Even when you stretch out to a five-year horizon, returns remain positive at 33.3%.

So, what is driving this long-term climb, despite some recent volatility? Broader market optimism about travel and leisure has helped, as have signs that cruising demand is increasing after past disruptions. Investors are also attuned to ongoing improvements in Norwegian’s operating model, which many see as positioning the company for sturdier growth and profitability in the future. With market sentiment leaning forward and a proven rebound already recorded, risk perceptions around Norwegian’s stock seem to be shifting. Importantly, this is also reflected in its valuation numbers.

Here is something that should catch your eye if you care about getting good value: Norwegian Cruise Line Holdings currently receives a valuation score of 6 out of 6 on key undervaluation checks. In other words, every method used to compare price with underlying business strength indicates the shares are undervalued.

Let’s break down the valuation metrics to see how Norwegian looks from several perspectives. And if you are after an even sharper way to judge value, stay tuned, as I will wrap up with a simple framework that can put all these numbers into real-world perspective.

Approach 1: Norwegian Cruise Line Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model is a valuation approach that projects a company’s future cash flows and then discounts them back to their value today. This method is especially helpful because it anchors valuation in real business performance and growth over time.

For Norwegian Cruise Line Holdings, the DCF model starts by looking at today’s Free Cash Flow, which currently sits at negative $730.2 Million. Analysts project that this number will turn around over the next several years, with future Free Cash Flow expected to reach about $1.97 Billion by the end of 2029. Estimates through 2035, extrapolated using growth assumptions, continue to indicate significant improvements. These projections all use the US dollar as the reporting currency.

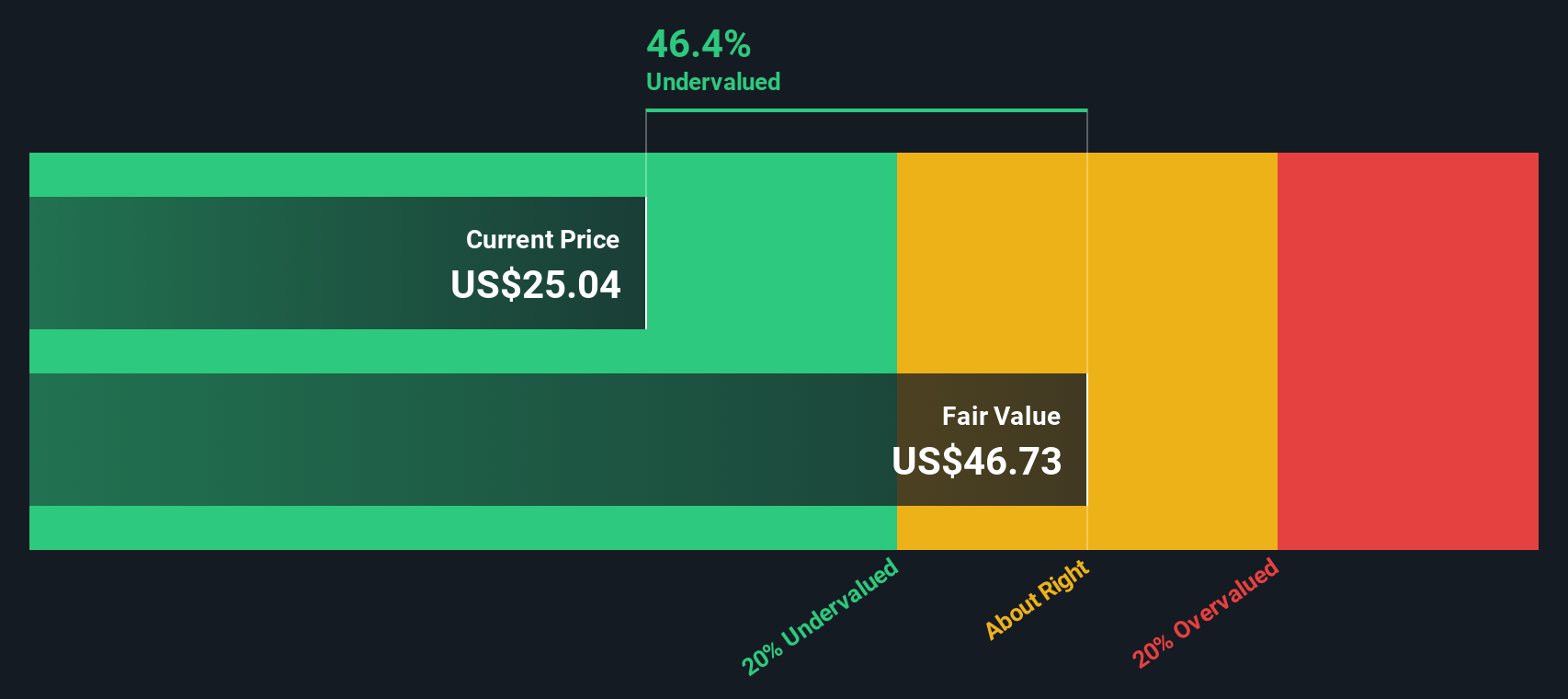

After applying the DCF methodology to these projected numbers, Norwegian’s intrinsic, or fair, value per share comes out at $46.63. This is roughly 48.3% higher than where the shares currently trade and suggests a wide margin of undervaluation if these cash flow forecasts are achieved.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Norwegian Cruise Line Holdings is undervalued by 48.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Norwegian Cruise Line Holdings Price vs Earnings

The price-to-earnings (PE) ratio is a popular and practical valuation metric when reviewing profitable companies like Norwegian Cruise Line Holdings. This metric tells investors how much they are paying for each dollar of company earnings, making it especially useful for comparing companies that actually report consistent profits.

What makes a “normal” or “fair” PE ratio can depend on numerous factors, especially expected growth and risk. Faster-growing, less-risky companies can often justify higher PE ratios, as investors are willing to pay up for future potential. Conversely, companies with less growth or higher risk tend to trade at a discount, reflected in lower PE ratios.

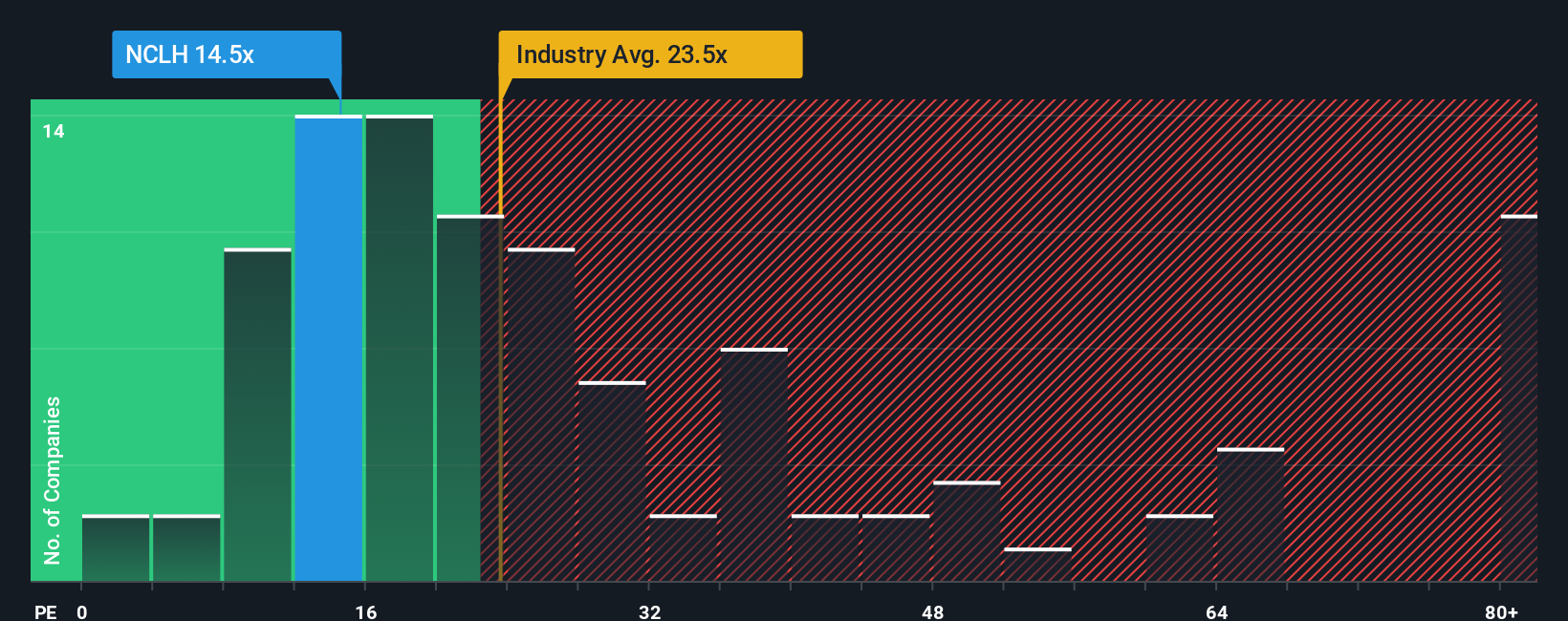

Norwegian’s current PE ratio stands at 15.3x, which is notably below both the industry average of 24.9x and the peer average of 42.8x. At first glance, this makes the stock look cheap versus similar businesses and the broader hospitality sector.

To dive deeper, Simply Wall St’s proprietary Fair Ratio sets a more nuanced benchmark. The Fair Ratio for Norwegian is 38.0x, calculated using a model that considers not just earnings and industry figures, but also growth prospects, profit margins, market cap, and risk profile. This method is more comprehensive than a simple peer or industry average comparison because it reflects the company’s unique financial outlook and sector context.

With Norwegian’s actual PE ratio of 15.3x coming in well below the Fair Ratio of 38.0x, there is a strong suggestion the shares remain undervalued based on this approach as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Norwegian Cruise Line Holdings Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a way for you to connect your outlook or “story” about Norwegian Cruise Line Holdings directly to its forecasted revenue, earnings, margins, and resulting fair value. Instead of just relying on numbers, Narratives let you describe your investment thesis in plain language and back it up with your chosen financial assumptions, linking the company’s real-world developments to a tangible valuation all in one place.

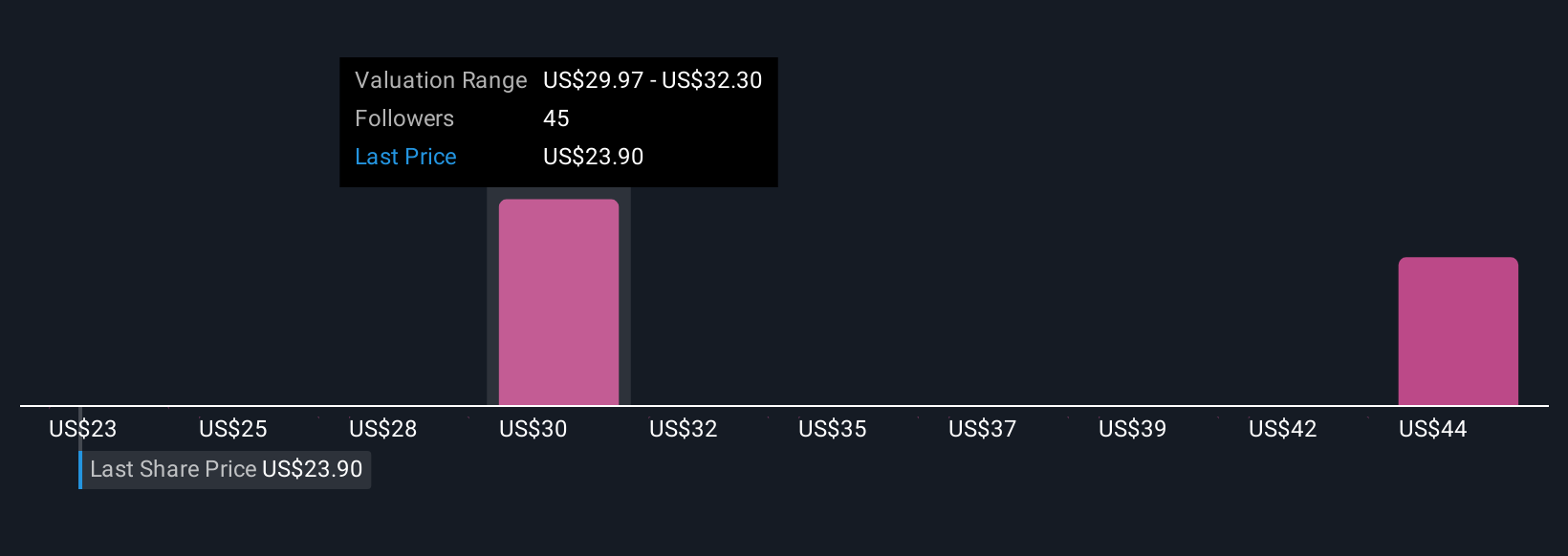

On Simply Wall St’s platform (within the Community page), Narratives make it easy for anyone to publish or explore investment perspectives, compare fair values with current prices, and see how other investors are thinking. This helps you decide not just if Norwegian is undervalued, but why. Narratives are continuously refreshed as new news or earnings come out, so your decisions can adapt as the story evolves. For example, some investors believe Norwegian’s luxury-focused fleet upgrades and destination expansion will boost earnings and push the fair value as high as $40 per share, while others are more cautious about debt and cost pressures, with fair values closer to $23.

Do you think there's more to the story for Norwegian Cruise Line Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norwegian Cruise Line Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NCLH

Norwegian Cruise Line Holdings

Operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives