- United States

- /

- Hospitality

- /

- NYSE:NCLH

Does Norwegian’s Renewable Fuel Pact Signal a Strategic Sustainability Shift for NCLH Investors?

Reviewed by Sasha Jovanovic

- Norwegian Cruise Line Holdings and Repsol recently announced an eight-year partnership to supply renewable marine fuels at the Port of Barcelona, beginning with biofuels in 2026 and renewable methanol from 2029, supporting Norwegian's Sail & Sustain program.

- This agreement represents a significant shift toward sustainable cruising, aligning with industry-wide decarbonization targets and introducing long-term environmental compliance for Norwegian’s European operations.

- We'll assess how this renewable fuels partnership could impact Norwegian's investment narrative, particularly its alignment with evolving sustainability initiatives.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Norwegian Cruise Line Holdings Investment Narrative Recap

Shareholders in Norwegian Cruise Line Holdings need to believe in the company's ability to expand premium offerings and drive guest spending while managing significant debt. The renewable fuels partnership with Repsol showcases Norwegian’s focus on sustainability but does not materially shift the most immediate catalyst, successful execution of the Great Stirrup Cay expansion, or address the ongoing risk of high leverage and major debt maturities looming in 2026.

Of the latest announcements, the $81.3 million equity offering in September 2025 stands out in direct relation to the balance sheet risk facing Norwegian. As the company seeks new avenues for financial flexibility, these capital raises underline the importance of maintaining liquidity ahead of substantial debt obligations and reinforce why debt reduction remains critical for its near-term outlook.

In contrast, investors should also be aware of the financial implications tied to Norwegian’s sizeable euro-denominated debt maturities as 2026 approaches…

Read the full narrative on Norwegian Cruise Line Holdings (it's free!)

Norwegian Cruise Line Holdings' outlook anticipates $12.6 billion in revenue and $1.7 billion in earnings by 2028. This scenario implies a 9.5% annual revenue growth rate and a $980.8 million increase in earnings from the current $719.2 million.

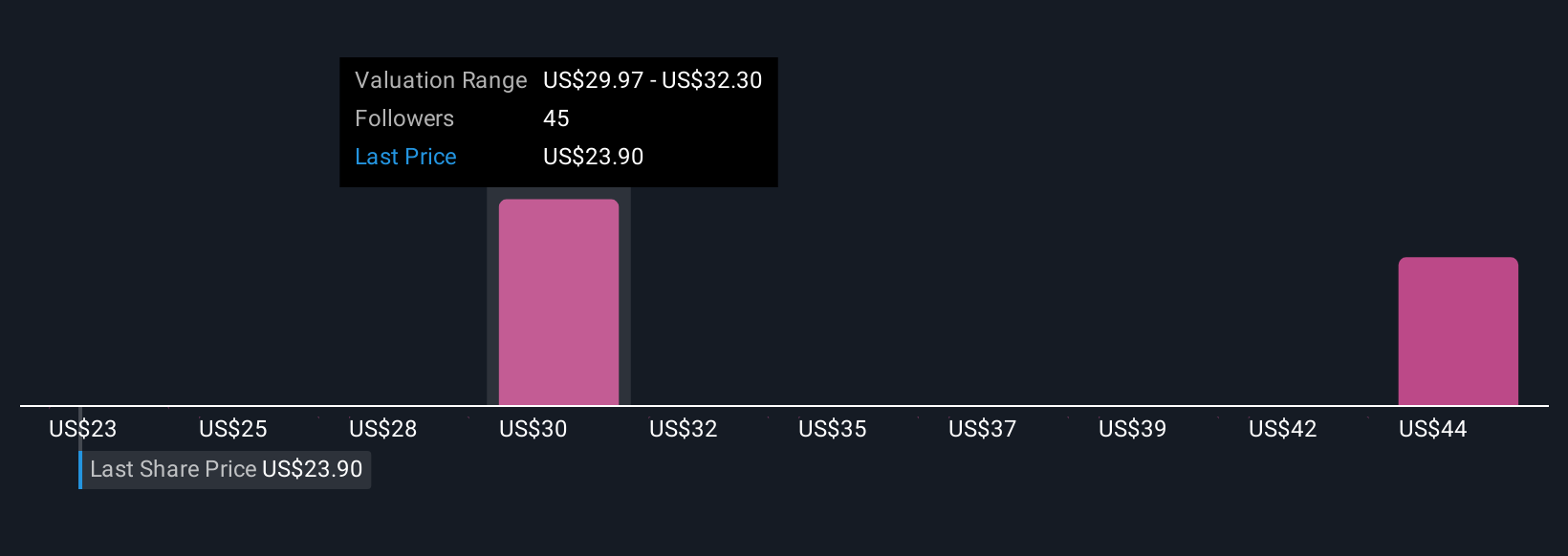

Uncover how Norwegian Cruise Line Holdings' forecasts yield a $31.12 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community range from US$31.12 to US$45.50. While many see meaningful upside, persistent high leverage and upcoming debt maturities could shape Norwegian’s future performance and are key for you to explore further views.

Explore 6 other fair value estimates on Norwegian Cruise Line Holdings - why the stock might be worth just $31.12!

Build Your Own Norwegian Cruise Line Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Norwegian Cruise Line Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Norwegian Cruise Line Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Norwegian Cruise Line Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norwegian Cruise Line Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NCLH

Norwegian Cruise Line Holdings

Operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives