- United States

- /

- Hospitality

- /

- NYSE:MTN

Vail Resorts (MTN): Exploring Value After Earnings Miss and Ongoing Dividend Concerns

Reviewed by Kshitija Bhandaru

Vail Resorts (NYSE:MTN) recently released quarterly earnings that came in below Wall Street expectations. Management acknowledged the need to better adapt to shifting guest behavior. The results put fresh attention on recurring challenges for the company.

See our latest analysis for Vail Resorts.

Recent months have brought a flurry of developments for Vail Resorts, from Board refreshment and dividend declarations to strategic buybacks and capital investment plans. Still, these moves were not enough to spark optimism, as reflected in a one-year total shareholder return of -4.6% and five-year total shareholder return of -24.9%. This suggests momentum continues to fade despite ongoing efforts to revitalize growth potential and guest engagement.

If you're thinking about broadening your investment perspective beyond leisure and resorts, now's a smart time to explore fast growing stocks with high insider ownership.

This backdrop of underperformance and cautious outlook naturally raises a key question for investors: Is Vail Resorts undervalued after its share price slump, or is the market already accounting for its future growth challenges?

Most Popular Narrative: 9.2% Undervalued

The most widely followed narrative values Vail Resorts above its recent share price, suggesting the company could offer more upside if key expectations materialize.

Continued investment in guest experience through lift, terrain, and food and beverage expansions, along with technology upgrades like My Epic App and AI capabilities, are expected to drive higher ancillary revenue and overall customer satisfaction, contributing positively to revenue growth.

Curious how ambitious margin improvements and guest experience investments factor into such an optimistic outlook? The real surprise may be which operating assumptions drive this compelling valuation, especially compared to where the broader market stands. Read on to discover what numbers back the claim that Vail could be trading well below its true value.

Result: Fair Value of $173.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unpredictable visitation patterns and economic headwinds could still challenge Vail Resorts' growth outlook and test the assumptions behind the current valuation.

Find out about the key risks to this Vail Resorts narrative.

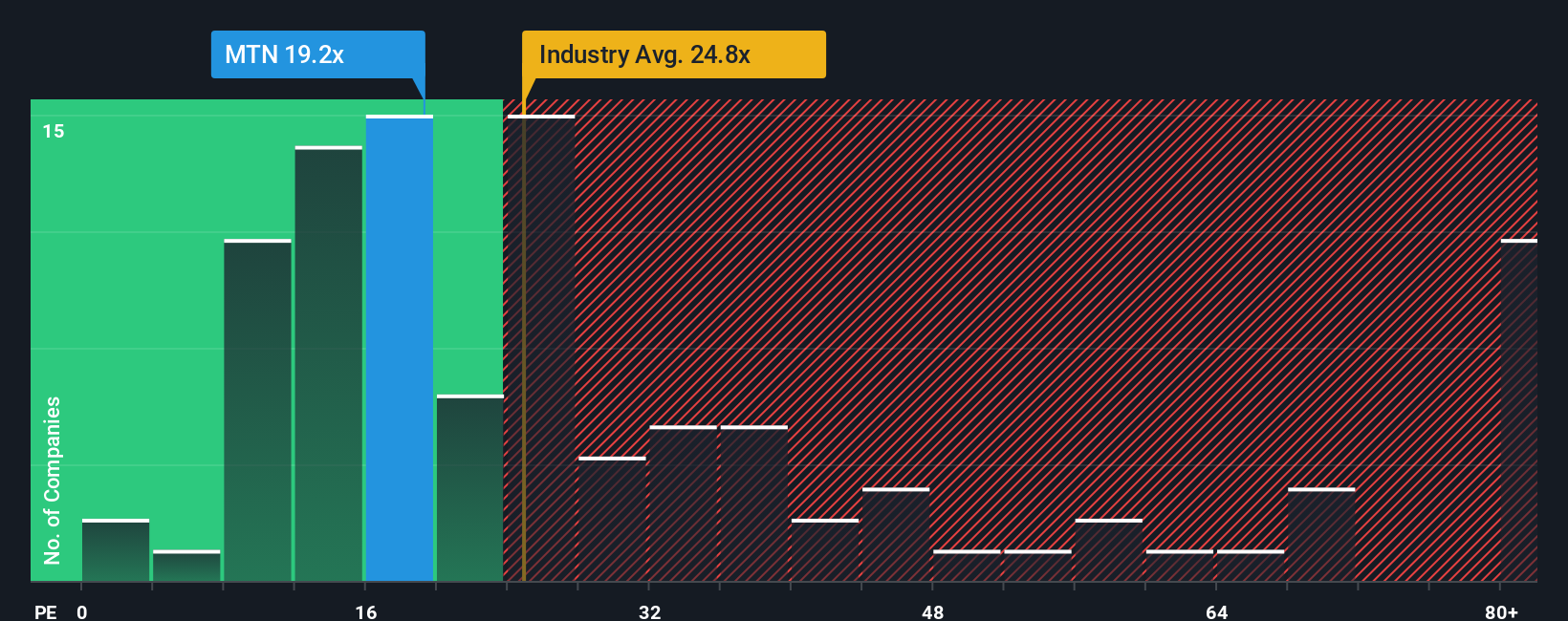

Another View: What Do Multiples Say?

Looking at Vail Resorts through the lens of its price-to-earnings ratio reveals a different story. The company's current multiple of 20.1x is lower than both the industry average of 24.4x and the peer average of 38.2x. It is, however, slightly above its fair ratio of 18.9x. This suggests shares are not deeply discounted by all metrics and highlights potential valuation risk if the company fails to deliver on growth plans. Which method of valuation feels more convincing to you?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vail Resorts Narrative

If the numbers here do not quite fit your perspective or you want to dig deeper, you can analyze the data yourself and build a unique storyline in just a few minutes, your way. Do it your way.

A great starting point for your Vail Resorts research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Smarter Investment Moves?

Don’t let opportunity pass you by. Use the Simply Wall Street Screener now to pinpoint fresh stock ideas and spot tomorrow’s winners before others do.

- Boost your pursuit of returns by tapping into these 886 undervalued stocks based on cash flows, a collection of companies that look cheap based on future cash flows.

- Take charge of your financial future with these 19 dividend stocks with yields > 3%, featuring strong yields above 3% for consistent income.

- Fuel your portfolio’s innovation engine with these 32 healthcare AI stocks, combining health breakthroughs and artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTN

Vail Resorts

Operates mountain resorts and regional ski areas in the United States and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives