- United States

- /

- Hospitality

- /

- NYSE:MGM

MGM Resorts (MGM) Is Up 6.9% After Record F1 Weekend Attendance and Sportsbook Activity - Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- During the recent Las Vegas Formula 1 weekend, MGM Resorts International saw approximately 150,000 additional visitors and achieved over 98% occupancy at its Strip properties, with record-setting activity at the Bellagio and BetMGM sportsbook.

- This surge in attendance marked the most bet-on F1 event in BetMGM’s history, highlighting the power of major events to drive incremental demand and gaming revenue.

- We’ll now explore how this exceptional event-driven demand could influence MGM Resorts International’s investment narrative and future growth outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

MGM Resorts International Investment Narrative Recap

To be an MGM Resorts International shareholder, you need to believe in the company’s ability to sustain demand for Las Vegas destination travel, capitalize on digital gaming, and manage significant global expansion. The recent surge in visitor numbers and all-time sportsbook records during the Las Vegas Formula 1 weekend showcase how large events can act as vital short-term catalysts for MGM. However, this event-driven boost does not materially alter the ongoing risk: persistent weakness in year-round Las Vegas Strip visitation and structural pressures on physical property revenues remain a concern.

Among the recent announcements, the October Q3 earnings report stands out for its relevance: while revenue continued to rise modestly, net losses returned compared to the prior period’s profit, reflecting the underlying margin pressures the company faces. This underscores how exceptional event weekends, while impressive, may not be enough on their own to offset broader operational and financial challenges that investors will want to monitor.

In contrast, investors should be aware of the persistent doubts about Las Vegas visitation trends and the potential for these pressures to...

Read the full narrative on MGM Resorts International (it's free!)

MGM Resorts International's outlook anticipates $18.4 billion in revenue and $906.1 million in earnings by 2028. This is based on a projected 2.3% annual revenue growth rate and a $369.7 million increase in earnings from $536.4 million today.

Uncover how MGM Resorts International's forecasts yield a $44.15 fair value, a 27% upside to its current price.

Exploring Other Perspectives

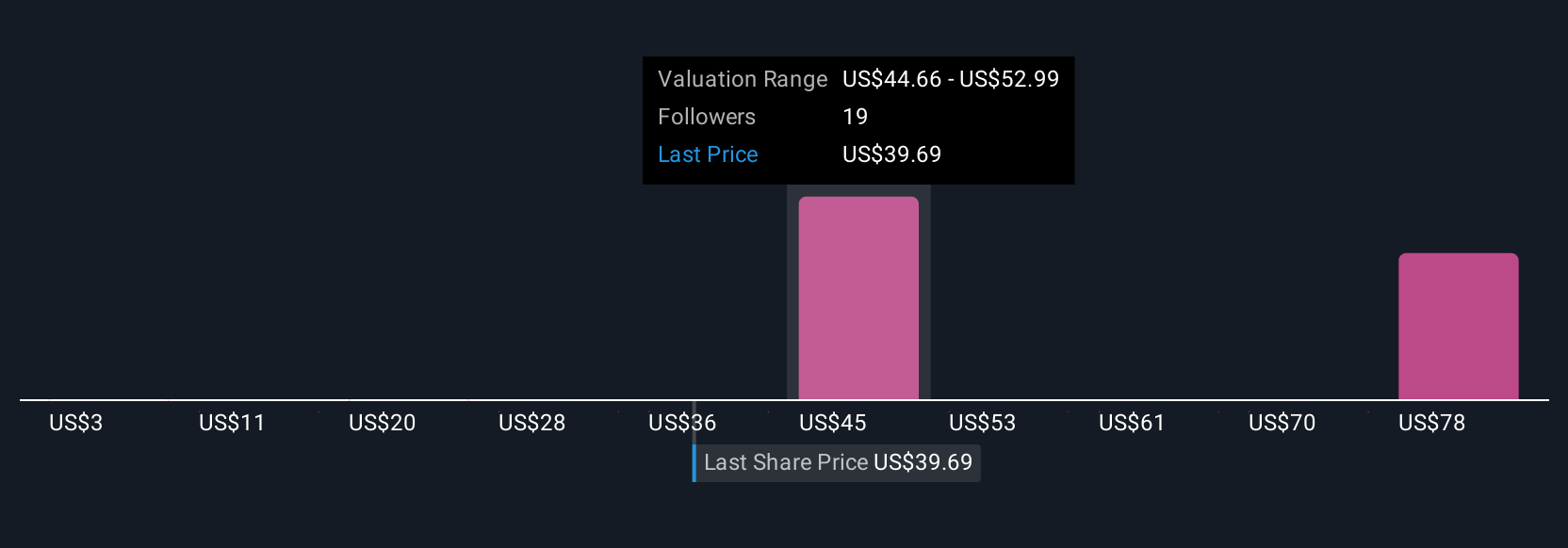

Seven Simply Wall St Community fair value estimates for MGM Resorts International range widely, from US$26.92 to US$86.31 per share. While some see opportunity in MGM’s digital and sports betting focus, others highlight that uncertain Las Vegas demand poses risks to future returns, explore the full spectrum of views.

Explore 7 other fair value estimates on MGM Resorts International - why the stock might be worth 23% less than the current price!

Build Your Own MGM Resorts International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MGM Resorts International research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free MGM Resorts International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MGM Resorts International's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MGM

MGM Resorts International

Through its subsidiaries, operates as a gaming and entertainment company in the United States, China, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.